Introduction

Digital assets have moved from niche hobby to mainstream conversation, making cryptocurrency gifts an increasingly popular choice for Christmas 2025. Instead of another sweater or gadget, gifting crypto can introduce friends and family to a new financial technology, help them experiment with digital ownership, and spark conversations about the future of money.

However, because crypto involves price swings, security practices and tax rules, the gift needs to be handled thoughtfully. The goal is not to overwhelm the recipient with technical details, but to offer a simple, safe, and practical starting point.

This guide explains how to pick which crypto to give, use gift cards, hardware wallets, or direct transfers to deliver your gift, and highlight key security basics and tax considerations so your present remains a pleasant surprise rather than a future headache.

Key Takeaways

- Stick to established cryptocurrencies like Bitcoin and Ether when gifting, especially to beginners, to keep things simple and widely usable.

- Crypto gift cards and vouchers are the most beginner-friendly option, since recipients only need to redeem a code.

- Hardware wallets work best for larger, long‑term gifts and add an extra layer of security plus a physical present to wrap.

- Direct transfers via exchanges or wallets are suitable for recipients who already use crypto and know how to manage wallet addresses.

- Crypto prices are highly volatile, and gifts should be seen as a thoughtful gesture, not a guaranteed investment.

- Tax rules differ by country, but in many places, gifting crypto under certain thresholds is not immediately taxable for either party.

How To Choose Which Cryptocurrency To Gift

With more than 27 million cryptocurrencies circulating by late 2025, choosing just one can feel confusing. For a Christmas gift, especially for someone new to the space, the safest approach is to focus on established, widely recognized coins rather than obscure or ultra‑speculative tokens.

Prioritize Well‑Known, Widely Supported Coins

There is no single “perfect” cryptocurrency for gifting. Each asset differs in:

- Purpose (payments, smart contracts, gaming, DeFi, etc.)

- Age and track record

- Level of adoption and community support

For most recipients, especially beginners, it is sensible to choose Bitcoin (BTC), Ether (ETH), or other high‑ranked cryptocurrencies on major data aggregators like CoinMarketCap or CoinGecko

These coins generally have:

- Longer histories and more proven resilience over time.

- Larger and more active communities, so it is easier for the recipient to find tutorials and support.

- Wide support on crypto exchanges and wallet apps, making it simpler to store, trade, or cash out later.

Be Cautious With New Or Very Cheap Coins

Some newer or extremely low‑priced cryptocurrencies are promoted with bold promises of rapid growth. While the upside can look tempting, these assets often:

- Show extreme price volatility, rising and falling sharply in short periods.

- Have limited liquidity, which makes converting them into other assets more difficult.

- May be harder for beginners to understand and manage, both technically and emotionally when prices move.

For a Christmas gift, the priority is usually clarity and ease of use, not speculation. In most cases, a stable, well‑known asset is a more thoughtful choice than a token that is hard to explain.

Crypto Gift Cards And Vouchers

For someone who has never held digital assets before, crypto gift cards and vouchers are one of the most straightforward ways to give crypto. They function similarly to traditional gift cards for retail stores, but instead of store credit, they represent a claim on a specific amount of cryptocurrency.

How Crypto Gift Cards Work

The basic flow looks like this:

- Purchase the card or voucher

- You buy a digital code or physical card from a provider.

- The card is loaded with a fixed amount of fiat money (for example, 100 USD).

- Give the code as the present

- The card or email containing the code becomes your Christmas gift.

- Recipient redeems the code

- The recipient goes to the provider’s website or app and enters the code.

- At redemption, the fiat value is used to buy the chosen cryptocurrency (e.g., Bitcoin) at the current market rate.

- The purchased crypto is then deposited into an account or wallet created or connected by the recipient.

From the recipient’s perspective, the process is similar to redeeming any standard gift card, except that the result is digital currency instead of store credit.

Why Gift Cards Are Beginner‑Friendly

This method is ideal for people who:

- Have no prior experience with wallets or exchanges.

- Feel intimidated by technical terms like seed phrase or network fees.

- Prefer a simple, code‑based redemption process without handling complex transaction screens.

The recipient mainly needs to:

- Visit a website or app.

- Enter the gift code.

- Follow guided steps to receive their crypto.

However, every provider operates differently. Availability, supported coins, redemption conditions, and fees can vary. It is wise to read the terms and conditions before purchasing to ensure:

- The card is valid in the recipient’s country or region.

- The coins offered are ones you are comfortable gifting.

- The redemption process is clear and not overly restrictive.

Gifting Crypto Through Hardware Wallets

For larger or more long‑term gifts, a hardware wallet can add both extra security and a physical object to wrap and place under the tree.

What A Hardware Wallet Is

Hardware wallets are small, dedicated devices built for secure crypto storage. They are designed so that your private keys remain completely offline, which helps protect your funds from:

- Malware and viruses

- Phishing attacks

- Remote hacking attempts

In cryptocurrency, control of funds depends on control of the private keys. Whoever has access to those keys can move the assets. Because hardware wallets never expose the keys directly to the internet, they significantly reduce certain cyber‑security risks.

Two Ways To Use A Hardware Wallet As A Gift

There are two common approaches to making a hardware wallet part of a Christmas present:

- Preload the device with crypto

- You set up the wallet, generate the recovery phrase, and transfer the cryptocurrency onto it.

- Then you gift the fully loaded hardware wallet to the recipient.

- This method is convenient but requires strong trust, because you have seen the recovery phrase.

- Gift the wallet unopened and set it up together

- You buy a sealed hardware wallet and present it as is.

- After the gift is opened, you help the recipient set it up.

- The device generates a recovery phrase (seed phrase), and only the recipient writes it down and stores it.

- You then help them transfer crypto from your wallet or an exchange to their new hardware wallet.

Generally, the second method is safer, because only the recipient knows the recovery phrase. This preserves their full control and keeps you from having ongoing access to their funds.

Why The Recovery Phrase Matters

The recovery phrase (often 12 or 24 words) is the single critical backup for the wallet. If the device is lost, stolen, or damaged, the funds can only be restored using this phrase.

Key rules to emphasize to the recipient:

- Never share the recovery phrase with anyone.

- Never type it into unofficial websites, apps, or “support” chats.

- Store it offline in a secure place, such as a paper backup in a safe location.

Whoever knows the recovery phrase can effectively control the crypto, so it must be treated like the keys to a safe.

Choosing The Right Hardware Wallet

Hardware wallets vary in:

- Price range (from budget options to premium devices)

- Supported cryptocurrencies (some support only Bitcoin, others many different assets)

- Extra features, such as:

- Small screens for transaction confirmation

- Passphrase or PIN support

- Companion mobile or desktop apps

This allows you to choose a model that matches:

- Your budget

- The level of crypto experience of the recipient

- The number and type of assets they might eventually hold

How To Gift Crypto Using Exchanges And Software Wallets

If your recipient already uses crypto, or if both of you are comfortable with wallet interfaces, sending cryptocurrency directly can be a practical option. This is typically done via a centralized exchange account or a self‑custody software wallet.

When Direct Transfers Make Sense

Direct on‑chain gifting is suitable if:

- The recipient already has a crypto wallet or exchange account.

- They understand how to find and share their public address.

- You both are confident about selecting the correct network and double‑checking details.

If these conditions are not met, a gift card or hardware wallet might be safer.

Step‑By‑Step: Sending Crypto As A Gift

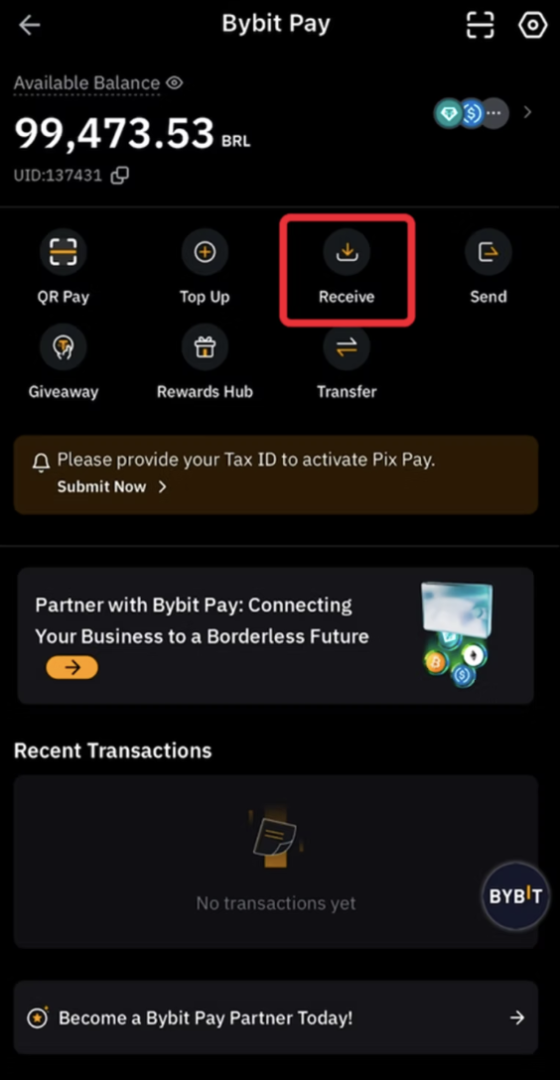

- Recipient finds their wallet address

- They log in to their crypto wallet app or exchange account.

- They select “Receive” or “Deposit” for the specific coin (for example, Bitcoin or Ether).

- The application shows a public wallet address (a long string of letters and numbers, and often a QR code).

- You prepare the transfer

- Log in to your own wallet or exchange.

- Select “Send” or “Withdraw” for the same cryptocurrency.

- Paste or scan the recipient’s address into the destination field.

- Verify all details carefully

- Confirm that the network matches on both sides (for example, sending ETH on the Ethereum network rather than another chain).

- Double‑check the address character by character, or verify via QR code.

- Review network fees and the final amount.

- Send a small test transaction first

- To reduce risk, send a small trial amount initially.

- Confirm that it arrives correctly in the recipient’s wallet.

- After verification, send the remainder of the intended gift.

Because blockchain transactions are generally irreversible, any mistake in the address or network selection can result in permanent loss of funds. Taking a few extra minutes to verify can prevent an expensive error.

Risks And Responsibilities When Gifting Crypto

While gifting crypto can be exciting and novel, it comes with unique risks and responsibilities that both givers and recipients should understand.

Market Volatility

Cryptocurrencies are known for significant price swings. The value of your gift may:

- Increase substantially over time, or

- Decrease sharply, sometimes within hours or days

For this reason, crypto should be presented as a thoughtful and educational gift, not as a guaranteed profit or investment promise. Setting the right expectations helps avoid disappointment if prices drop.

Security Risks And Phishing

Unlike traditional bank accounts, many crypto setups place full responsibility for security on the user. New holders can be particularly vulnerable to:

- Phishing emails imitating exchanges, wallets, or support teams

- Fake websites and fraudulent apps that request recovery phrases or private keys

- Social engineering attempts via messaging platforms and social media

The single most important rule to share with the recipient is:

Never reveal the seed phrase or recovery phrase to anyone, under any circumstances.

Legitimate support staff, apps, and companies will never ask for the recovery phrase. If someone demands it, it is almost certainly a scam.

Tax Implications Of Gifting Crypto

Tax treatment of crypto gifts differs significantly by jurisdiction, so both givers and recipients should consult a qualified local tax advisor to understand their obligations.

However, a common pattern in many countries is:

- Gifting or transferring ownership of cryptocurrency is often not immediately taxable for either party, as long as the gift stays below certain annual exclusion thresholds.

- In the United States, for example, the annual gift tax exclusion for 2025 is 19,000 USD per recipient. Gifts under this amount generally do not trigger gift tax for the giver.

- The recipient’s tax obligation typically arises later, when they:

- Sell the gifted crypto for fiat, or

- Trade it for another cryptocurrency or asset.

To correctly calculate future tax on any gains, the recipient usually needs:

- The original purchase price (cost basis) paid by the giver.

- The date the giver acquired the asset.

Sharing this information at the time of the gift helps the recipient:

- Record their cost basis.

- Understand how potential capital gains might be calculated if they later sell or exchange the crypto.

Fast Facts

- There are tens of millions of cryptocurrencies in existence as of late 2025, but only a small fraction are widely adopted.

- Bitcoin and Ether remain the most recognized and supported assets across exchanges and wallet apps.

- Many crypto gift card providers let you buy cards in fixed fiat amounts (for example, 100 USD) that are converted into crypto at redemption.

- Hardware wallets keep private keys fully offline, helping protect funds from online attacks.

- In the United States, the annual gift tax exclusion per recipient is 19,000 USD for 2025, meaning most personal crypto gifts fall under this limit.

- A lost seed phrase (recovery phrase) usually means lost funds, so recipients must store it securely and never share it.

Conclusion

Gifting cryptocurrency at Christmas in 2025 is a creative way to introduce loved ones to the world of digital assets. Whether you choose a user‑friendly gift card, a secure hardware wallet, or a direct transfer, the most important principles remain the same:

- Keep it simple by choosing established, widely supported coins.

- Prioritize security by explaining seed phrases, hardware wallets, and basic scam awareness.

- Set realistic expectations about volatility and potential value changes.

- Acknowledge tax rules and share cost basis details to help the recipient later.

When handled thoughtfully, a crypto gift can become more than just a transfer of value—it can be the starting point for a deeper understanding of digital finance, long after the wrapping paper is gone.

Frequently Asked Questions

1. What is the safest cryptocurrency to gift in 2025?

There is no single “safest” coin, but Bitcoin and Ether are generally considered reliable choices due to their long track records, high liquidity, and broad exchange and wallet support. High‑ranked cryptocurrencies on well‑known tracking platforms are usually more suitable than obscure tokens for gifts.

2. Are crypto gift cards a good idea for complete beginners?

Yes. Crypto gift cards and vouchers are one of the easiest entry points for newcomers. The recipient mainly needs to redeem a code through a website or app, without manually handling wallet addresses or complex transaction settings. It is still important to guide them on basic security and to choose a reputable provider.

3. Should I preload a hardware wallet with crypto before gifting it?

You can, but there are trade‑offs. Preloading is convenient, yet it means you have seen the recovery phrase, which gives you theoretical access to the funds. A safer route is often to gift the hardware wallet sealed, then help the recipient set it up from scratch so only they know the seed phrase, after which you can transfer the crypto to their new wallet.

4. What happens if the hardware wallet is lost or damaged?

If the hardware wallet is lost, stolen, or breaks, the funds are not necessarily gone—as long as the recovery phrase is safely backed up. The owner can buy a new compatible device or use supported software, enter the seed phrase, and restore access. Without that phrase, the funds are usually unrecoverable.

5. How do I avoid mistakes when sending crypto directly to someone’s wallet?

Follow these steps:

- Always copy‑paste or scan the wallet address; avoid typing it manually.

- Check that both sender and recipient are using the same network for that coin.

- Send a small test transaction first, confirm it arrives, then transfer the full gift.

- Double‑check every detail before pressing “Send,” since blockchain transfers are typically irreversible.

6. Is gifting crypto taxable for me or the recipient?

In many jurisdictions, gifting cryptocurrency up to certain annual thresholds is not an immediate taxable event for either party. In the United States, for example, the 2025 annual gift tax exclusion per recipient is 19,000 USD, so most small personal crypto gifts fall under this limit. The recipient generally becomes liable for tax only if they later sell or trade the gift for a profit. Because laws differ by country and can change, both parties should consult a local tax professional for tailored advice.

7. How should I explain the risks to someone who has never used crypto before?

Be transparent but concise:

- Explain that prices can rise or fall sharply, so the gift is not a guaranteed investment return.

- Emphasize that whoever controls the recovery phrase controls the funds, so it must never be shared.

- Warn about phishing attempts and fake support messages that ask for seed phrases or passwords.

- Encourage them to ask questions before taking any actions they do not fully understand.

8. Can children receive crypto as a gift?

Yes, but the legal and practical setup may vary by country and age. Some parents store crypto on behalf of their children in their own wallets or use custodial accounts where an adult controls the funds until the child is older. Regardless of the method, guardians should pay attention to local regulations, tax rules, and long‑term security.

9. What is the best method overall for gifting crypto at Christmas?

There is no one‑size‑fits‑all solution. For complete beginners, a crypto gift card or a hardware wallet set up together is usually best. For experienced users, a direct transfer to an existing wallet is simple and efficient. Choose the approach that matches the recipient’s familiarity level, the size of the gift, and how much time you can spend guiding them.

10. Can the recipient immediately convert the gifted crypto to cash if they want?

In many cases, yes—especially if you gift popular coins like Bitcoin or Ether. The recipient will need to:

- Use a regulated exchange or service that supports their region and the coin.

- Complete any required identity verification (KYC).

- Sell the crypto for fiat and withdraw to a bank account or payment method.

The ease and speed of this process depend on the recipient’s country, local regulations, and the platforms available to them.