Introduction

Crypto’s never sitting still, is it? In the last few years, one of the big headliners has been DeFi staking platforms. They’ve turned heads by offering folks in the crypto world—be it casual investors or those all-in on web3—some pretty snazzy ways to make that money work for them while they sit back and watch the magic happen. Right out front in this buzz is the Lara Protocol.

So, what makes Lara Protocol stand out? It’s not your run-of-the-mill DeFi staking platform. Picture it as a savvy blend of the newest features running under the hood to make your crypto earn more and run smoother than a greased-up lightning bolt. Doesn’t matter if you’re just dipping your toes in or you’ve been swimming in the crypto pool for ages—Lara’s got something for you.

In this piece, we break down what makes Lara tick. We’ll line it up against some of the top DeFi staking names from 2025—like Lido, Rocket Pool, EigenLayer, and Pendle Finance. Our aim here? To give you a clear rundown on why the Lara Protocol might just be your new best friend in the crypto staking game.

So, if you’re itching to crank up your staking profits, get in on the liquid staking frenzy or peek at the freshest DeFi goodies, hang tight. We’ve packed this article with the kind of handy tips and info that’ll make you want to click ‘sign up’ before you can say “blockchain”.

Key Takeaways

- Lara Protocol is a DeFi staking platform built for modularity, liquidity, and cross-chain access.

- It supports both native and liquid staking strategies with high APYs and flexible lock-up options.

- Lara integrates seamlessly with Web3 wallets and major blockchain networks.

- It offers strong potential for yield generation while mitigating risks through automated strategies and governance.

- A growing number of DeFi users are considering Lara among the best staking platforms in 2025.

Deep Dive into Lara Protocol: Core Features and Mechanics

What Is Lara Protocol and How Does It Work?

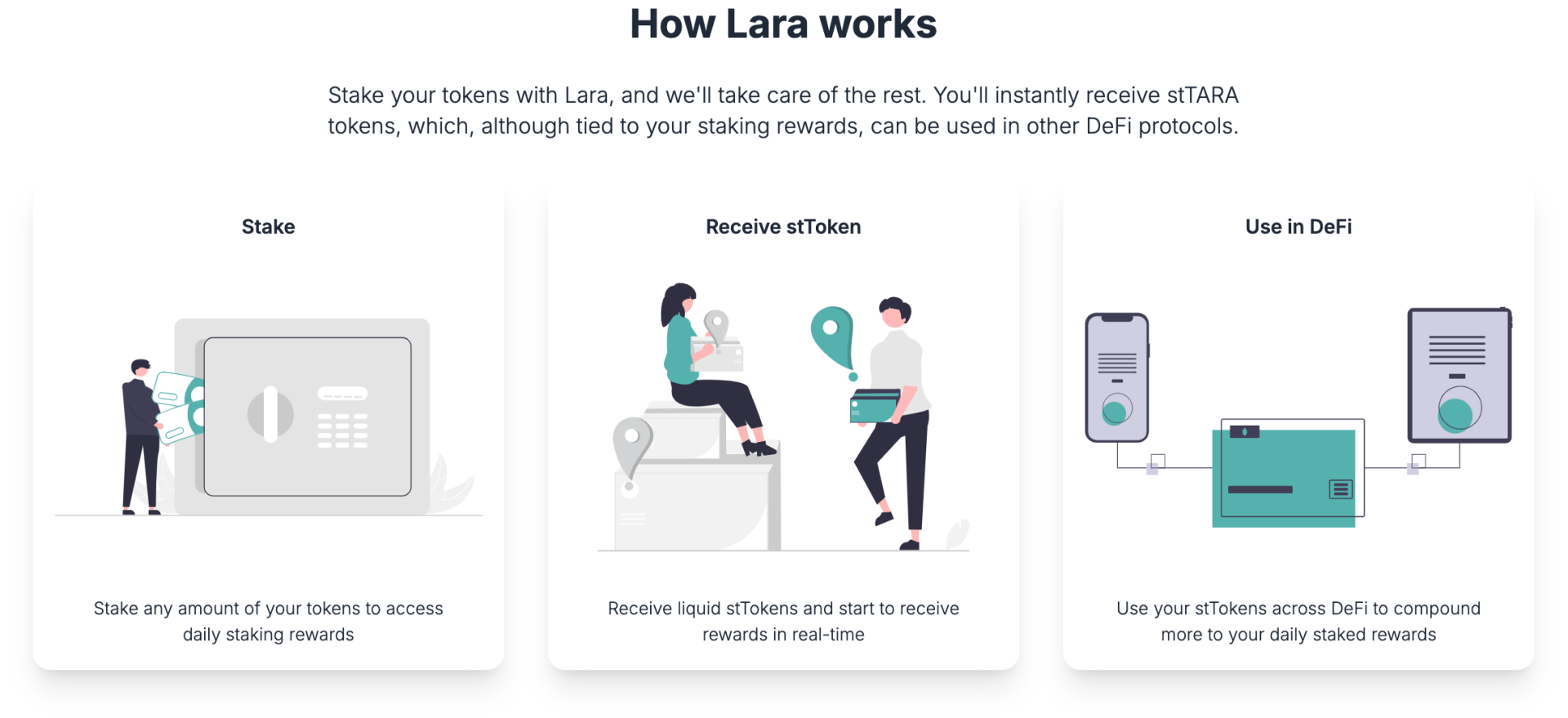

The Lara Protocol stands out in the decentralized finance (DeFi) scene as a funky staking spot designed for you to make the most out of your crypto and get some sweet returns. It’s like setting your money up to work a 9 to 5 but in the coolest way. With the magic of blockchain, users can stake their digital coins and watch as multiple crypto opportunities help them stack up the cash – passive income style!

At its heart, Lara Protocol gives off a slick staking vibe, spotlighting liquidity, strong security, and juicy yields. Smart contracts are its sidekick, ensuring your moolah stays secure while roaming around various DeFi playgrounds to bag maximum profits.

| Feature | Description |

|---|---|

| Platform Type | DeFi Staking |

| Core Technology | Smart Contracts |

| Primary Function | Yield Optimization |

| Security Mechanism | Multi-Sig, Audits |

| Supported Assets | Various Crypto Assets |

Staking With Lara: User Experience and Options

Stepping into the Lara Protocol feels as cozy and familiar as that local coffee shop everyone loves, whether you’re a crypto rookie or a seasoned vet. The platform unfolds multiple staking avenues, helping you play the risk-reward game according to your appetite and plans.

- Simple Staking: Pop your crypto assets in and watch a steady stream of yields flow towards you.

- Liquid Staking: Stake without tying up your assets, keeping them free for trading while earning.

- Restaking Innovations: Keep the earnings wheel spinning by letting rewards auto-restake and snowball your returns.

Governance, Security, and Tokenomics

Governance

Think of Lara Protocol as a DeFi democracy where holders of the governance token, LARA, get a voice in shaping the future. They’re the ones guiding upgrades and key decisions.

- Governance Token: LARA

- Voting Mechanism: On-chain voting

- Proposals: Open to all LARA holders

Security

Protecting your stash is like personal security on steroids with Lara Protocol. It’s got multi-signature wallets, regular check-ups for codes, and strong security layers to make sure your assets are secure.

- Multi-Sig Wallets: Needs a team of signatures to greenlight any move.

- Audits: Regular code investigations to catch and fix weak spots.

Tokenomics

LARA’s got a well-thought-out financial plan to keep users, stakers, and devs happy and hustlin’. Here’s the scoop:

| Metric | Details |

|---|---|

| Token Supply | 1,000,000 LARA |

| Initial Distribution | 20% IDOs, 70% Staking Rewards, 10% Dev Fund |

| Staking APY | Variable based on the hustle of the market |

When you’ve grasped what makes Lara Protocol tick, you’ll be ready to make savvy moves in the crypto world for the big returns.

Lara Protocol Compared to the Best DeFi Staking Platforms in 2025

Checking out how Lara Protocol stacks up against the top DeFi staking platforms in 2025 is a treasure trove for crypto buffs and yield hunters. It’s all about liquidity, how the moolah moves, validator options, how easy it is to get started, and any new tricks they got up their sleeves.

Lara vs. Lido: Liquidity and Yield Dynamics

Lido’s still a celeb in DeFi circles with its liquid staking gig, shining especially bright for Ethereum (ETH). Folks stick their ETH and snag stETH, a versatile ticket for the DeFi playground.

| Metrics | Lara Protocol | Lido |

|---|---|---|

| Liquidity | High (stTARA) | High (stETH) |

| Yield | Competitive auto-compounding | Competitive auto-compounding |

| Interoperability | Plays nicely with loads of DeFi protocols | Mostly keeps it in the ETH family |

Lara’s got a leg up with stTARA tokens, offering snap liquidity for all the DeFi tricks—like making bets, loaning out, and farming yields. High liquidity and yields are a shared vibe, but Lara’s tokens bring that little extra sprinkle of adaptability.

Lara vs. Rocket Pool: Validator Flexibility and Accessibility

Rocket Pool’s all about decentralized staking, letting folks either run their own validator show or hop into a communal pool. Extra goodies for those who play node operator, while making sure even the little guys can play.

| Metrics | Lara Protocol | Rocket Pool |

|---|---|---|

| Validator Flexibility | Let’s users delegate to pros | Run your own validator or join the gang |

| Accessibility | Easy-peasy, no KYC drama | Need a chunk of ETH for node operators |

| User Experience | One-click simplicity | More hoops, but juicy rewards for techies |

Lara’s all about making it easy-peasy for staking and passing the baton in just a click, plus no need for that KYC stuff. Perfect for anyone new to staking or just looking to keep things smooth and painless.

Lara vs. EigenLayer and Pendle: Innovation in Yield Aggregation

EigenLayer and Pendle are busy rewriting yield aggregation, each with their own crafty ways in DeFi land. EigenLayer is deep into restaking, where you get a bonus for keeping the new blockchains safe. Pendle’s all about time-decayed tokens for clever yield farming.

| Metrics | Lara Protocol | EigenLayer | Pendle |

|---|---|---|---|

| Yield Source | Auto-compounding and staking rewards | Restacking across blockchains | Time-based yield tricks |

| Innovation | Liquid staked tokens (stTARA) in DeFi | Extra rewards for restakers | Future yield trading |

| Flexibility | Mixes well in DeFi land | Spans multiple chains | Shiftable yield options |

EigenLayer and Pendle are drawing new maps for yield maximization with their restaking and time tokens gig. Lara shakes things up by giving you quick liquidity and wide-ranging DeFi compatibility through stTARA tokens.

Pick a protocol that vibes with what you’re after—liquidity, validator options, or fresh yield moves—to get the most out of your crypto stash. Learn more about how to work your stTARA magic and while you’re at it, scope out some hair-straightening products for curly hair today.

Fast Facts

| Feature | Details |

|---|---|

| Blockchain | Taraxa |

| Staking Tokens | TARA |

| Liquid Staking Token | stTARA |

| Protocol Language | Solidity |

| Governance | Lara DAO |

| Key Features | Sit back while it auto-compounds, delegate, and claim those rewards |

| Usage | Make the most of stTARA in other DeFi setups |

| Security Measures | Top-notch validator picking, smart contract check-ups |

| Yield Optimization | Sky-high APY with zero effort thanks to auto-compounding |

| DAO Involvement | Pioneering DAO on Taraxa |

Conclusion

The Lara Protocol’s making its mark on the DeFi scene in 2025, offering a fresh and user-friendly way for crypto enthusiasts to dive into staking. With its stTARA tokens bringing quick liquidity and easy-peasy links to various DeFi setups, Lara lets you get the most bang for your crypto buck.

Look closely at what Lara’s packing, and you’ll see why it’s set to shake up staking with its no-hassle interfaces, rewards that grow on their own, and staking choices that fit just right. It’s not just about the tech, though. The community’s got a voice in the form of Lara DAO, making sure everyone’s on board with where things are headed and how secure everything stays.

When you stack Lara against big names like Lido and Rocket Pool, or even forward-thinking options like EigenLayer and Pendle Finance, its flair for keeping things smooth with liquidity and yield stands out. Plus, there’s a nod to flexible validators and some pretty slick yield gathering.

If you fancy yourself a die-hard DeFi fan hunting for the gold standard in staking platforms for 2025, Lara’s ticking all the boxes. By keeping the user experience front and center and doubling down on security and smart tokenomics, Lara’s on track to stay a solid choice in the ever-changing world of DeFi. Want the full scoop? Get all the deets on how Lara sizes up against the competition in our articles on best defi staking platforms in 2025.

FAQ

How does staking work with the Lara Protocol?

With the Lara Protocol, you pop your tokens in, let them get to work with validators, and sit back as rewards roll in and blend back in all by themselves. The core contract is the busy bee, managing deposits, earnings, and withdrawals. Each network has its own sidekick contract, and Lara Oracles are there to point you to top-notch validators.

Can users opt in and out of the auto-compounding feature?

Absolutely! Twist the auto-compounding on or off as it suits your style.

What is the role of the DAO in the Lara Protocol?

The Lara Protocol has a DAO—think of it like the boss, but cooler. This digital head honcho is responsible for steering growth, setting protocol parameters, and a bunch of other gigs.

Which networks does the Lara Protocol support?

The Protocol spreads its wings over various networks, each with their own special contract. And Lara Oracles? They’re like your personal advisor, pointing out the best validators in the crowd.

Where can users use the TARA tokens?

Lara’s TARA tokens don’t just sit in one place—they’re always on the move. Use them anywhere in the DeFi domain to give your crypto assets a fancy dance.