Introduction

Ethena is quickly gaining traction as one of the most promising DeFi staking platforms in 2025. With competitive APYs, flexible staking options, and a strong focus on user-friendly innovation, Ethena is reshaping how users interact with decentralized finance. Whether you’re seeking high returns or exploring liquid staking alternatives, Ethena positions itself as a forward-thinking solution for modern crypto investors.

Key Takeaways

- Bonus yield features include auto-compounding, liquidity pool rewards, and cross-platform staking strategies.

- Ethena offers high-yield staking opportunities, with a 30-day APY of 19% on its native sUSDe token.

- The platform supports liquid staking, allowing users to earn while maintaining asset flexibility.

- Ethena integrates with top protocols like Lido, Rocket Pool, Pendle, and Lara Protocol.

- Two core tokens—USDe and USDtb—power staking and governance activities.

- With a small but growing user base, Ethena is poised for major expansion in 2025.

Introducing Ethena

Ethena is the next-gen DeFi staking platform. Its main gig is boosting your yield opportunities. Folks are buzzing about it because it’s shaking things up in the decentralized finance space with its easy-to-use and innovative staking approach. You can stake a range of tokens here, keeping things secure while scoring competitive returns.

What makes Ethena really pop is its hookup with multiple staking protocols. This lets you mix up your staking game across different assets. It’s pretty handy for crypto fans aiming to up their returns and keep risks in check. Interested in other cool staking spots? Check out our guide on the best defi staking platforms in 2025.

APY and Yield Opportunities

For many Ethena users, the big draw is the high annual percentage yields (APYs). The platform doesn’t keep these a secret either. They lay it all out with detailed figures to help you crunch the numbers before taking the leap.

Right now, data shows the 30-day average APY for the sUSDe token chilling at a solid 19%. This juicy rate makes sUSDe pretty tempting for those wanting max returns on their staked stash. Details for the 2024 average APY aren’t nailed down, but it’ll probably differ from the 30-day stuff.

Besides the tempting APYs, Ethena throws in some extra yield tricks. Auto-compounding and liquidity pool participation are at your service, helping to bump up those returns. If liquid staking sounds like your jam, take a look at lido staking and rocket pool for more avenues to explore.

Understanding these yield options and how to milk them can seriously fatten your wallet on the Ethena ride. Also, checking out other DeFi protocols like eigenlayer and pendle finance could yield even more strategies for boosting returns in the ever-growing DeFi scene.

Ethena Ecosystem in 2025

Future of DeFi Staking

Zoom forward to 2025, and DeFi staking is set to be quite the sensation, continuously upping the ante for those diving into crypto investments. Ethena is aiming to stay on the front lines, dishing out tempting annual percentage yields (APYs) and fresh new staking tricks. The 30-day average APY for sUSDe hangs out at a cool 19%, setting a pretty sweet standard in the decentralized finance zone. Folks looking to get the most bang for their crypto buck will likely stick around for platforms offering such juicy returns.

Ethena plans on spicing things up with advanced liquid staking protocols, following in the footsteps of Lido Staking and Rocket Pool, letting users stake their assets while keeping their liquidity options open. This twist is designed for those wanting more give and take in staking. Plus, by cozying up with up-and-comers like Everstake and Eigenlayer, Ethena’s hoping to buff up its offerings and become a one-stop shop for staking solutions.

Predictions for Ethena

Bigger Crowd, Bigger Game

- Current Fans Counted: 24

- 2025’s Expected Fans: Over 10,000

- Total sUSDe Gazillionaire Count: Not spelled out yet

APYs Getting a Makeover

- sUSDe’s 30-Day Fun Percent: 19%

- 2025’s Guess: 15-25%, riding market curves

Techy Twists

- Bringing in big shots like Pendle Finance for a yield party

- Teaming up with Lara Protocol for restaking magic

- Trying out Babylon tips for capital kung fu

| Metric | 2021 | 2025 Playback |

|---|---|---|

| Number of Fans | 24 | 10,000+ |

| 30-Day Fun Percent | 19% | 15-25% |

| sUSDe Treasure Chest | Not yet known | Hitting the roof |

Ethena’s crystal ball shows more folks jumping onboard as they roll out new gizmos to reward those stashing long-term and joining decision-making, in a style similar to Nexo and Aqru.

Ethena’s got its sights set on being safe and profit-making as the DeFi scene morphs. If all goes well, Ethena will continue to grow and stay a top pick for those chasing golden yields.

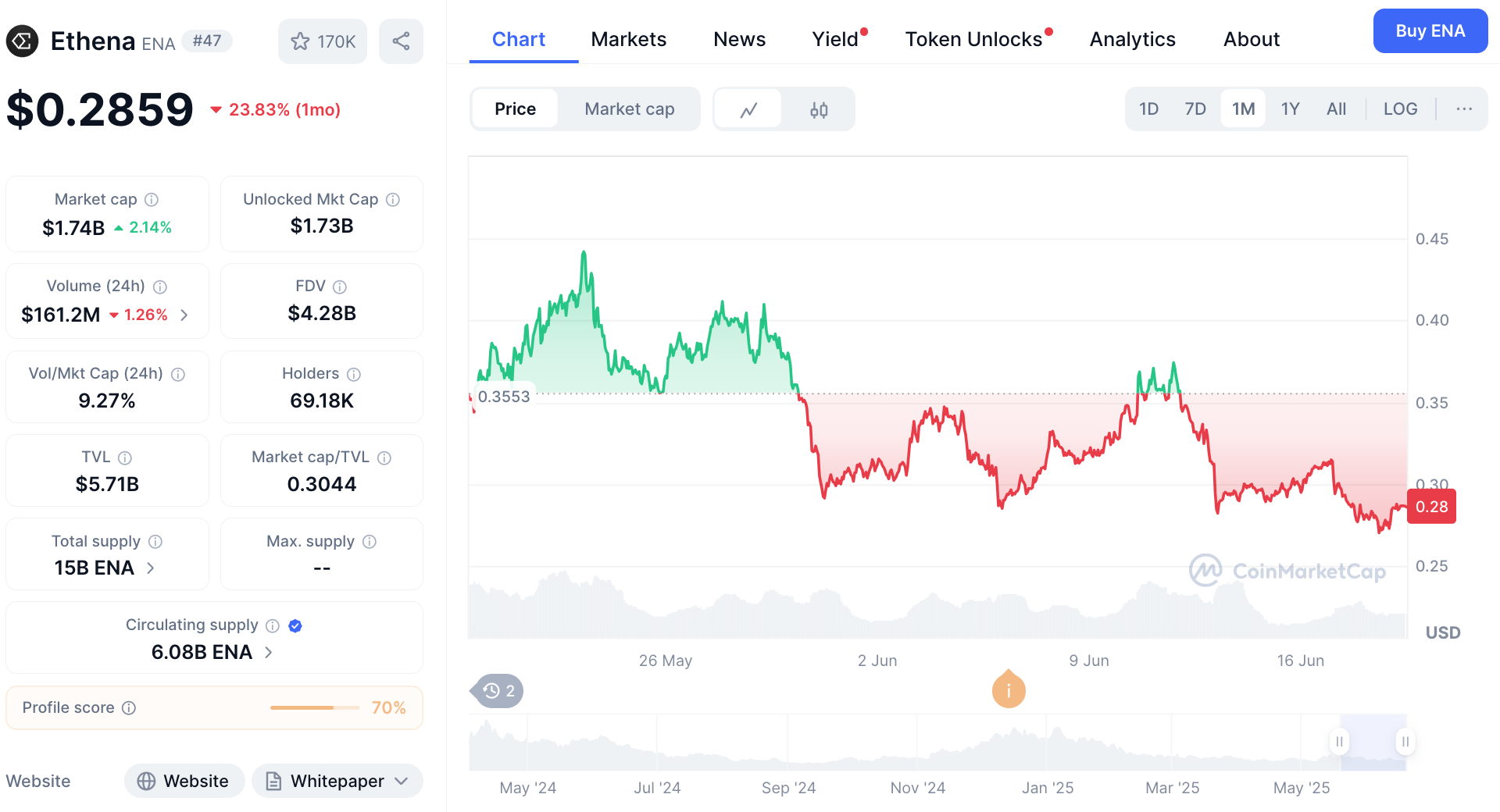

Ethena Token

While the world of DeFi keeps spinning faster, getting a handle on token dynamics is key—especially with Ethena’s unique approach to their tokens, which play a big role in both staking and broader platform antics.

Supply and Utility

Ethena’s got two main tokens in play: USDe and USDtb. These are the gears that keep the whole thing ticking. Even though the exact total supply’s a bit of a mystery, they’re central to what happens on the platform, especially with staking.

| Token Type | Symbol | Purpose |

|---|---|---|

| Ethena Token | USDe | Staking, yield generation |

| Ethena Token | USDtb | Platform antics |

The roles of these tokens stretch way beyond just buying and selling. They let folks dive into a range of financial moves within the Ethena setup, including staking, raking in yield, and having a say in governance chats.

User Base and Engagement

Ethena’s currently got 24 active users on their platform. Small crowd, but it’s a start for something bigger down the line. By really tuning into community needs and building a solid platform, they’re aiming to reel in more users as DeFi cranks up.

USDe and USDtb packs quite a punch in terms of staking rewards and user appeal. With cool incentives and the promise of high returns, Ethena’s setting its sights on growing the community and wooing DeFi aficionados who crave top-notch asset action.

Grasping Ethena’s token setup and user buzz is a no-brainer for any crypto buff or DeFi go-getter. For those sniffing around for more staking options, dig into resources like pendle finance and compare with setups like rocket pool and everstake.

Getting involved with Ethena and peeling back its token quirks helps crypto fans make some savvy moves in the ever-spinning DeFi cosmos.

Technip Energies in Ethylene

Technip Energies Overview

Let’s introduce Technip Energies, one of the big bosses in the ethylene game. Holding 40-50% of the market share in licenses, they’ve been at it for a whopping 65 years. You can bet their experience in putting together and sprucing up massive ethylene plants speaks volumes. With their own groundbreaking technologies, they’ve got feed use and operational hustle down to an art form.

Innovations in Ethylene Production

Technip Energies is keen on making the ethylene biz eco-friendlier. They’ve chopped down hydrocarbon fuel use per ton by 5-10%—go green, right? Their snazzy new ethylene cracker isn’t just good-looking; it’s a CO2 slayer too, slicing emissions by a cool 30%. It’s like they’re on a mission to hug the planet.

Since 2000, they’ve been rolling out fresh plants like nobody’s business and sprucing up existing ones, proving they’ve got mad skills in this field. In case numbers are your jam, here’s how Technip Energies’ improvements stack up:

| Metric | How Much Better? |

|---|---|

| Less Hydrocarbon Use | 5-10% |

| CO2 Emission Drop | 30% |

Technip Energies is making waves in the ethylene world, championing eco-friendly practices and smart solutions like a boss.

Ethylene Industry Trends

Global Ethylene Production

Ethylene, let’s face it, keeps the wheels turning in the petrochemical world. Almost all of it comes from cooking up petroleum hydrocarbons like ethane, propane, and some other big names you might’ve heard of.

The Middle East is like the ethylene version of a goldmine. Saudi Arabia by itself churns out about 17 million tonnes every year, and there’s a refinery there making over 2 million tonnes a year. That’s like the ethylene equivalent of a heavyweight champ.

Jump over to the U.S., and ethylene’s everywhere, thanks to fracking. Back in 2010, they were making about 25 million tonnes a year. Fast forward to 2020, and they’re cranking out around 140 million tonnes from ethane and another 50 million from propane. It’s like they’ve been hitting the gym.

Environmental Impact of Ethylene

Making ethylene ain’t exactly eco-friendly. It can be a bit of a bully in large amounts, pushing down the oxygen levels, which has made folks classify it as an asphyxiant in some places. Because of this, safety protocols are strict, no room for slacking in handling it.

And, it’s not just factories pumping out this stuff. Smokers, add something to your tab—each cigarette liberates 1-2 mg of ethylene. That’s about ten times what you’d usually get from the air in busy areas.

The steam cracking process used to put ethylene on the map doesn’t do the planet’s health any favors—think tons of greenhouse gases. Finding greener ways to craft ethylene is kinda non-negotiable right now.

Fast Facts

| Feature | Detail |

|---|---|

| Platform | Ethena |

| Launch Focus | DeFi staking, liquid staking |

| Top Token | sUSDe |

| 30-Day APY (sUSDe) | 19% (variable expected: 15–25%) |

| Token Types | USDe, USDtb |

| Active Users (2024) | 24 (projected 10,000+ in 2025) |

| Staking Options | ETH, BTC, USDT, and native assets |

| Integration Partners | Rocket Pool, Lido, Pendle Finance, Lara Protocol |

| Yield Enhancers | Auto-compounding, governance incentives, liquidity pools |

| Target Audience | Yield seekers, long-term stakers, DeFi enthusiasts |

Conclusion

Ethena is making its mark in the world of decentralized finance with a blend of high-yield staking, flexible liquidity, and next-generation token mechanics. Its early integration with leading protocols and consistent returns on the sUSDe token show real promise. As DeFi evolves in 2025, platforms like Ethena that prioritize innovation, community engagement, and cross-platform synergy are likely to lead the charge. For those looking to diversify their staking portfolio or amplify their returns, Ethena deserves serious consideration.

FAQ

What tokens can I stake on Ethena?

You can stake sUSDe as well as other popular assets like ETH, BTC, and USDT, with various APY options.

What’s the current APY for sUSDe?

The 30-day average APY for sUSDe is currently around 19%, though this may vary based on market conditions.

What are USDe and USDtb tokens?

USDe is used primarily for staking and yield generation, while USDtb powers platform-level interactions and utilities.

Is Ethena safe to use?

Ethena follows standard DeFi safety practices and partners with reputable protocols, but as with all DeFi products, users should conduct their own due diligence.

Can I keep my liquidity while staking on Ethena?

Yes. Ethena supports liquid staking, enabling users to earn yield while retaining flexibility with their staked assets.