Introduction

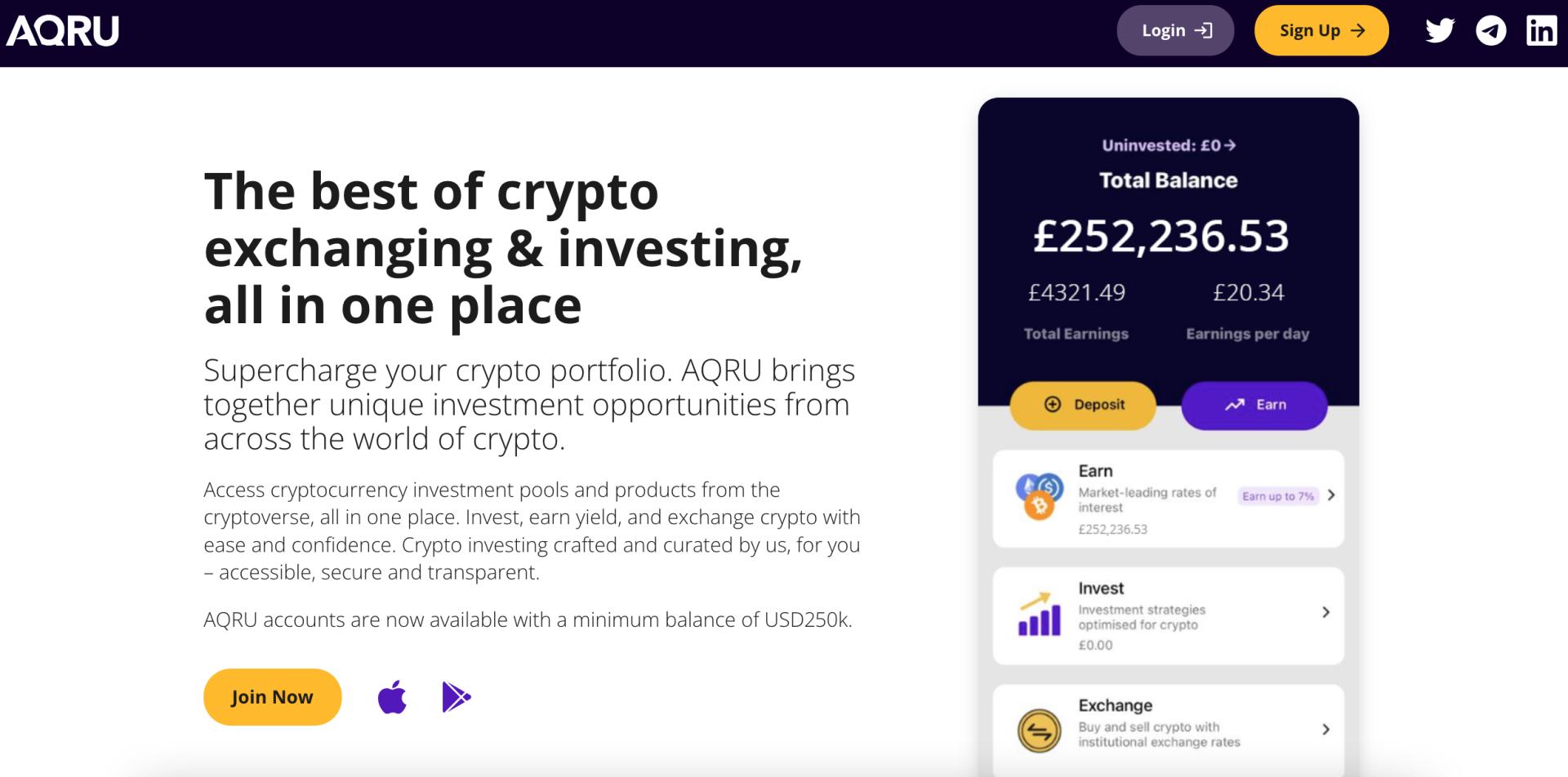

In 2025, AQRU shakes up how folks dive into staking platforms, setting up a straight-shooting way for crypto buffs and DeFi die-hards to make some easy bucks without the hassle. Founded by some sharp minds in investments, payments, and tech, they’ve had it with the headaches of turning a profit from digital coins. AQRU’s ready to make life a cinch with a platform that’s easy on the eyes, letting users flip their cash to crypto and start earning like nobody’s business.

While other staking joints are all over the place, AQRU’s got a thing going with focused investments like AQRU Trend and AQRU Ten, also throwing in some trading action for select crypto and stablecoins. One thing they don’t do is lend out crypto, which totally sets them apart from a bunch of other guys.

In this article, we’ll see how AQRU stacks up against big hitters in 2025, like Lido, Rocket Pool, and Nexo. You’ll get the scoop on user vibes, support, how they mesh with DeFi’s latest, plus all the juicy bits on stuff like staking yields, custodial staking, and keeping everything under lock and key. Want to dig deeper into the top DeFi staking spots for 2025? Keep reading.

Key Takeaways

- Juicy Returns on Crypto and Stablecoins: AQRU’s throwing out some tantalizing offers: up to 3% on stablecoins like USDT, USDC, and DAI. They’re even giving major cryptocurrencies their due, with up to 1% returns on BTC and ETH.

- Bigger Role in Asset Plays and Crypto Exchange Game: AQRU isn’t just about staking anymore. They’ve rolled out an exchange, charging a straightforward 0.35% every time you do the crypto shuffle. That no-nonsense fee keeps things honest and offers institutional-level rates.

- Crypto Withdrawals Come With a Price: Heads up—AQRU slaps a $20 charge on pulling out crypto, taken from the booty you’re withdrawing. But if you’re all about bank transfers or moving fiat, you get a free ride, perfect for the savvy planners out there.

- Hefty Minimum to Get in the Club: If you’re eyeing an AQRU account, come prepared with a cool $250k minimum. Yep, it’s mostly for the big fish or financial heavy-hitters.

- Secure Handling and Compliance: AQRU runs a tight ship, being a regulated player under the watchful eyes of England, Wales, and Bulgaria. They’re big on security and sticking to the rulebook.

- Rolling with the Trends: AQRU swears by what’s called the AQRU Trend strategy. In simple terms: they ride the wave of positive market vibes, and when things sour, they sit it out in cash. No betting on the market’s downturns.

Deep Dive into AQRU’s Core Features

Platform Overview and Onboarding

AQRU sets itself up as a straightforward, no-nonsense DeFi staking platform. It’s here to make things easy for folks wanting to dip their toes into crypto waters. They’ve made it so that anyone, whether a newbie or a seasoned crypto player, can breeze through the platform. You got your institutional exchange rates, and they’re gonna charge you a 0.35% flat commission for doing business. User-friendly? You bet!

Onboarding Process

Signing up? AQRU keeps it simple. Just toss in your basic info, go through the KYC (yeah, the grown-up way to say “make sure it’s really you”), and boom—you’re in the game. Loading up your account is easy-peasy, send over your crypto or use your good ol’ bank transfer with fiat money.

Staking Yields and Assets Supported

AQRU rolls out the red carpet for a mix of cryptocurrencies you can stake to snag competitive yields. They lend out these coins to both the big wigs and regular folks, making sure everyone’s playing fair with everything locked down and collateralized.

But those numbers can play switcheroo depending on market whims and other shenanigans. Best bet? Peek at the live rates on AQRU’s official site to stay on top of it.

Custodial Staking and Security Measures

Safety first, folks! The platform takes your security seriously while you’re bobbing and weaving through the world of investing and earning interest. Acting as your crypto’s bodyguard, they make sure everything’s tied up neatly, keeping funds locked down with some serious collateral in play.

Security Protocols

- Encryption in Transit and at Rest: Covers your data not just when you’re sending it off, but while it’s chilling in storage, making it tough for anyone to mess with it.

- Address Whitelisting: Only pre-set, approved addresses get to take out funds, shutting down any bad actors from walking off with your digital gold.

- Compliance and Monitoring: They ain’t playing around when it comes to following the rules. AQRU might block or close accounts, snub or undo transactions if you’re not playing by the book.

These measures build a fortress around your investments, making AQRU a trustworthy partner in your crypto-staking adventures.

AQRU vs Other Best DeFi Staking Platforms in 2025

In the ever-evolving world of DeFi staking, this platform is proving to be a strong player in 2025. Let’s see how AQRU stacks up against popular platforms like Lido, Rocket Pool, and Nexo, focusing on what it’s like to use them, how they support users, and how they tap into the latest DeFi trends. Our goal here is to help folks invested in crypto or who love DeFi figure out the best platform for maximizing their crypto assets.

Comparing AQRU to Lido, Rocket Pool, and Nexo

This platform brings a range of staking services to the table, like BTC Auto AQRU, ETH Auto AQRU, and USD Stablecoin Auto AQRU. Lido’s got the spotlight for its liquid staking services that support Ethereum and other assets. Rocket Pool and Nexo aren’t slouches either, with Rocket Pool being a decentralized Ethereum staking platform and Nexo offering flexible staking with juicy APYs backed by various assets.

| Platform | Assets Supported | Staking Yields | Unique Features |

|---|---|---|---|

| AQRU | BTC, ETH, USD Stablecoins | Up to 12% | Auto AQRU services, custodial staking through Fireblocks |

| Lido | ETH, Solana, Polygon | Variable (4-20%) | Liquid staking, instant liquidity |

| Rocket Pool | ETH | ~10% | Decentralized, trustless node operators (rocket pool) |

| Nexo | BTC, ETH, various altcoins | 8-12% | Flexible staking terms, DeFi integrations (everstake) |

User Experience and Support

Navigating the platform is a breeze with its easy-to-use design meant for everyone to get the hang of, even if they’re new to this. They make signing up simple, and your assets are secure thanks to Fireblocks. Their customer support is on point, helping out through multiple channels, so users don’t feel left hanging.

Lido, Rocket Pool, and Nexo also make sure users have a good time and feel supported. Lido is easy to figure out and offers loads of documentation and community backing. For those who are more technically inclined, Rocket Pool decentralizes everything, providing resources for node operators. And Nexo? They make sure you have a smooth ride with their platform and backup from solid customer service, whether you’re new or have been in the DeFi game for a while.

Integration with DeFi Trends

This platform is ready to roll with budding DeFi trends like liquid staking and restaking. Liquid staking lets folks keep their assets earning interest while still being able to access them, a feature that Lido is really getting into. AQRU’s broad asset range and Auto AQRU services fit right in with the rising demand for easy passive income and simplified investment handling.

AQRU plays nice with DeFi trends, synching up with yield optimization protocols and staking pools. Rocket Pool’s decentralized vibe matches the growing preference for trustless systems, whereas Nexo hooks up a wide range of DeFi perks like lending and borrowing, adding more zing to the staking experience.

Fast Facts

| Feature | Details |

|---|---|

| Minimum Account Balance | Set at $250,000 for starters |

| Annual Percentage Yield (APY) | Could reach up to 10% |

| Transaction Fees | A flat 0.35% commission on all deals, nothing more, nothing less |

| Custodial Services | This platform plays custodian, lending assets out to both big fish and starry-eyed folks. All funds are 100% collateralized and cozied up with Fireblocks crypto wallets |

| Supported Activities | Rake in some interest, snag institutional exchange rates, and dive into decentralized exchange action |

| Platform Security | Making sure everything’s locked down with Fireblocks |

Conclusion

AQRU’s made itself a big deal in the DeFi staking scene as we roll into 2025, offering a smooth ride for crypto investors looking to make some extra cash from their digital stash. It’s got a simple but secure setup that really shines when stacked up against the competition, attracting web3 fans hungry for yield.

With perks like custodial staking and support for all sorts of assets, this platform keeps users’ investments safe and ready to rake in the rewards. Switching from good ol’ regular money to crypto’s a breeze here, so you can start earning right away. Plus, the platform’s top-notch security has got your back, giving you some peace of mind as you handle your digital goodies.

When you put it side by side with platforms like Lido, Rocket Pool, and Nexo, AQRU stays ahead with its user-first approach and stellar customer service. It’s got its finger on the pulse of the DeFi trends, such as liquid staking protocols and momentum strategies, making sure users are ready to surf the latest DeFi waves.

Here’s the rundown of AQRU’s big points against others:

| Feature | AQRU | Lido | Rocket Pool | Nexo |

|---|---|---|---|---|

| Easy Peasy Interface | Yes | Yes | Yes | Yes |

| Custodial Staking | Yes | No | Yes | Yes |

| Asset Variety | Diverse | ETH-focused | ETH-focused | Diverse |

| Security Level | Top-Notch | High | High | Top-Notch |

| Support Quality | Excellent | Good | Good | Excellent |

| Trend Savvy | Yes | Yes | Yes | Yes |

If you’re all about getting the most out of your crypto stash without getting tangled in complexity, AQRU is a solid bet for 2025.

FAQ

What is AQRU?

AQRU’s like having your cake and eating it too, but in the crypto world. It’s a platform where folks can stake their crypto and earn some sweet, sweet yields. Navigating is a breeze with easy onboarding, and guess what? You can forget about deposit fees or getting tied down with lock-ins. It’s all about keeping it simple and user-friendly.

What are the fees associated with using AQRU?

With this platform, fee headaches are a thing of the past. There’s no charge on deposits whether you’re using crypto or bank transfers. Everything’s upfront with rates that don’t mess around, plus you enjoy the freedom of pull-out-without-penalty perks for your assets.

What is AQRU Trend?

If Bitcoin makes you jittery like a caffeine high, AQRU Trend might be the chill pill you need. It’s crafted for those aiming to beat Bitcoin returns without the ups and downs. With a daily compounding bonus for Bitcoin, Ethereum, and those trusty stablecoins, it’s like having a buffer for the crypto rollercoaster ride.

What are the withdrawal times for AQRU?

Need your funds pronto? AQRU’s got it. With withdrawals typically sorted in about a day, you’re never too far from your cash. It’s all about making sure you’ve got quick access when you need it.

Can AQRU help reduce the volatility of cryptocurrency investments?

AQRU’s set up to help you keep steady in the storm of crypto madness. With strategies like AQRU Trend, focusing on balancing out returns while keeping volatility at bay is their bread and butter. It’s a solid pick for stability seekers.