Introduction

Can you generate passive income by mining XRP in 2025? Let’s start with a crucial fact: XRP cannot be mined. Unlike Bitcoin or Ethereum, all 100 billion XRP tokens were created (“pre-mined”) when the network launched. This means there is no ongoing “mining” process to validate transactions and create new coins.

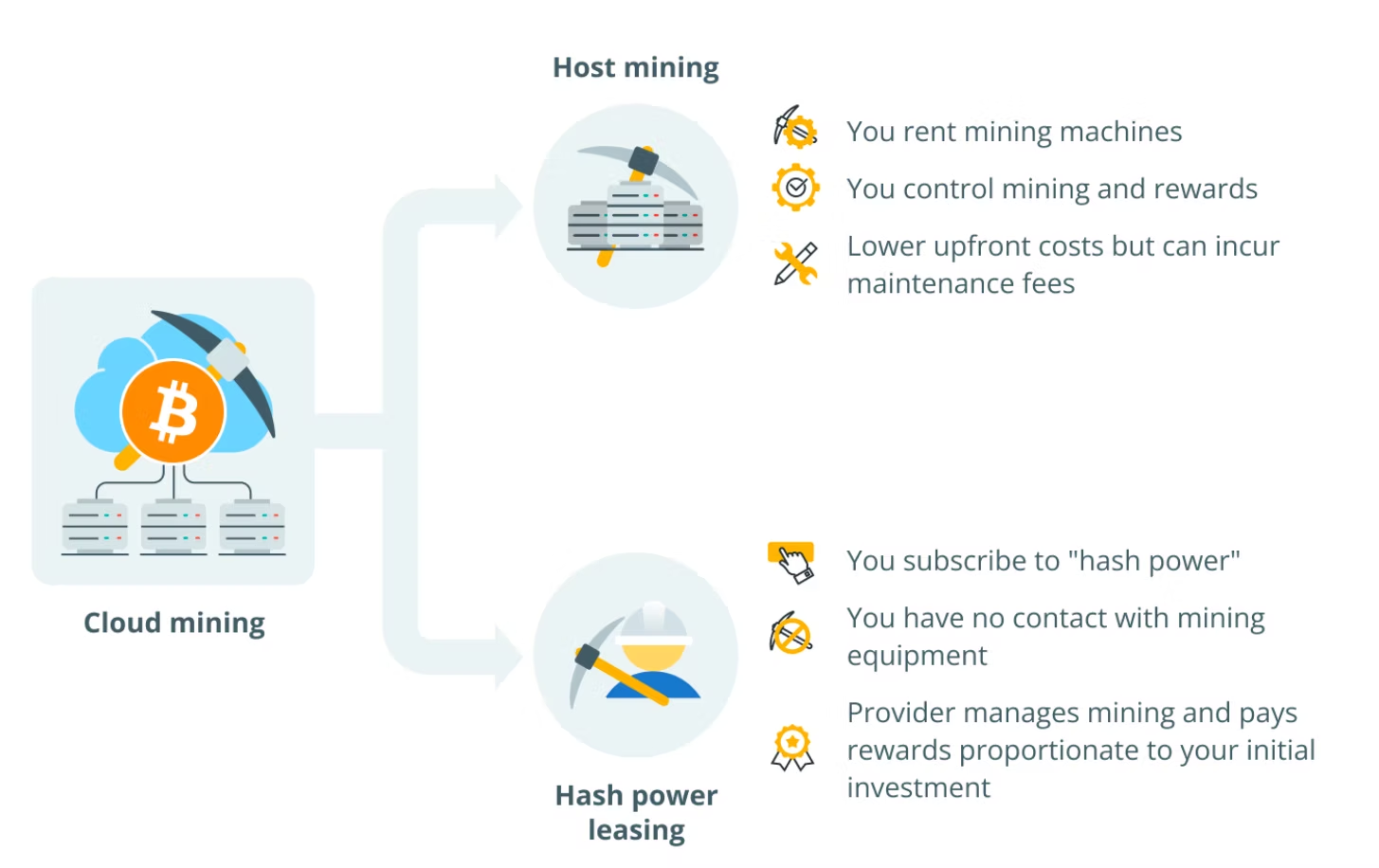

So, what is “XRP cloud mining”? It’s primarily a marketing term used by platforms to attract XRP holders looking for passive returns. In practice, these services do not mine XRP. Instead, they allow you to use your XRP to fund mining contracts for other cryptocurrencies, typically Bitcoin (BTC) or Ethereum (ETH).

While this may seem like a simple distinction, it’s the key to understanding the model. The appeal lies in the unique benefits of using XRP for these transactions. In mid-2025, a surge of platforms emerged, offering daily-payout contracts for as little as $10. Their promises are bold: exceptional return on investment (ROI), instant settlements, and a frictionless user experience.

This guide cuts through the hype to analyse how these XRP cloud mining contracts actually work, what you can realistically expect to earn, and whether the sky-high returns are simply too good to be true.

Key Takeaways

- XRP cloud mining does not involve mining XRP. It is a mechanism to fund BTC or ETH mining contracts using your XRP holdings.

- Advertised returns, often ranging from 100% to over 800% APR, are a significant red flag and are generally unsustainable in legitimate mining operations.

- The space is fraught with risks, including a high probability of scams, extreme market volatility, hidden fees, and a near-total lack of regulatory oversight.

- More secure options for earning yield on XRP exist, such as using wrapped XRP in DeFi protocols or lending through regulated platforms.

How XRP Cloud Mining Works

Here’s a breakdown of how these XRP mining contracts operate:

You deposit XRP into a platform to rent a specific amount of hashrate (computing power), which is directed towards mining established cryptocurrencies like BTC or ETH. The platform handles all the operational complexities—hardware procurement, electricity costs, and maintenance. In exchange for your investment, you receive daily payouts, which can be in XRP, Bitcoin, or another designated currency. This model enables users to earn passively without needing to purchase or manage any mining equipment.

The process is designed to be attractive, leveraging the XRP Ledger’s core strengths: ultra-low transaction fees (around $0.0002) and rapid settlement times (3-5 seconds). This makes depositing funds and withdrawing earnings fast and cost-effective.

There is typically no technical setup required from the user:

- Choose a contract: Select a plan based on duration (e.g., 2, 5, or 32 days).

- Deposit funds: Fund the contract with as little as $10 worth of XRP.

- Receive rewards: Start earning daily payouts almost instantly.

These platforms market an easy entry into passive income with flexible terms, but the real story is often hidden in the fine print.

Advertised Earnings and ROI: A Reality Check

Let’s examine the returns advertised by these platforms. For security, company names have been omitted, but the following data was collected from active platforms in July 2025.

Platform A: This provider offers a $10 sign-up bonus. A $100 contract is advertised to yield approximately $3 per day for five days, resulting in a total return of $15.

- Analysis: This represents a 15% ROI in just five days, which annualises to an astonishing ROI of over 1,000%.

Platform B: This service offers contracts from $100 to $12,000.

- A two-day plan is advertised to pay $6-$8 per day on a $100 investment.

- A 32-day contract for $12,000 claims to return a profit of $6,528.

Another platform goes even further, promising payouts of up to $50,000 per day on its most expensive packages.

A Snapshot of Advertised ROI:

- $100 invested for 2 days: +6% to +8% return (annualised to 1,100%-1,500% APR)

- $500 invested for 5 days: +20% to +25% return (annualised to over 1,500% APR)

- High-tier plans: +50% or more in a matter of weeks (often exceeding 800% APR)

When compared to legitimate, traditional cloud mining operations—which typically yield a far more modest 5%-15% APR—it’s clear why these offers attract so much attention.

However, a critical hidden risk is asset volatility. Payouts are fixed in cryptocurrency terms, not fiat value. A sharp downturn in the price of XRP or BTC could wipe out the real-world value of your earnings overnight, regardless of the promised returns.

The Key Risks of XRP Cloud Mining

- Unsustainable Returns & Ponzi Structures: Returns of 800% APR or more are mathematically impossible to generate from legitimate crypto mining activities. These yields are a classic red flag, strongly suggesting that payouts to older investors are being funded by the deposits of new users—the defining characteristic of a Ponzi or pyramid scheme.

- Counterparty Risk: Many of these platforms are new, operate anonymously, and lack any verifiable credentials or track record. Community forums and social media are filled with reports flagging these operations as potential scams dressed up as investment opportunities.

- Hidden Fees and Lockups: Advertised ROI rarely accounts for hidden charges. Many platforms impose undisclosed management fees or high withdrawal fees that significantly erode your net profit. Some may also enforce unexpected lockup periods, preventing you from accessing your funds.

- Lack of Regulation and Audits: Despite claims of “bank-grade security,” the vast majority of these services operate without regulatory oversight, third-party audits, or legal accountability. In the absence of regulation, users have no recourse in the event of platform failure, hacks, or outright fraud.

A Safer Approach: Strategy and Alternatives

If you are considering engaging with these platforms, a cautious and strategic approach is essential. The landscape is noisy, and the risks are high.

A Prudent Strategy

- Start Small: Begin with a minimal deposit ($20-$50) that you are fully prepared to lose. Use this to test the platform’s withdrawal process and see if they honour payouts on a matured contract.

- Verify and Research: Look for independent, verifiable reviews and user feedback. Dig deep into the fee structure—even supposedly reputable sites may deduct a percentage of profits upon withdrawal.

- Diversify (If You Must): A more advanced (but still high-risk) strategy involves spreading small amounts across multiple platforms, contracts, and durations to mitigate the risk of a single point of failure.

For long-term holders seeking more reliable and secure yield, consider these options:

- Decentralised Finance (DeFi): Use wrapped XRP (wXRP) on established DeFi lending and borrowing protocols on networks like Ethereum or BNB Chain. These platforms offer more modest but transparent and often algorithmically-secured yields.

- Centralised Lending: Lend your XRP through reputable and regulated cryptocurrency exchanges. These platforms typically offer 3%-10% APY under clear terms of service and with better security protocols.

- Long-Term Holding: For many, the simplest and potentially most effective strategy is to hold XRP and benefit from its potential long-term price appreciation, avoiding the counterparty risks associated with lending and “mining” schemes.

Conclusion

While “XRP cloud mining” offers a seemingly easy path to passive income, its promises of 100%-800% APR are almost always unrealistic and unsustainable. The aggressive returns heavily suggest a business model that relies on a constant inflow of new capital rather than legitimate mining profits.

If you are determined to explore this high-risk frontier, do so with extreme caution. Start with a small, disposable amount, verify payouts immediately, and treat it as a speculative gamble—not a reliable investment strategy.

For the majority of XRP holders, safer and more transparent avenues for growth exist. Exploring regulated lending services or DeFi protocols will provide more realistic and sustainable returns, backed by verifiable audits instead of anonymous testimonials.

Frequently Asked Questions

Can you actually mine XRP?

No. XRP is a pre-mined cryptocurrency. All 100 billion XRP tokens were created at its inception. Unlike Bitcoin, there is no mining process to validate transactions or create new coins. Any platform claiming to “mine XRP” is using misleading terminology.

How do these platforms offer “XRP mining” if it’s not possible?

These platforms use “XRP mining” as a marketing hook. What you are actually doing is using your XRP to pay for a contract that rents computing power (hashrate) for mining other cryptocurrencies, like Bitcoin. The platform then pays you back in XRP or another currency. Your XRP is just the method of payment.

Are all XRP cloud mining platforms scams?

While it’s difficult to label every single platform a scam without direct proof, the business model is inherently high-risk and exhibits many characteristics of fraudulent schemes. The advertised returns are unsustainable through legitimate mining, strongly suggesting that many operate as Ponzi schemes. It is best to assume any platform offering such returns is a high-risk venture until proven otherwise.

How much can I realistically earn from these platforms?

The advertised earnings are highly unreliable. If a platform were operating legitimately by renting out hashrate, the returns would align with the broader cloud mining market—typically 5% to 15% APR. Any earnings beyond that are likely coming from other sources, such as new user deposits, making the platform’s solvency highly questionable. You are more likely to lose your entire initial deposit than to achieve the advertised returns.