Key Takeaways

- Bitcoin mining is the backbone of the BTC network, maintaining its security and integrity through proof-of-work computations.

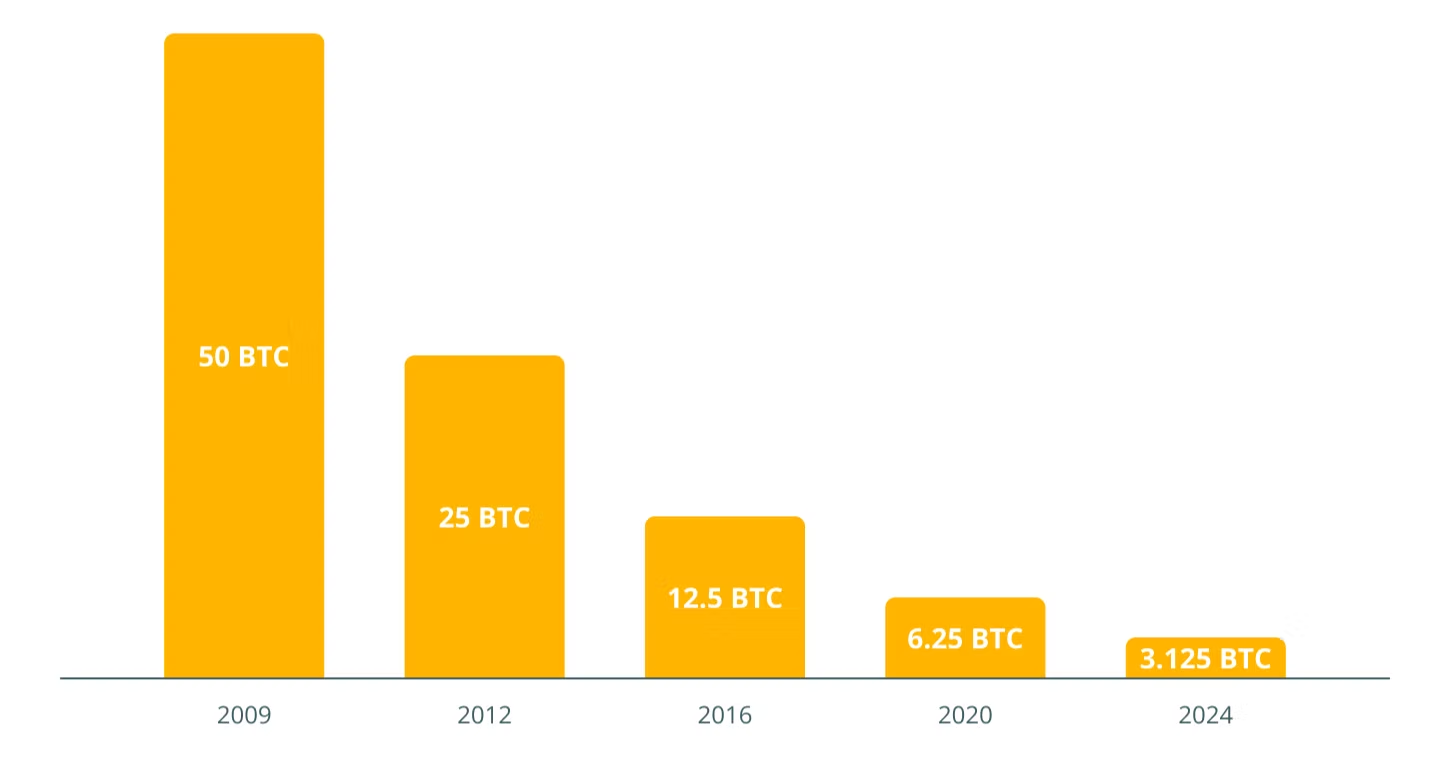

- The 2024 halving reduced the block reward to 3.125 BTC, drastically impacting profitability.

- Transaction fees can temporarily exceed block rewards during network congestion.

- Mining efficiency in 2025 hinges on advanced ASIC hardware and low-cost energy access.

- Global mining has consolidated in regions with cheap electricity, such as Texas and parts of Canada.

- The industry’s electricity consumption is estimated at around 190 TWh per year, representing about 0.8% of global energy usage.

Introduction

Bitcoin mining remains one of the most competitive and technologically advanced industries in the world. In 2025, as the ecosystem adapts to the 2024 halving, miners face new challenges defined by record-breaking hashrates, surging energy costs, and an unrelenting race for efficiency. This article explores the complete picture of Bitcoin mining — from block creation and mining rewards to global energy consumption and hardware innovation — and explains how this decentralized process keeps the Bitcoin network secure and functional.

What Is Bitcoin Mining?

Bitcoin mining is the decentralized process that validates transactions and secures the network. Miners gather pending transactions, group them into blocks, and perform countless cryptographic hashing attempts to find a result that meets the network’s difficulty target. The miner who first finds a valid hash broadcasts their block, and once the network confirms it, that miner earns a reward.

As of 2025, each valid block pays 3.125 BTC, following the April 2024 halving, plus any transaction fees included in the block. Since only one miner can win each round, competition is fierce. To mitigate income volatility, most miners join large mining pools that distribute rewards based on participants’ contributed computing power. The use of

Application-Specific Integrated Circuits (ASICs) has become standard, effectively replacing general-purpose hardware.

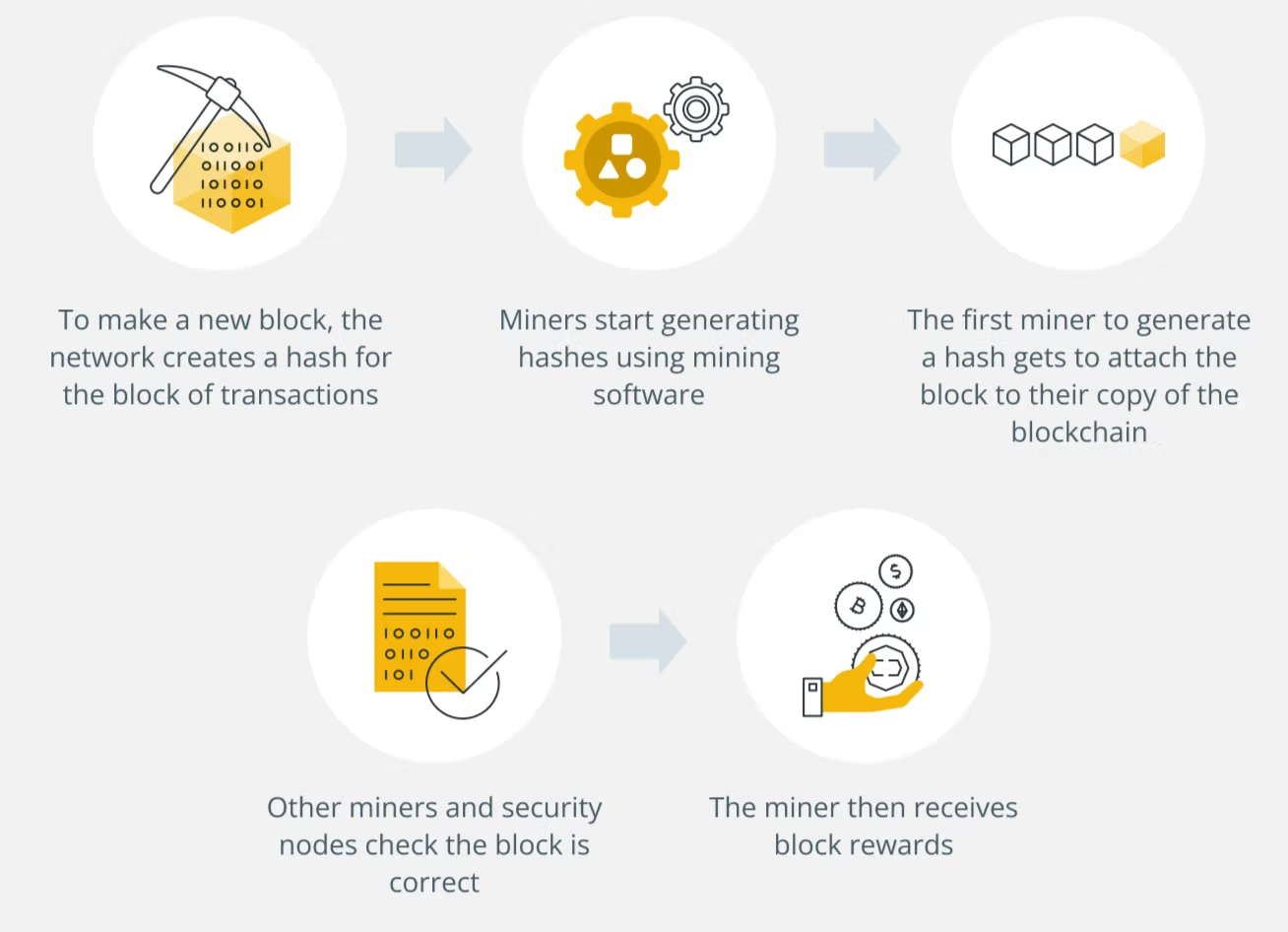

How a Block Is Mined

A block’s creation follows a meticulous and transparent process:

- Miners select unconfirmed transactions from the mempool and build a candidate block.

- A coinbase transaction is added, minting new BTC and collecting all transaction fees.

- The miner repeatedly hashes the block’s header using the SHA-256 algorithm, adjusting the nonce until they find a hash below the network’s target.

- Once a valid hash is found, the miner broadcasts the block.

- Other nodes verify its validity before adding it to the blockchain.

If two miners solve blocks almost simultaneously, the blockchain briefly splits until the network agrees on the longest chain, ensuring consensus follows the branch with the greatest accumulated proof-of-work. This process guarantees Bitcoin’s stability and immutability.

Mining Rewards After the 2024 Halving

The fourth Bitcoin halving in April 2024 reduced the block reward from 6.25 BTC to 3.125 BTC, cutting the pace of new Bitcoin issuance in half. With around 144 blocks mined per day, the network now creates approximately 450 BTC daily, excluding transaction fees.

The Fee Wildcard

Transaction fees make miner revenue unpredictable. Around the 2024 halving, the Runes token protocol triggered an unprecedented spike in transaction volume, causing fees to temporarily exceed the block reward. Some blocks even paid miners tens of BTC in fees. However, by mid-2025, median fees normalized as demand stabilized. These fluctuations are common: whenever Bitcoin’s mempool overflows, competition for limited block space drives temporary fee surges before returning to baseline.

Hashrate and Difficulty

Bitcoin’s mining power is measured by its hashrate, representing the total computational effort securing the network. To maintain an average 10-minute block time, the network adjusts mining difficulty every 2,016 blocks (about two weeks).

- If the hashrate rises, blocks are found too quickly, and difficulty increases.

- If the hashrate drops, block production slows, and difficulty decreases.

Each adjustment effectively resets miners’ revenue expectations for the next cycle. In 2025, both hashrate and difficulty reached all-time highs as newer, more efficient ASICs replaced outdated models. Miners with high power costs often shut down operations unless they can offset expenses through cheaper energy or price spikes.

The result is a constant arms race where only the most efficient and cost-effective setups remain profitable.

Hardware and Setups in 2025

Bitcoin mining has evolved from a hobby into a global-scale industrial operation focused on maximum efficiency per watt.

ASIC Hardware

Modern mining farms rely exclusively on ASICs optimized for SHA-256. Efficiency is measured in joules per terahash (J/TH) — the lower the number, the better.

- Air-cooled rigs like Bitmain’s S21 (17.5 J/TH) and MicroBT’s M60S (18.5 J/TH) dominate standard deployments.

- Advanced models such as the Bitmain S21 XP reach 13.5 J/TH, while hydro and immersion models like the S21 XP Hyd achieve around 12 J/TH.

Cooling Innovations

Efficient cooling systems are vital for sustaining performance:

- Air cooling remains cost-effective but is noisy and less efficient.

- Immersion cooling submerges rigs in dielectric fluid, improving uptime and enabling overclocking.

- Hydro cooling integrates closed water loops directly into machines, offering top efficiency at higher infrastructure cost.

Fleet Strategy

Mining profitability fluctuates weekly, so operators use dynamic strategies:

- Underclocking lowers power consumption during low-profit periods.

- Overclocking increases output when Bitcoin prices or fees surge.

In 2025, efficiency outweighs raw hashrate unless miners access extremely cheap electricity.

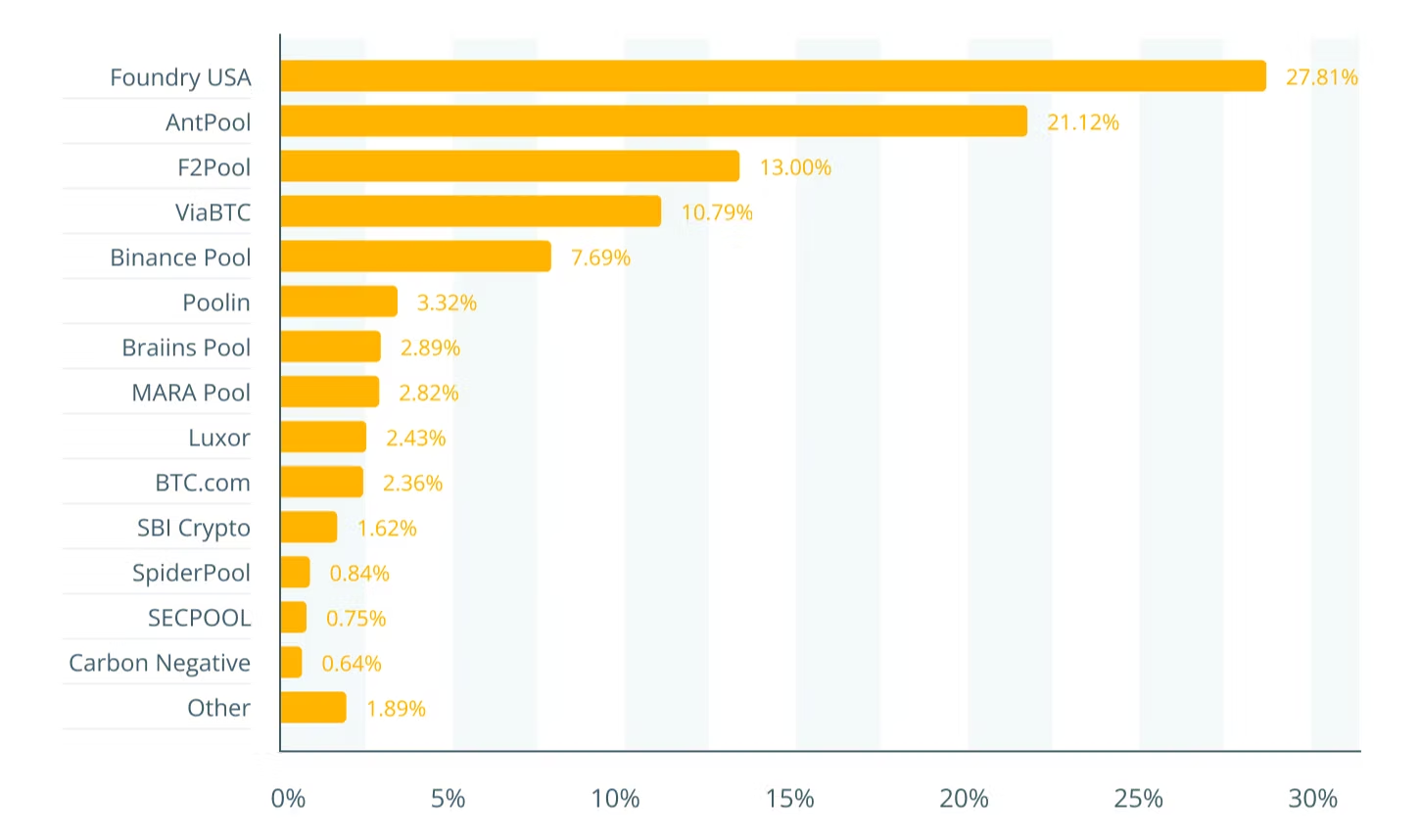

Pools, Payouts, and Hashprice

Since solo mining is rarely profitable, nearly all miners contribute their hashrate to pools such as Foundry USA, AntPool, F2Pool, and ViaBTC. Pools distribute earnings based on contributed work, ensuring more consistent payouts.

Payment Models

- Pay-Per-Share (PPS) and Full Pay-Per-Share (FPPS) offer predictable income, with FPPS including transaction fee estimates.

- Pay-Per-Last-N-Shares (PPLNS) is riskier, paying only when the pool finds a block, but can yield higher returns.

Understanding Hashprice

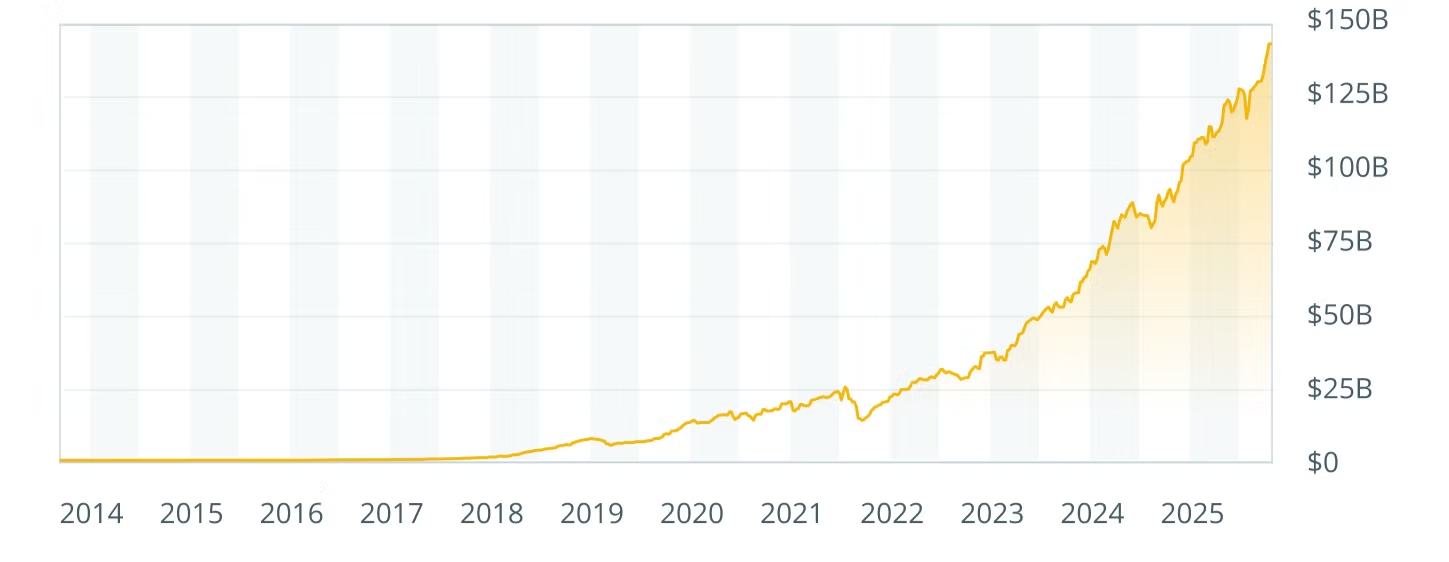

Hashprice measures miner revenue in USD per petahash per day. It rises with Bitcoin’s price and transaction fees but drops as difficulty increases. By October 2025, hashprice averaged $51 per PH/s per day. Break-even thresholds vary widely depending on hardware efficiency and energy rates, giving miners with flexible or cheap power deals a strong advantage.

Energy Use and Geography

Energy pricing and regulation shape mining profitability more than any other factor.

Electricity Consumption

Bitcoin’s total energy demand depends on the estimation model. As of May 2025, Digiconomist reported an annualized consumption of about 190 TWh, roughly equivalent to Poland or Thailand’s total usage. Data from the Cambridge Bitcoin Electricity Consumption Index suggests Bitcoin represents around 0.8% of global electricity demand, while U.S. government reports estimate domestic mining consumes between 0.6% and 2.3% of national power.

Miners as Flexible Power Consumers

Bitcoin miners can rapidly adjust their energy usage. In Texas, the Electric Reliability Council of Texas (ERCOT) pays miners to power down during grid stress. In August 2023, Riot Platforms earned demand-response credits equivalent to 1,136 BTC, showing how grid participation can reshape mining economics.

Where Mining Happens

Following China’s 2021 mining ban, operations shifted to countries with abundant, low-cost energy. By 2025, the U.S. and Canada hosted an estimated 7.4 gigawatts of public mining capacity, concentrated in Texas and hydroelectric provinces like Quebec. The key drivers remain consistent: affordable, stable power, supportive regulations, and grid programs rewarding flexibility.

Conclusion

Bitcoin mining in 2025 stands at a crossroads of technology, finance, and energy. The latest ASICs have made mining more efficient than ever, but rising difficulty and energy costs demand precision and strategy. While halvings continue to compress block rewards, transaction fees and grid partnerships introduce new revenue models. The miners that thrive in this environment are those who innovate, optimize, and adapt — keeping Bitcoin’s decentralized engine running securely for the next generation.

Frequently Asked Questions

How much Bitcoin is mined daily in 2025?

Around 450 BTC are created per day, excluding transaction fees.

Why do miners join pools?

Pooling combines computing power, providing steady income rather than waiting to find a solo block.

How much energy does Bitcoin mining consume?

Estimates place annual usage around 190 TWh, roughly 0.8% of global electricity consumption.

Which countries dominate Bitcoin mining in 2025?

The United States and Canada lead, especially Texas and hydro-rich regions.

What is hashprice?

Hashprice represents the USD revenue per petahash per day, influenced by Bitcoin’s price, fees, and difficulty.