Key Takeaways

- KYC-free platforms still exist, though options are narrower than before.

- They provide privacy and fast access, but users must accept higher risks.

- Strong security habits are essential for protecting funds in a no-KYC environment.

- Some no-KYC platforms impose strict withdrawal caps, while others allow high limits, making it vital to match your exchange with your trading needs.

- Decentralized platforms like dYdX eliminate withdrawal limits but require stronger technical knowledge and self-custody responsibility.

Introduction

No-KYC crypto exchanges allow you to buy and sell digital assets without handing over IDs or proof of address. They are designed for anonymity and cut out the delays that come with lengthy verification processes. The choices today are more limited than they were five years ago, when privacy-focused platforms were easier to find. Still, a handful continue to carry the torch for traders who want to remain anonymous. In this review, we explore the best no-KYC exchanges available in 2025, highlight their features, and explain how they work so you can trade quickly and privately without linking every transaction to your identity.

Why Use No-KYC Crypto Exchanges?

Trading without KYC means you do not need to provide personal documents like a passport, driver’s license, or utility bill. This alone makes such platforms worth considering if you prioritize privacy.

Each time you upload sensitive information to a centralized exchange, you place trust in that company to secure your data. History has shown that this is not always a safe bet, as breaches and leaks are far more frequent in the crypto industry compared to other sectors.

No-KYC exchanges eliminate this risk by removing the document submission process entirely. To them, you are just another wallet address, not a personal file in a corporate database. Speed is another significant advantage. Forget waiting for approval emails or lengthy reviews. With no-KYC platforms, you can often register with just an email address, or sometimes with no registration at all, and begin trading immediately. This makes them especially useful if you need to react quickly to market moves and cannot afford delays of hours or even days.

Access is another benefit. If you live in a country where crypto trading faces restrictions, a no-KYC exchange may be your only available entry point. By cutting out unnecessary barriers, these platforms make it possible to buy, sell, or swap assets without interference from regulators or banking institutions.

However, freedom comes with trade-offs. Account recovery is limited if you lose access, and legal gray zones may put you at risk in certain jurisdictions. Even so, many traders consider the balance of speed, privacy, and accessibility to be worth the compromise.

Ultimately, no-KYC exchanges return control to the user, protecting real-world identities in a way that aligns with the vision of crypto’s early builders.

How to Choose a No-KYC Exchange

Trading without verification does not mean ignoring all rules. Selecting the right exchange still requires careful evaluation of security, limits, fees, features, and accessibility.

Security should always come first. Even without sharing your identity, you need to ensure the platform itself is trustworthy. Look into its operating history, whether it publishes proof-of-reserves, and what the community says about its reliability. Privacy means little if the exchange is hacked or disappears overnight.

Withdrawal limits are another factor. Every platform sets ceilings on what unverified accounts can move. Some allow up to 10 BTC per day, while others barely exceed $1,000. Align the limit with your trading needs to avoid hitting walls.

Fees and available tools matter as well. Privacy does not mean free trading. Some no-KYC exchanges impose higher spreads, while others add network costs. Compare these against the features you need, whether that means basic spot swaps or advanced futures and margin trading. Not every product is available without verification.

Liquidity and token selection are equally important. It is frustrating to prioritize anonymity only to find thin order books or a lack of tokens you want to trade. Ensure that the platform supports the assets you seek and offers sufficient depth for trades without heavy slippage.

Finally, examine the fine print. Some platforms restrict users from certain jurisdictions, while others reserve the right to request KYC if suspicious activity arises. Anonymity has limits, and you should understand them before signing up.

Top Anonymous Trading Platforms in 2025

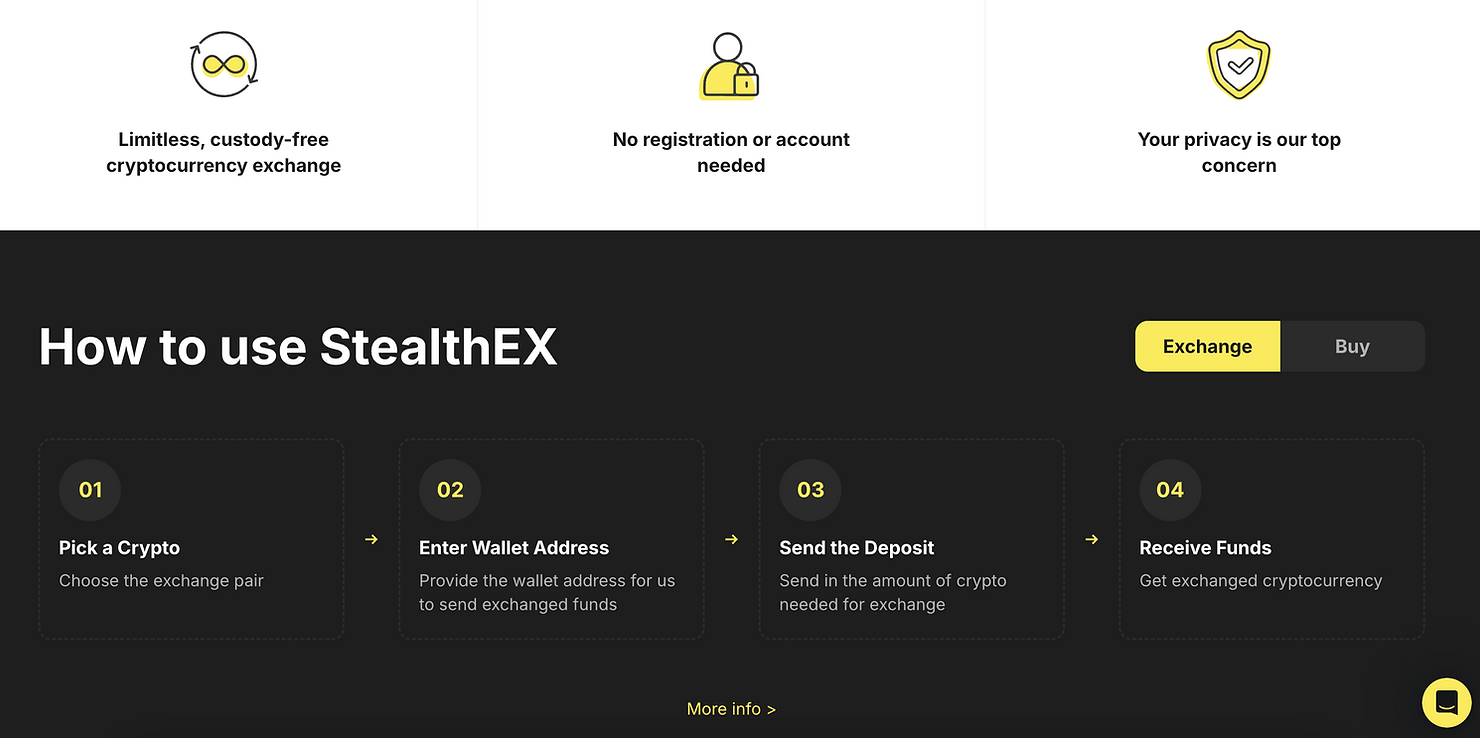

StealthEX

StealthEX, launched in 2018, functions as a privacy-focused exchange aggregator. It does not require an account, and swapped assets are sent directly to your wallet so you always maintain custody. The platform aggregates liquidity from major exchanges like Binance and KuCoin, which allows competitive rates without connecting to your identity.

With support for more than 1,500 cryptocurrencies, including cross-chain swaps, StealthEX offers access to both leading assets and niche tokens. Purchases with credit cards are available through partners, although those options may require light verification. The service avoids regulatory complications by not handling fiat directly, which strengthens its commitment to anonymity. StealthEX is designed for traders who value speed, privacy, and simplicity.

BYDFi

BYDFi, short for “Build Your Dream Finance,” is a Singapore-based exchange launched in 2020. Accounts can be created with only an email, letting you trade immediately without verification. Unverified users may withdraw up to 1.5 BTC per day, which is sufficient for most traders while retaining privacy.

Unlike many rivals, BYDFi does not restrict futures, margin, or copy trading behind KYC walls. This gives access to up to 200× leverage on derivatives while staying anonymous. The platform supports around 280 cryptocurrencies across spot and derivatives markets. It also provides grid and DCA bots and a copy trading feature where users can follow strategies with as little as $10.

Overall, BYDFi combines accessibility, advanced features, and low fees in a way that serves both beginners and experienced traders.

BloFin

BloFin is a newer exchange with a focus on advanced tools such as automated strategies and copy trading. Despite this, KYC remains optional, and accounts can be created with only an email.

Unverified users can withdraw up to 20,000 USDT daily, one of the more generous limits among non-KYC platforms. This provides flexibility for active traders who want to maintain privacy.

BloFin lists over 350 cryptocurrencies across spot and derivatives markets, offering leverage up to 150× on futures. It also provides analytics and bot features that enhance trading strategies without requiring identity checks.

dYdX

dYdX is a decentralized exchange for derivatives trading, built for advanced users who prioritize privacy and control. You connect a wallet such as MetaMask and trade directly, keeping full custody of your funds at all times.

The exchange specializes in perpetual futures and supports over 180 markets with leverage up to 100×. Since funds remain in your wallet, there are no withdrawal limits, giving you unrestricted access to capital.

The platform operates on a custom blockchain developed with the Cosmos SDK, offering high throughput, quick confirmations, and low transaction costs. Fees are structured by volume, with rebates available for high-frequency traders, while standard taker fees remain lower than most centralized platforms.

Governance is decentralized and handled by holders of the DYDX token, who vote on upgrades, parameters, and rules. This makes the platform resistant to centralized control and closely aligned with crypto’s ethos.

MEXC

Founded in 2018, MEXC has grown into one of the largest platforms by scale and liquidity. It lists more than 2,800 cryptocurrencies, far exceeding most centralized competitors. This makes it particularly attractive for those who want exposure to niche or newly launched tokens.

Unverified accounts can withdraw up to 10 BTC per day, one of the highest thresholds in the industry. Spot trading fees begin at 0 percent for makers and around 0.05 percent for takers, while futures trading offers 0 percent for makers and 0.02 percent for takers, keeping costs low.

MEXC also provides futures markets with leverage up to 200×, as well as leveraged ETFs and staking products. While KYC is optional, completing verification increases withdrawal limits to as much as 80 BTC and unlocks OTC and fiat gateway access.

Conclusion

Trading without KYC delivers speed, privacy, and independence. There are no identity checks, no approval delays, and no paper trails. As 2025 progresses, many platforms that once allowed no-KYC trading have shifted toward stricter requirements, including exchanges such as Kraken and BingX.

Although options are fewer today, several centralized and decentralized platforms continue to provide anonymity or minimal verification requirements. Whether or not KYC-free trading is right for you depends on your priorities. If fast access, privacy, and independence matter more than account recovery options and regulatory clarity, then no-KYC exchanges may be a good fit.

The trade-offs include higher responsibility for security, limited customer support, and the risk of sudden regulatory changes. For smaller traders and privacy-conscious users, however, the appeal remains strong. Ultimately, the safety of your funds depends on how carefully you handle your own security practices.

Frequently Asked Questions

Is it legal to use no-KYC crypto platforms?

Legality depends on your jurisdiction. Some countries allow trading on no-KYC platforms, while others restrict or ban it. Using such services in restricted regions may carry legal risks, so check local regulations first.

Which exchanges allow high withdrawal limits without KYC?

A few centralized platforms still permit significant withdrawals without identity checks, sometimes reaching several BTC or tens of thousands in stablecoins. Limits differ between exchanges, and policies change over time. Decentralized platforms generally impose no withdrawal limits since trades occur directly from your wallet.

Are decentralized exchanges safer than centralized no-KYC platforms?

DEXs eliminate custody risks since you hold your own funds, but they introduce risks like smart contract exploits and liquidity shortages. Centralized platforms are often easier to use but remain targets for hacks. Safety depends on your experience and the platform’s track record.

What are the risks of trading crypto without KYC?

Main risks include the lack of account recovery, potential scams, and sudden policy changes. Without identity verification, support teams may be unable to help if you lose access to funds or credentials. Regulatory crackdowns also remain a possibility.

Do no-KYC exchanges support fiat deposits or withdrawals?

Most do not, since fiat services require banking partners that enforce KYC. Some exchanges integrate third-party processors for card payments or peer-to-peer markets, though these often involve light verification. For full anonymity, crypto-to-crypto transactions remain the most reliable route.