Key Takeaways

- Altcoin season describes the period when a majority of altcoins outperform Bitcoin. Historical data shows these seasons can deliver massive gains, such as the 174 percent surge in large-cap altcoins during 2021 compared to Bitcoin’s modest 2 percent rise.

- Bitcoin’s price cycle remains the central catalyst, but factors such as investor psychology, global liquidity, regulatory clarity, and technological innovation all play crucial roles.

- Institutional inflows, like the $4 billion Ethereum ETF investments in August 2025 and the $1.16 billion directed toward Solana exchange-traded products, underscore how much capital drives these rallies.

- Retail FOMO, DeFi expansion beyond $140 billion in total value locked, and Bitcoin dominance dipping below 60 percent confirm shifting tides.

- Yet risks remain high, and successful navigation requires diversification, risk management, and awareness of broader macroeconomic signals.

Introduction

The world of cryptocurrency is famous for its volatility, rapid innovation, and cycles of wealth creation. Among the most exciting and closely watched phenomena is what traders and analysts call “altcoin season.” This term refers to periods when digital assets beyond Bitcoin capture the spotlight and generate extraordinary returns. While Bitcoin remains the anchor of the crypto market, the rotation of capital into altcoins can reshape the landscape of digital finance. Understanding what drives these seasons is critical for both new and experienced investors, as the factors that fuel altcoin rallies reveal much about market psychology, global liquidity, technological trends, and institutional adoption.

What Really Is Altcoin Season?

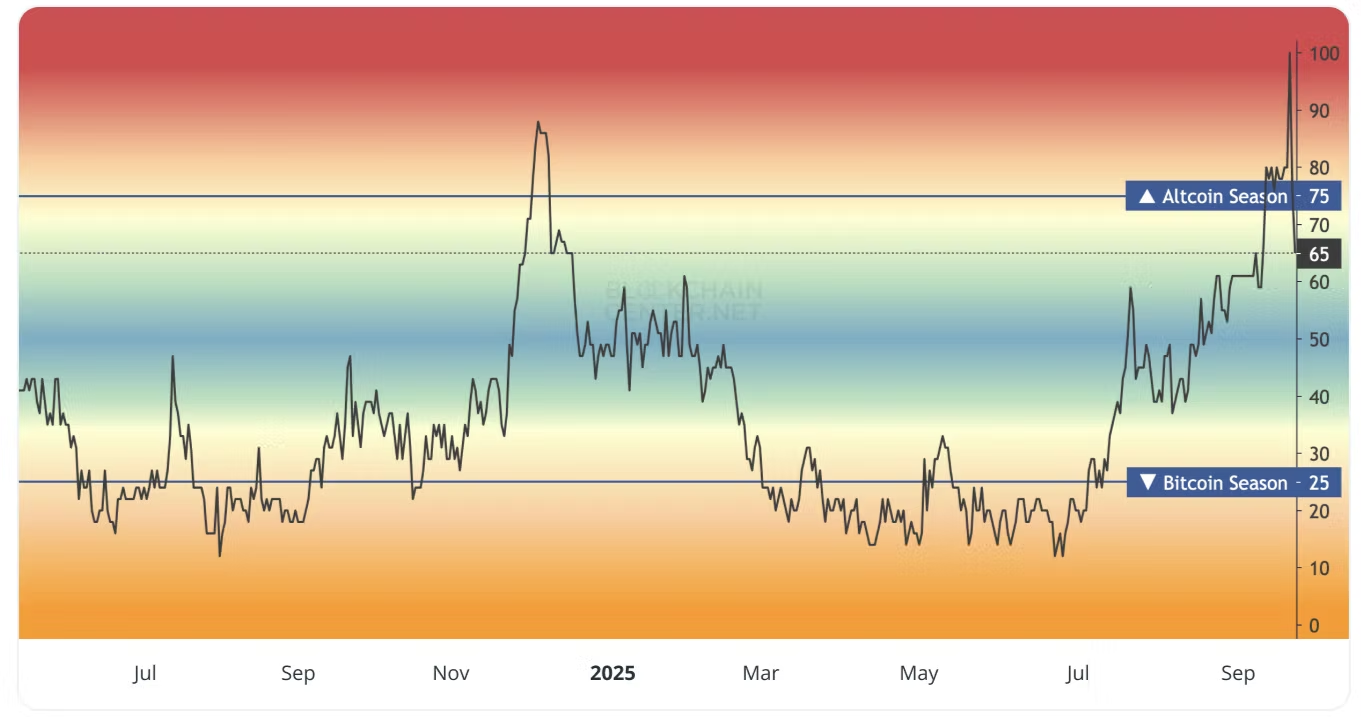

Altcoin season, often shortened to “altseason,” describes periods when a large number of altcoins outperform Bitcoin in terms of price growth. In these cycles, investor capital moves away from Bitcoin into other tokens such as Ethereum, Solana, Cardano, and even smaller speculative coins like Dogecoin or Pudgy Penguins. The Altcoin Season Index, a popular benchmark created by Blockchain Center, defines altseason as beginning when at least seventy-five percent of the top one hundred altcoins outperform Bitcoin across a ninety-day window.

History offers vivid examples of this pattern. During the 2021 bull market, large-cap altcoins appreciated by about 174 percent, while Bitcoin managed to rise only around 2 percent during the same timeframe. These data points raise the critical question of what factors consistently ignite altcoin seasons and why they matter so much for investors.

Bitcoin’s Price Cycle: The Catalyst for Altcoin Rallies

Bitcoin remains the bellwether for the crypto industry. Its performance often sets the tone for the entire market, and altcoin rallies generally emerge after strong Bitcoin advances. When Bitcoin crosses symbolic milestones, such as its surge to above one hundred thousand dollars in late 2024, the resulting inflow of capital fuels market optimism. As Bitcoin begins to stabilize or consolidate, many traders rotate profits into altcoins, which tend to offer higher risk but also potentially much larger rewards.

This behavior reflects market psychology. Bitcoin’s rise validates crypto in the eyes of investors, drawing in new participants and confidence. Once the main rally slows, attention shifts to altcoins, whose smaller market capitalizations and narratives make them attractive for outsized returns. For example, after Bitcoin gained 124 percent in 2024, twenty of the top fifty altcoins went on to outperform it, marking the early stages of altseason. Bitcoin dominance, or BTC.D, is a useful measure here. It tracks Bitcoin’s share of the overall crypto market capitalization. When BTC.D declines below the range of fifty to sixty percent, it usually signals capital flowing into altcoins. In August 2025, Bitcoin dominance dropped from 65 percent to 59 percent, hinting strongly at an approaching altcoin season.

Market Sentiment and FOMO: The Psychological Fuel

Investor psychology plays a central role in the unfolding of altcoin season. The fear of missing out, or FOMO, is one of the most powerful forces in speculative markets. When assets like Ethereum or memecoins such as Pepe start delivering double or even triple-digit gains, social platforms like X, Reddit, and Telegram erupt with discussions, memes, and excitement.

This creates a self-reinforcing cycle. Rising prices attract more buyers, which in turn pushes prices even higher. In 2024, for instance, Dogwifhat skyrocketed by more than 1,100 percent thanks to a wave of community-driven enthusiasm. Online trends provide valuable clues. In 2025, Google Trends data for the word “altcoins” shattered previous records in August, surpassing the May 2021 peak and entering what analysts described as “price discovery” during Bitcoin’s consolidation above $110,000. The retail FOMO was particularly strong for Ethereum, Solana, and memecoins like Dogecoin, at the same time institutional flows added fuel with nearly $4 billion in Ethereum ETF inflows shifting capital from Bitcoin into altcoins.

Macroeconomic Factors: Liquidity and Risk Appetite

The state of the global economy directly shapes altcoin season. Variables such as interest rates, inflation levels, and liquidity injections determine how much speculative capital is available. When central banks, particularly the United States Federal Reserve, cut rates or provide liquidity through measures like quantitative easing, riskier assets like altcoins often surge. Lower yields in traditional markets drive investors toward high-risk, high-reward opportunities in crypto.

Hopes for Federal Reserve rate cuts in 2025 are already fueling speculation that liquidity injections could power the next altcoin boom. Conversely, restrictive policies limit growth potential. The experience of 2020–2021 illustrates this dynamic clearly: aggressive money printing and historically low rates created an environment in which the altcoin market capitalization soared to record levels. Geopolitical developments and regulation matter as well. The approval of Ether spot ETFs in 2024, with inflows reaching nearly $4 billion by August 2025, highlights how regulatory clarity and supportive policy can unlock substantial capital flows into altcoins.

Technological Innovation and New Narratives

Beyond macroeconomics and investor psychology, altcoin season is often defined by technological breakthroughs and emerging narratives that capture imagination and investment. Each cycle tends to spotlight a different theme. The 2017 season was dominated by initial coin offerings. The 2021 rally centered on decentralized finance and non-fungible tokens. In 2025, analysts argue that artificial intelligence-driven blockchain projects, tokenization of real-world assets, and advancements in layer-two scalability are providing the next narrative wave.

Ethereum continues to be the backbone of this ecosystem. Its role in supporting decentralized finance, NFTs, and scaling solutions makes it a key driver. When Ethereum’s price rises sharply, it often signals the broader start of altcoin rallies. Solana and Avalanche also draw attention for their throughput and ability to tokenize assets such as real estate and equities, attracting institutional interest and, eventually, retail speculation.

Institutional and Retail Capital: The Money Flow

The maturation of the crypto market has brought institutional players into the heart of altcoin season. Unlike earlier cycles driven almost entirely by retail investors, the 2025 trend is led by institutional inflows. Bitcoin dominance has already dropped below 59 percent, reminiscent of conditions that preceded altcoin booms in 2017 and 2021.

Ethereum ETFs recorded nearly $4 billion of inflows in August 2025, while regulators began reviewing similar products for Solana and XRP. In September, the U.S. Securities and Exchange Commission streamlined ETF rules, resulting in more than ninety applications, with analysts placing the approval odds for an XRP ETF at ninety-five percent. Such approval could unlock between $4.3 and $8.4 billion in fresh inflows. Solana exchange-traded products alone saw $1.16 billion in inflows year-to-date, and CME’s launch of SOL and XRP futures options in October 2025 is expected to attract hedge funds.

Retail investors amplify these moves with speculative enthusiasm. Memecoins such as Dogecoin jumped 10 percent to $0.28, and presale tokens surged in parallel. Trading volume data supports this trend. CryptoQuant reports that Binance Futures recorded $100.7 billion in daily altcoin trading volume in July 2025, the highest since February, with activity concentrated in altcoin-to-stablecoin pairs rather than Bitcoin. DeFi total value locked climbed to more than $140 billion, while the Altcoin Season Index reached 76, confirming that three-quarters of altcoins were outperforming Bitcoin. Overall, this represented around $4 trillion in market capitalization growth, and with ETF decisions expected in October, analysts predict another $5 billion of inflows that could sustain altcoin rallies into the final quarter of the year.

Key Metrics to Watch: How to Spot Altcoin Season

Spotting altcoin season in real time requires monitoring certain indicators. Analysts often look for Bitcoin dominance falling below the 55 percent threshold and an Altcoin Season Index score above 75. Spikes in altcoin-to-stablecoin trading volumes, rising altcoin market capitalization, and positive technical indicators reinforce the case.

Recent figures align with this. In September 2025, the Altcoin Season Index hovered around 78, while Bitcoin dominance slipped under 60 percent. The altcoin market capitalization reached $1.63 trillion, nearing its all-time peak. Technical tools such as the relative strength index and the moving average convergence divergence remain useful for identifying profitable entry and exit points.

Risks and Strategies to Navigate Altcoin Season

Despite the enormous opportunities, altcoin season carries significant risks. Altcoins often lose between fifty and ninety percent of their value following peak cycles, and speculative hype can magnify losses. Fraudulent projects, sudden regulatory changes, and liquidity shocks pose additional dangers.

Prudent investors adopt strategies to mitigate these risks. Diversification across large, mid, and small-cap assets helps spread exposure. Technical indicators guide optimal entry and exit timing. Stop-loss orders provide protection against sudden downturns. Staying informed through news outlets and community discussions enables quicker adaptation. Securing profits in reliable wallets with two-factor authentication safeguards gains. Still, caution is essential because the exact timing and duration of altcoin season usually becomes clear only in hindsight. By understanding the drivers such as Bitcoin’s performance, market sentiment, macroeconomic conditions, and technological narratives, investors can prepare to benefit from the cycles while managing the downside effectively.

Conclusion

Altcoin season is one of the most powerful dynamics in cryptocurrency markets. It represents not only a rotation of capital but also a shift in investor psychology and a reflection of broader economic and technological trends. While these periods bring extraordinary opportunities, they also carry heightened risks. Investors who recognize the signals, monitor the metrics, and approach with both optimism and caution can better position themselves for potential gains. As the crypto market matures, altcoin season is likely to remain a defining feature of each cycle, revealing how innovation, regulation, and investor behavior converge in digital finance.

FAQs

What is the Altcoin Season Index?

It is a metric created by Blockchain Center that signals altcoin season when at least seventy-five percent of the top one hundred altcoins outperform Bitcoin during a ninety-day period.

How does Bitcoin dominance affect altcoin season?

When Bitcoin dominance falls below the range of fifty to sixty percent, it usually indicates that capital is rotating into altcoins, often preceding altseason.

Why do altcoins outperform Bitcoin during these periods?

Altcoins are smaller, more volatile, and carry narratives that attract speculative capital. Once Bitcoin stabilizes after a rally, investors rotate into altcoins seeking higher returns.

What role do institutional investors play?

Institutional adoption is now central. For instance, Ethereum ETFs drew nearly $4 billion in inflows in August 2025, and Solana exchange-traded products attracted $1.16 billion year-to-date. These moves provide both capital and legitimacy, driving altcoin rallies.

What are the main risks of investing during altcoin season?

The risks include extreme volatility, potential losses of 50 to 90 percent, scams, regulatory crackdowns, and speculative bubbles. Risk management and diversification are critical.