Introduction

The global crypto market capitalization has surged by $28.5 billion, reflecting a broader stabilization in financial markets. Bitcoin continues its upward trend, trading at $107,619, while Pi Network has become the day’s standout altcoin with a 15.6% gain.

Key Takeaways

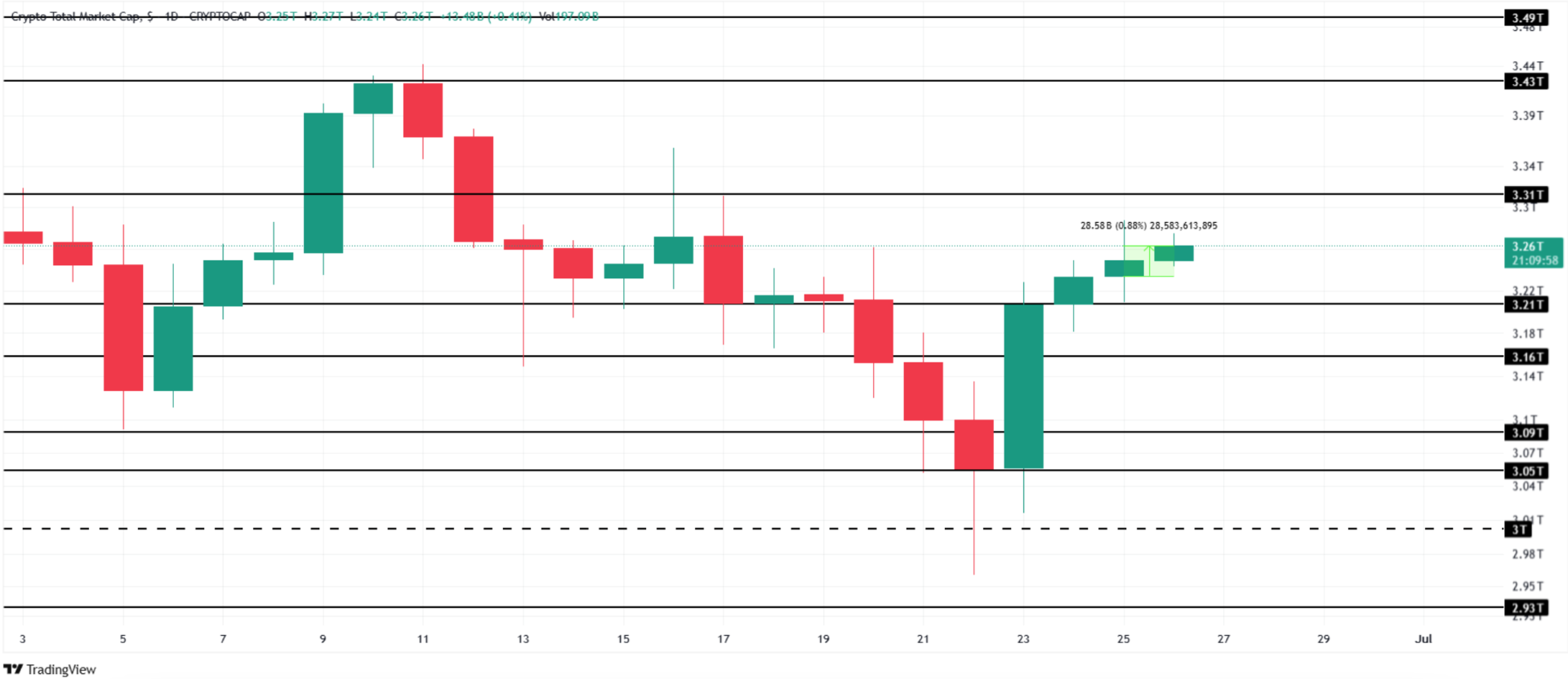

- Total crypto market cap climbs to $3.26 trillion, targeting a breakout above $3.31 trillion. Holding the $3.21 trillion level remains essential for continued momentum.

- Bitcoin hovers around $107,619, striving to flip $107,724 into support. A drop below $106,842 could invalidate the bullish setup.

- Pi Network jumps 15.6%, trading at $0.62. A decisive move above $0.64 could confirm a bullish breakout, while losing $0.61 might lead to a retracement to $0.57.

The Crypto Market Shows Renewed Strength

The total crypto market cap added $28.5 billion in the last 24 hours, reaching $3.26 trillion. This positive move stems from improving macroeconomic conditions and renewed investor appetite for risk. With confidence returning, major digital assets are regaining momentum.

The market now eyes the $3.31 trillion resistance. A clean breakout could propel the market toward $3.43 trillion, inviting more capital inflows and strengthening bullish sentiment. However, a drop below the key $3.21 trillion support might trigger a reversal, potentially pushing valuations back to $3.16 trillion or lower.

Bitcoin Tests Crucial Resistance Zone

Bitcoin continues its steady rebound, trading just shy of a key resistance at $107,724. Reclaiming this level as support would open the door to a test of $110,000, potentially setting off a wave of buying interest. The Relative Strength Index (RSI) supports this outlook, showing strength above the neutral zone.

Failure to hold $106,842 could disrupt the upward momentum. In such a case, Bitcoin might revisit the $104,643 zone — a move that could shake short-term bullish expectations.

Pi Network Leads the Altcoin Rally

Pi Network saw a significant price jump, rallying 15.6% to reach $0.62. It now faces a key resistance at $0.64, a level closely watched by traders for confirmation of trend continuation.

The Parabolic SAR currently indicates bullish pressure, suggesting a favorable environment for a breakout. If $0.64 is flipped into support, Pi Network may continue climbing. However, losing support at $0.61 would expose the asset to a decline toward $0.57, potentially signaling a short-term top.

Fast Facts

- Total Market Cap: Up by $28.5 billion, currently at $3.26 trillion

- Target Resistance: $3.31 trillion; critical support at $3.21 trillion

- Altcoin Leader: Pi Network is today’s top performer

- Technical Indicators: Parabolic SAR on Pi Network signals bullish trend and market-wide sentiment improving, driven by macro stabilization

Conclusion

The crypto market’s renewed rally is fueled by macro stability, improving sentiment, and technical resilience. Bitcoin is testing resistance with confidence, while Pi Network leads the altcoin charge. Key support levels must hold for the current momentum to continue — otherwise, traders should brace for a possible retracement. As always, staying informed on resistance flips and macro triggers is critical in navigating the crypto landscape. Want to know more up-to-date data in the crypto world? Check our articles in the Guides page.

FAQ

Why is the crypto market up today?

The market is rebounding due to easing macroeconomic concerns, improved liquidity, and positive investor sentiment, pushing up both Bitcoin and altcoins.

What is the current Bitcoin price level to watch?

$107,724 is the key resistance. Holding above this level could trigger a rally toward $110,000.

Is Pi Network a good buy right now?

Pi Network is showing bullish momentum. However, failure to hold $0.61 could reverse recent gains. Monitor $0.64 for confirmation.

What happens if the total market cap drops below $3.21T?

Losing that support could signal a shift to bearish conditions, with the potential to fall toward $3.16T or lower.

Which altcoins are leading today?

Pi Network stands out with over 15% gains, followed by moderate strength in Bitcoin and select majors.