Introduction

The pursuit of passive income is a cornerstone of modern investing, and the cryptocurrency space offers unique opportunities to achieve it. As of 2025, two methods consistently dominate the conversation: cloud mining and crypto staking. While both promise to generate returns on your digital assets without active trading, they operate on fundamentally different principles and carry distinct risk-reward profiles. Cloud mining allows you to rent computing power from remote data centres, while staking involves locking up your tokens to help secure a blockchain network. This guide provides a comprehensive breakdown of cloud mining versus staking in 2025, analysing their mechanisms, profitability, risks, and suitability for different types of investors.

Key Takeaways

- Cloud mining is the act of renting hardware (hash power) to mine cryptocurrencies like Bitcoin remotely. Staking is the process of locking your own crypto assets to participate in and secure a Proof-of-Stake (PoS) network.

- Reputable cloud mining platforms typically offer an Annual Percentage Rate (APR) between 5% and 10%. Staking yields vary by network, with major assets like Ethereum offering around 3% APY, while others like Solana and NEAR can provide 6%−12%, and some Cosmos chains can reach up to 18%.

- Cloud mining’s primary risks are platform-related, including scams, opaque fees, and provider bankruptcy. High-yield schemes (e.g., those promising 100%−800% APR) are extremely risky and often turn out to be Ponzi schemes. Staking risks include network penalties (“slashing”), validator downtime, and the volatility of the staked asset’s price.

- Cloud mining is generally more beginner-friendly, requiring minimal technical knowledge. Staking is becoming increasingly accessible through exchanges and liquid staking protocols, which solve the problem of locked funds by issuing tradable derivative tokens.

- Staking, based on the energy-efficient Proof-of-Stake consensus mechanism, is vastly more environmentally friendly than cloud mining, which relies on energy-intensive Proof-of-Work mining.

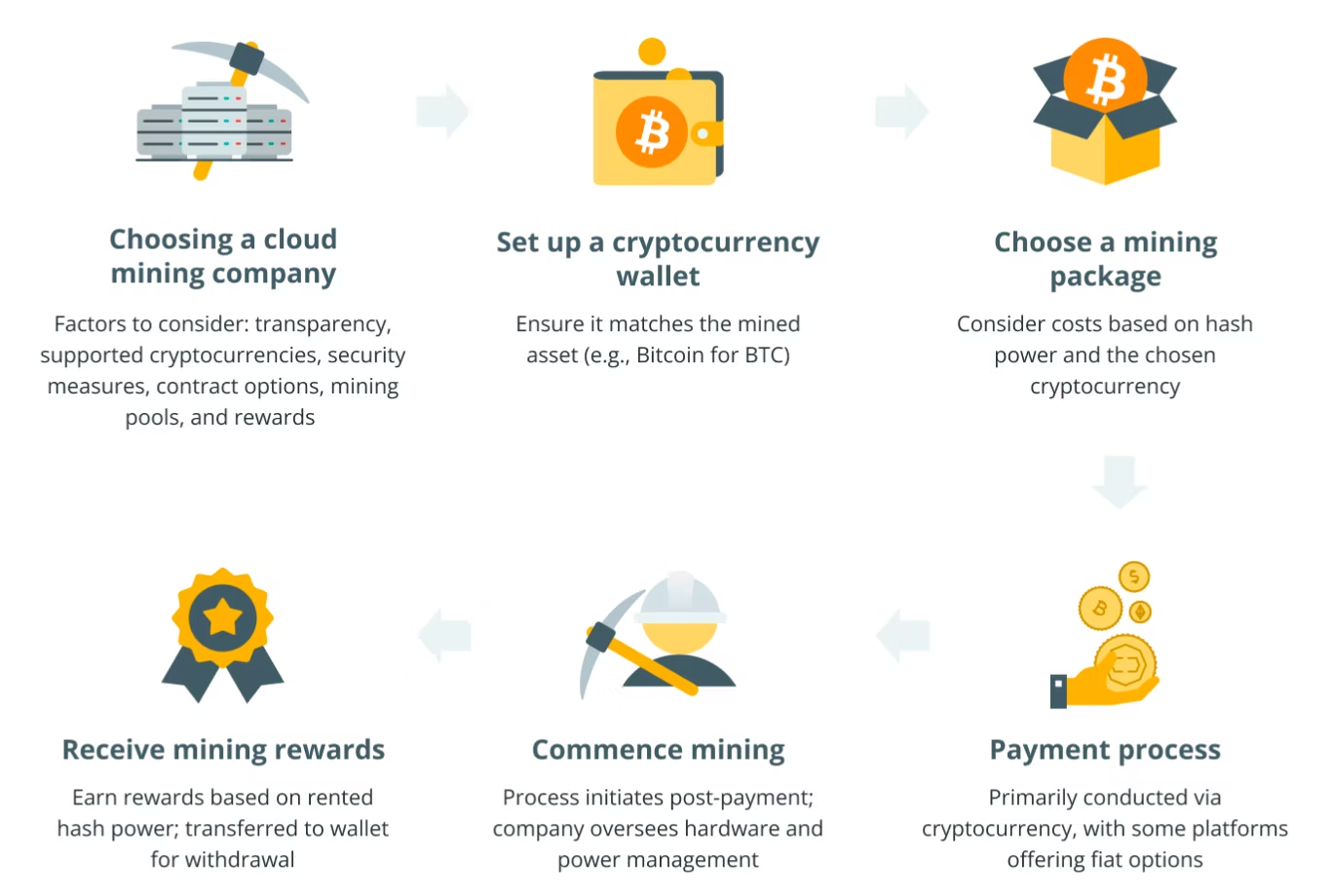

How Cloud Mining Works in 2025

Cloud mining offers a gateway to cryptocurrency mining without the need to purchase, operate, and maintain specialised hardware like ASICs. Instead, users purchase contracts from a cloud mining provider, effectively renting a portion of their data centre’s hash power. In exchange, the user receives daily mining rewards (typically in Bitcoin or Ethereum) proportional to their rented hash power, minus service and electricity fees.

In 2025, the market is led by several key platforms:

- MiningToken: Focuses on Swiss regulatory compliance, using AI to optimise hash power allocation and sourcing renewable energy. It offers flexible contracts, some as short as a single day.

- ECOS: Operating from Armenia’s Free Economic Zone, ECOS provides an integrated ecosystem with mining contracts, wallets, and ROI calculators, with entry-level plans starting from just $50.

- NiceHash: Functions as an open marketplace where users can buy or sell computing power with dynamic pricing. However, its convenience comes with fees of around 3%.

While typical Bitcoin cloud mining contracts yield a stable 5%−10% APR, the sector remains rife with speculative schemes. Offerings linked to assets like XRP that tout unrealistic returns of 100%−800% APR should be treated with extreme caution, as they often exhibit the characteristics of Ponzi schemes. Although next-generation ASICs and green energy are improving margins and sustainability, concerns about the centralisation of hash power and environmental impact persist, making them crucial factors in any comparison.

How Crypto Staking Works in 2025

By 2025, Proof-of-Stake (PoS) has solidified its position as a leading strategy for generating passive crypto income. Staking enables token holders to “lock” their assets to support a network’s security and operations. In return for this service, they earn rewards. While some advanced users run their own validator nodes, the vast majority delegate their tokens to established validators and collect rewards minus a small commission.

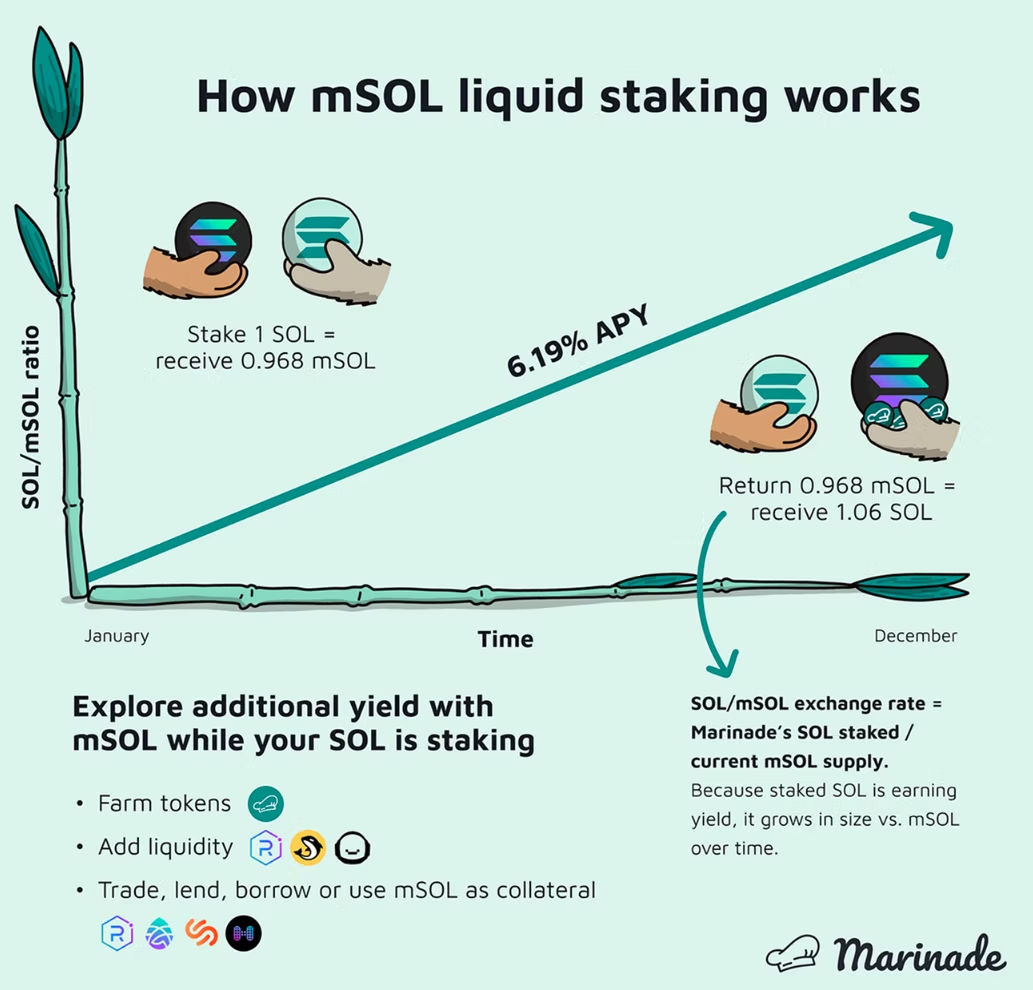

A major innovation in this space is liquid staking. Platforms like Lido (for Ethereum) and Marinade (for Solana) issue derivative tokens (e.g., stETH, mSOL) that represent the staked assets. These derivatives can be traded or used in DeFi, allowing stakers to remain liquid while still earning yield.

As of August 2025, staking profitability varies significantly across networks:

- Ethereum (ETH): ~ 3% APY

- Solana (SOL): ~ 6%−7% APY

- Cardano (ADA): ~ 4%−6% APY

- NEAR Protocol (NEAR): ~ 9%−11% APY

- Cosmos (ATOM): Up to 18% APY (netting around 6% after commissions on exchanges)

Compared to the often-opaque world of cloud mining, staking payouts are generally more predictable. However, risks remain, including validator downtime, “slashing” penalties for misbehaviour, and asset price drops. The industry has matured significantly, with regulated staking-as-a-service providers now offering institutional-grade infrastructure with custody, audits, and insurance.

Comparison Matrix: Cloud Mining vs. Crypto Staking

| Feature | Cloud Mining | Crypto Staking |

| Typical Returns | 5%−10% APR on reputable platforms. | 3%−18% APY, depending on the network and risk. |

| Risk Profile | High. Platform risk (scams, bankruptcy), opaque fees, contract terms. | Moderate. Slashing risk, validator downtime, smart contract vulnerabilities, market volatility. |

| Liquidity | Low. Principal is locked for the duration of the contract, though rewards are often paid daily. | Varies. Traditional staking involves lockup/unbonding periods. Liquid staking offers immediate liquidity. |

| Technical Barrier | Very Low. Platforms handle all technical aspects. | Low to High. Easy via exchanges; moderate via liquid staking; high for running a private validator. |

| Initial Investment | Low entry points, often starting from $50 – $100. | Varies. No minimum for delegating on many networks, but some have minimums (e.g., 32 ETH for an ETH validator). |

| Sustainability | Low. Relies on energy-intensive Proof-of-Work mining. | High. Based on the highly energy-efficient Proof-of-Stake model. |

Which Strategy Fits Your Investor Profile?

The right choice between cloud mining vs crypto staking depends entirely on your goals, risk tolerance, and technical comfort.

- Beginners & Low-Tech Users: Cloud mining platforms like ECOS or MiningToken offer a simple, hands-off approach to earning passive income. Staking via a major crypto exchange or a liquid staking service is also an excellent and increasingly simple entry point.

- High-Risk, High-Yield Seekers: While the astronomical APRs of speculative XRP cloud mining contracts are tempting, they are best avoided due to a lack of transparency and high scam potential. A more transparent high-yield alternative lies in staking newer or more complex PoS networks like Cosmos or Polkadot, which can offer returns above 15% for those willing to do their research.

- Institutional & Compliance-Focused Investors: Staking is the clear winner here. The maturation of staking-as-a-service providers, complete with KYT/KYB checks, insured custody, and regulator-friendly reporting, makes it a far more credible option than the largely unregulated cloud mining sector.

- Sustainability-Oriented Investors: For those focused on Environmental, Social, and Governance (ESG) criteria, staking is the only viable choice. Its Proof-of-Stake model consumes a fraction of the energy used by the Proof-of-Work mining that powers most cloud mining operations.

Additional Considerations

Before you commit your capital, consider these final factors:

- Tax Implications: In most jurisdictions, including the UK, rewards from both staking and mining are taxed as ordinary income at their value when received. Any subsequent sale of the crypto may trigger capital gains tax. Tax authorities are increasingly using data from exchanges to ensure compliance.

- Market Volatility: All your rewards are paid in cryptocurrency. A sharp downturn in the market can erase the fiat value of your earnings overnight.

- Platform Reliability: Due diligence is critical. Look for transparent, audited providers with clear Service Level Agreements (SLAs) and public uptime data. This information is becoming standard for staking platforms but remains rare in the cloud mining industry.

Conclusion

Choosing between cloud mining and crypto staking in 2025 involves a trade-off between simplicity, risk, and control. Cloud mining offers a straightforward, hands-off path to earning Bitcoin, but it requires placing immense trust in a third-party provider in an industry with a history of scams. Staking, on the other hand, offers more direct participation in the crypto economy with greater transparency and higher potential yields, though it comes with its own set of technical and market risks.

There is no single “best” answer. The optimal strategy is one that aligns with your financial goals, risk tolerance, and personal values—especially regarding environmental impact. By understanding the core differences outlined here, you can make an informed decision on how to best put your crypto assets to work.

Frequently Asked Questions

Is cloud mining still profitable in 2025?

Yes, legitimate cloud mining can be profitable, typically yielding 5%−10% APR. However, profitability depends on the contract price, electricity/maintenance fees, and the price of Bitcoin. Be extremely wary of any platform promising returns significantly higher than this range.

Is staking safer than cloud mining?

Staking is generally considered safer from a platform-risk perspective because you often retain more control over your assets and the ecosystem is more transparent. However, it has its own risks, such as “slashing” (losing a portion of your stake if your validator misbehaves) and smart contract bugs. The primary risk in cloud mining is the provider itself disappearing or being fraudulent.

Can I lose all my money in staking?

While possible, it is highly unlikely. Losing everything would require a catastrophic event, such as a critical bug in the network’s code or your validator being slashed for a severe violation, which typically penalises a small percentage, not the entire stake. The more common risk is the value of your staked asset decreasing due to market volatility.

What is liquid staking and how does it help?

Liquid staking allows you to earn staking rewards without locking your assets. When you stake via a liquid staking protocol (like Lido), you receive a derivative token (like stETH) that represents your staked position. You can then sell this token or use it in other DeFi applications, all while continuing to earn staking rewards. It solves the “liquidity” problem of traditional staking.

How much money do I need to start cloud mining or staking?

Both have low barriers to entry. Many cloud mining contracts start at around $50-$100. For staking, you can often delegate any amount to a validator pool through an exchange or wallet. The high capital requirements (like 32 ETH for an Ethereum validator) only apply if you want to run your own validator node.

Which method is better for the environment?

Staking is unequivocally better for the environment. It is based on the Proof-of-Stake (PoS) consensus mechanism, which is estimated to be over 99.9% more energy-efficient than the Proof-of-Work (PoW) algorithm that powers Bitcoin mining and, by extension, most cloud mining services.