Introduction

Picture this: you’re paying for your morning coffee with crypto. You tap your card, just like any other, spending your Bitcoin or Tether USDt. There’s no bank involved—just you and your digital wallet. But imagine one day your card is declined. The exchange that issued it has suddenly frozen withdrawals. Now your funds are stuck, and you’re locked out of your own money.

This scenario highlights a fundamental principle that extends beyond crypto. Whether it’s a centralized crypto service or a traditional bank, the reality is the same: if you don’t truly control your money, someone else does.

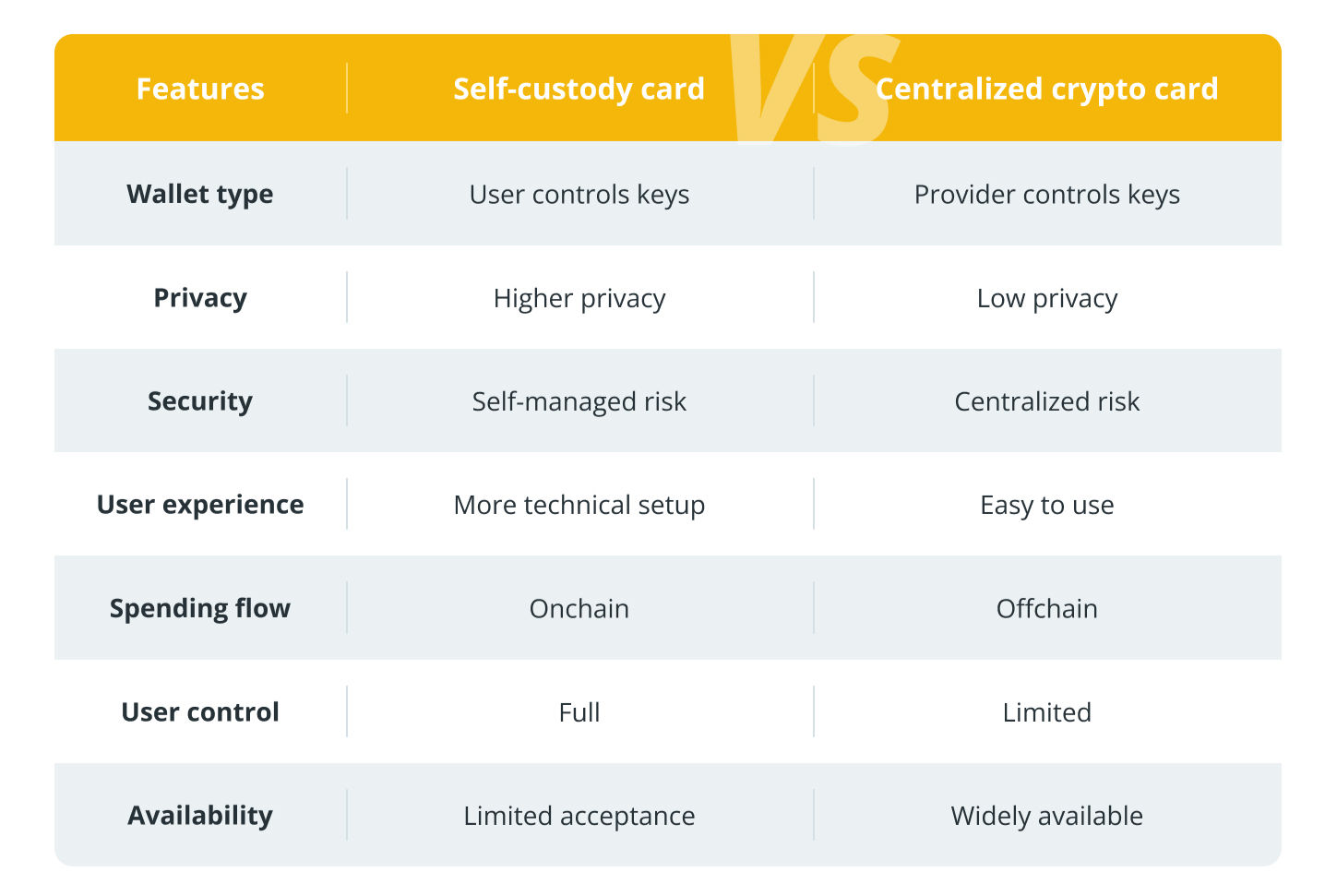

In the evolving world of crypto payments, two distinct paths are emerging. One champions financial sovereignty, where you alone control your cryptocurrency. The other prioritizes convenience, handing over some of that control for smooth, traditional-style payments. This brings us to a critical question: should you choose the freedom of a self-custody crypto card or the convenience of a centralized one?

Let’s break down the differences, explore the pros and cons, and help you decide which path is right for you.

Key Takeaways

- Self-custody cards grant you absolute control over your funds but demand technical understanding and complete personal responsibility.

- Centralized cards offer a convenient, user-friendly experience but place your assets at risk if the provider is compromised.

- The security of a crypto card depends entirely on who holds the keys. Centralized providers are vulnerable to hacks and regulatory pressure, while self-custody security relies on the user not losing their access keys.

- Self-custody cards operate on-chain, offering greater privacy and programmable features. Centralized cards use off-chain conversions for lower fees and simpler transactions.

What Are Self-Custody and Centralized Crypto Cards?

At its heart, the difference between these two cards boils down to one simple question: who holds your private keys?

A centralized crypto card, on the other hand, is linked to a custodial wallet. These are issued by centralized exchanges (CEXs) or fintech companies that store your cryptocurrency and manage your private keys on your behalf. They process payments for you, acting much like a bank. If you’ve ever used a card from a major platform like Coinbase or Crypto.com, you have used a centralized crypto card.

A self-custody crypto card connects directly to a non-custodial wallet—a wallet where you, and only you, hold the private keys. This means you have exclusive control over your funds. There is no third party managing your crypto and no bank-like entity to help you if you lose your password. These cards are often linked to decentralized platforms or hardware wallets and typically require more technical know-how.

The Argument for Centralized Cards

There’s a clear reason why centralized crypto cards are so popular: they make spending crypto feel effortless. You swipe the card, and your crypto is instantly converted to fiat currency at the point of sale. The user doesn’t need to worry about gas fees, blockchain delays, or wallet compatibility.

Key Advantages

- Simplicity and Ease of Use: Custodial wallets remove all the technical barriers. New users don’t have to manage seed phrases or understand blockchain mechanics. The provider handles the technology and offers customer support, just like a traditional bank.

- Speed and Rewards: Transactions are fast and predictable. These cards often come with attractive incentives, such as crypto cashback, staking rewards, or travel perks, which are integrated into polished mobile apps where you can track spending and manage your account.

The Trade-Offs

This convenience comes with significant strings attached. Your assets are held by a company, making them a target. This means the provider can restrict access, your funds can be frozen, and the platform can be hacked. This is where the case for convenience weakens; many users have suffered catastrophic losses following the collapses of platforms like FTX and Celsius.

Furthermore, centralized providers must comply with government regulations, which can compromise user autonomy. For instance, Binance was forced to shut down its Visa debit card services in the European Economic Area (EEA) in December 2023 due to regulatory issues, leaving users without a key service. These platforms also require Know Your Customer (KYC) processes, which involve transaction tracking and data sharing—a dealbreaker for privacy-focused individuals.

The Argument for Self-Custody

Self-custody debit cards empower users by never requiring them to deposit funds or pre-load an account with a third party. Instead, the card interacts with a smart contract, which verifies transactions on-chain in seconds and communicates directly with your personal wallet. This process ensures instant settlement without you ever giving up ownership of your assets.

Key Advantages

- Absolute Sovereignty: No third party can freeze, block, or access your funds. Your money remains yours, always.

- Programmable Features: By leveraging smart contracts, these cards can enable advanced features like programmable spending limits, time-locked transfers, or multi-signature approvals. This is particularly useful for DAOs, freelancers, and shared business accounts.

- Enhanced Privacy: Since transactions are settled on-chain from a personal wallet, your spending habits are not automatically logged by a central company. Some protocols are even experimenting with zero-knowledge (ZK) proofs, like $zk-SNARKs$, to further mask transaction details.

The Caveats

With great power comes great responsibility. Security depends entirely on you. If you lose your private keys or seed phrase, your funds are gone forever—there is no recovery hotline. Users must also manage transaction signing, gas fees, and wallet compatibility, which can add a layer of complexity.

Where Does the Risk Lie?

When it comes to security, the two card types present opposite risks. Centralized cards may seem secure, as large corporations invest heavily in security systems. However, they represent a centralized point of failure. A single successful breach can expose the funds of thousands or millions of users. The history of crypto is littered with examples, from Mt. Gox to FTX, where users lost everything when the platform failed. This is known as counterparty risk.

Self-custody cards eliminate counterparty risk. There is no company that can go bankrupt or be hacked, taking your money with it. However, the security burden shifts entirely to you. You become the single point of failure. Losing your private keys is the digital equivalent of losing a wallet full of cash with no way to get it back. This is personal responsibility risk.

Conclusion

So, which should you choose? The answer depends on your priorities and experience level.

If you are new to crypto or simply want a straightforward way to spend your digital assets like traditional money, a centralized crypto card is an excellent entry point. It abstracts away the complexity and integrates smoothly into your daily life.

However, if you are a firm believer in the core tenets of cryptocurrency—decentralization, privacy, and financial self-sovereignty—then a self-custody crypto card is the clear choice. The learning curve is steeper, but the reward is complete control over your financial destiny.

Whichever route you take, remain aware of the inherent risks and privacy considerations. In the world of digital finance, being informed is your greatest asset.

Frequently Asked Questions

Which type of card is better for beginners?

For most beginners, a centralized crypto card is the recommended starting point. The user experience is designed to be simple and familiar, closely resembling a traditional debit card, and it comes with customer support to help with any issues.

What does “not your keys, not your coins” mean?

This is a popular mantra in the crypto community. It means that if you do not personally hold the private keys to your crypto wallet, you don’t truly own or control your digital assets. A third party (like a centralized exchange) holds them for you and can restrict your access.

Are crypto cards accepted everywhere Visa or Mastercard is?

Yes. Crypto cards are issued in partnership with major payment networks like Visa or Mastercard. From the merchant’s perspective, it’s just a regular card payment. They receive fiat currency (e.g., USD, EUR), while the conversion from crypto happens seamlessly in the background.