Key Takeaways

- Blockchain growth in 2025 is defined by real-world usage and continuous technological upgrades, rather than speculation and hype.

- Active users, measured through wallet addresses completing transactions, remain the most reliable indicator of adoption.

- DeFi, NFT ecosystems, and stablecoin adoption continue to attract millions of new users across chains.

- Partnerships with mainstream platforms and institutional inflows via Bitcoin ETFs are accelerating network adoption.

- Ongoing challenges include inflated activity metrics, scalability trade-offs, regulatory pressure, and competition between L1 and L2 networks.

Introduction

The blockchain industry is experiencing its fastest expansion yet, with both new and established networks battling for dominance. But the real question remains: which platforms are actually gaining widespread, consistent use?

In 2025, growth has been less about hype cycles and more about sustained user engagement and innovative tech infrastructure. Both foundational layer-1 (L1) blockchains and efficient layer-2 (L2) scaling solutions are attracting millions through cheaper transactions, integrations with mainstream platforms, and thriving decentralized ecosystems.

This article ranks the top 10 fastest-growing blockchains of 2025, focusing on active user growth and the metrics behind their momentum.

Criteria for Ranking

The ranking relies primarily on active user numbers, while also factoring in fully diluted valuations (FDV), token trading volumes, growth drivers, and challenges.

- Layer-1 (L1): Foundational blockchains with their own consensus mechanisms (e.g., Ethereum, Solana).

- Layer-2 (L2): Scaling solutions that build on L1s to improve speed and reduce costs (e.g., Arbitrum, Base).

- Active users: Counted as unique wallet addresses completing transactions within a given timeframe.

- FDV (Fully Diluted Valuation): The total theoretical market value of a token if all supply were circulating. This provides perspective on long-term valuation relative to potential supply.

Top 10 Fastest-Growing Blockchains of 2025

1. Solana

- Type: L1

- Monthly active users: 57 million

- FDV: $107.2 million

- Token trading volume (30 days): $284.2 billion

Drivers: Explosive DeFi and NFT activity, high-frequency memecoin trading, the Firedancer validator client improving network reliability, and rising institutional adoption.

Challenges: Ongoing criticism over centralization, legacy issues with network outages, and growing competition from L2 ecosystems.

2. Near Protocol

- Type: L1

- Active addresses (monthly): 51.2 million

- FDV: $3.1 million

- Token trading volume (30 days): $7.8 million

Drivers: Integration of AI-native features enabling user-owned agents, ultra-low fees with carbon neutrality, and partnerships such as EigenLayer for faster finality. Expanding activity in DeFi and gaming ecosystems.

Challenges: Price volatility despite adoption growth, competition from faster rivals, and the complexity of sharding architecture potentially exposing vulnerabilities.

3. BNB Chain

- Type: L1

- Active addresses (monthly): 46.4 million

- FDV: $121.2 billion

- Token trading volume (30 days): $56.1 billion

Drivers: Block time reduction to 0.75 seconds, EVM compatibility, and early AI integrations enabling greater data ownership.

Challenges: High centralization due to Binance’s backing and continued regulatory scrutiny across jurisdictions.

4. Base

- Type: L2

- Active addresses (monthly): 21.5 million

- FDV: $2.92 billion

Drivers: Minimal transaction costs (~$0.01), massive onboarding potential through Coinbase’s 100+ million users, stablecoin flows, and rapid DApp partnerships.

Challenges: Heavy reliance on Ethereum for security, risk of congestion due to surging activity, and navigating regulatory frameworks as a relatively new network.

5. Tron

- Type: L1

- Active addresses (monthly): 14.4 million

- FDV: $33.5 billion

- Token trading volume (30 days): $51.7 billion

Drivers: Almost negligible transaction fees, deep integration with Telegram, and strong traction in stablecoin transfers. Partnerships such as Rumble Cloud strengthen ecosystem presence.

Challenges: Concentration of power, regulatory headwinds, and criticisms around network centralization.

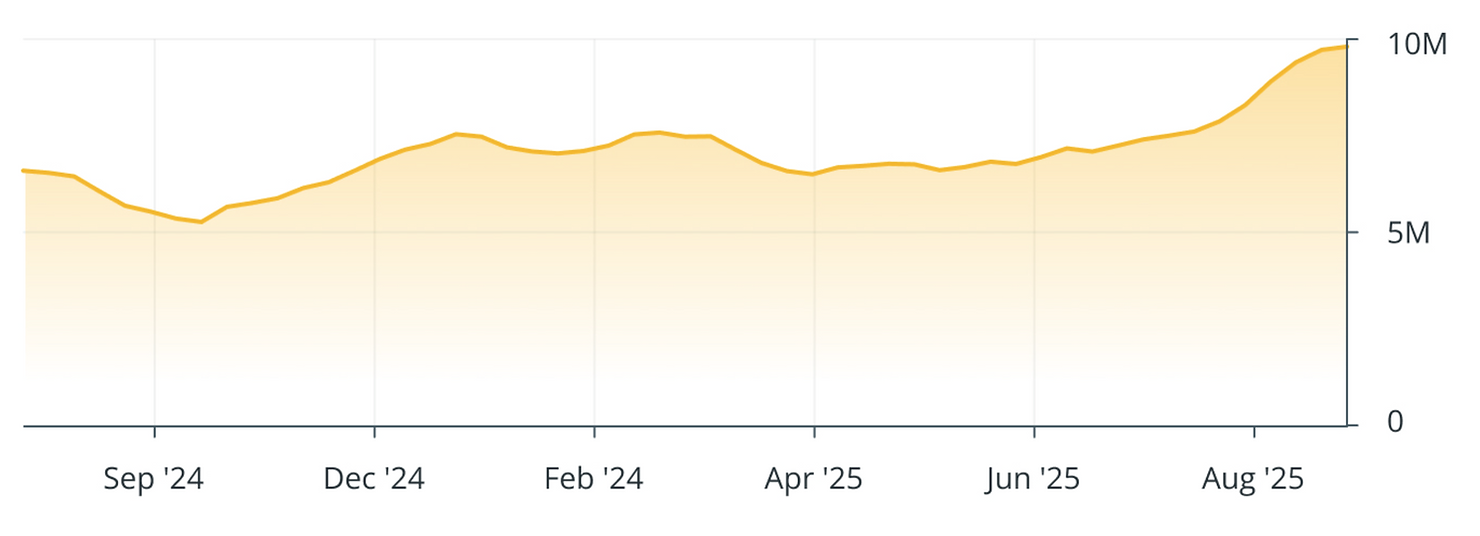

6. Bitcoin

- Type: L1

- Active addresses (monthly): 10.8 million

- FDV: $2.3 trillion

- Token trading volume (30 days): $1.3 trillion

Drivers: ETF inflows with institutional holdings surpassing $27.4 billion (Q4 2024), scarcity effects from halving events, and adoption as a macro hedge and reserve asset.

Challenges: High energy consumption from PoW mining and exposure to macroeconomic volatility.

7. Aptos

- Type: L1

- Active addresses (monthly): 10 million

- FDV: $5.3 billion

- Token trading volume (30 days): $13 billion

Drivers: Scalability with peak 19,200 TPS, adoption of the Move programming language for secure smart contracts, and partnerships such as Tether’s USDt launch.

Challenges: Competing against entrenched L1 players and still working toward broader DApp adoption.

8. Ethereum

- Type: L1

- Active addresses (monthly): 9.6 million

- FDV: $522.7 billion

- Token trading volume (30 days): $1.1 trillion

Drivers: The upcoming Pectra upgrade to improve scalability and UX, ETF inflows, and institutional participation in staking.

Challenges: Gas fees remain higher compared to rivals, scalability remains a bottleneck, and regulators are tightening oversight.

9. Polygon

- Type: L2 scaling ecosystem

- Active addresses (monthly): 7.2 million

- FDV: $2.6 billion

- Token trading volume (30 days): $4.2 billion

Drivers: Upgrades like Heimdall v2 enhancing interoperability, strong enterprise adoption, and partnerships with Fortune 500 companies.

Challenges: Increased scrutiny under MiCA regulations in Europe and rising competition from other L2s.

10. Arbitrum One

- Type: L2

- Active addresses (monthly): 4 million

- FDV: $5.1 billion

- Token trading volume (30 days): $14.3 billion

Drivers: Integrations with platforms like Robinhood for tokenized assets, and innovations such as Stylus for reduced transaction costs.

Challenges: Dependence on Ethereum’s mainnet security, regulatory uncertainty, and direct competition with Optimism.

Trends Driving Blockchain Growth in 2025

- Stablecoin adoption powering activity: Stablecoins such as USDT and USDC ($0.9998 each) continue to fuel transaction growth, liquidity, and ecosystem stickiness.

- L2 scalability improvements: Networks like Base and Arbitrum One enable Ethereum to process transactions at a fraction of the cost, sometimes as low as $0.01.

- DeFi and NFTs fueling new users: Protocols like GMX on Arbitrum and Polygon’s NFT trading volume of $227 million (Q1 2025) attract traders and collectors alike.

- Mainstream integrations: Base’s seamless integration with Coinbase showcases how exchanges are driving mass adoption.

- Institutional participation: Bitcoin ETFs received $36.4 billion in inflows in 2024, while corporate partnerships (e.g., Starbucks with Microsoft/Azure) continue to expand blockchain’s credibility.

Conclusion

The top 10 fastest-growing blockchains of 2025 reveal an ecosystem where both L1 and L2 networks are innovating aggressively to attract millions of users. Leaders like Solana, Near Protocol, and Arbitrum exemplify how low-cost transactions, scalable DeFi ecosystems, and integrations with mainstream platforms drive adoption.

Still, growth is tempered by persistent challenges:

- Inflated activity metrics due to bots and dormant addresses.

- Trade-offs between speed and decentralization, particularly for high-throughput chains.

- Regulatory pressure surrounding stablecoins and compliance.

- Fierce competition between major L1s and Ethereum’s scaling L2s.

Looking ahead, the winners will be those blockchains that continue to deliver real user value, enhance trust, integrate with mainstream platforms, and navigate regulation effectively.

Frequently Asked Questions

What makes “active users” a reliable metric for blockchain growth?

Active users, counted as unique wallet addresses completing transactions, represent real network engagement rather than speculative trading volume.

Why are layer-2 solutions like Base and Arbitrum growing so quickly?

They drastically reduce costs and congestion on Ethereum, making DApps, DeFi, and NFTs more accessible to mainstream users.

How important are stablecoins in blockchain adoption?

Extremely important. Stablecoins like USDT and USDC power liquidity, reduce volatility risks, and account for a major share of on-chain transactions.

Why is Solana leading in active users despite past outages?

Solana’s low fees, NFT/DeFi activity, and institutional adoption continue to outweigh concerns about past reliability.

What role do Bitcoin ETFs play in adoption?

Bitcoin ETFs have attracted tens of billions in institutional investment, cementing Bitcoin as a mainstream financial asset.