Introduction

Bitcoin has captured the world’s imagination as a revolutionary digital asset with the potential to redefine finance. As its price continues to climb and adoption grows, many wonder: could Bitcoin really reach the astonishing milestone of $1 million per coin?

This article explores the key drivers behind Bitcoin’s valuation, examines expert predictions, and delves into the challenges and implications of such a monumental price surge. From institutional investment and global adoption to technological threats like quantum computing, we break down what it would take for Bitcoin to hit $1 million—and what that could mean for investors, governments, and the global economy.

Key Takeaways

- Bitcoin’s capped supply and growing demand drive its long-term value potential, making a $1 million price target plausible.

- Institutional adoption, especially from major financial players, is crucial to pushing Bitcoin’s market capitalization into the trillions.

- Mass global adoption requires improvements in infrastructure, education, and clear regulatory frameworks to sustain Bitcoin’s growth.

- Bitcoin’s decentralized nature and reliance on elliptic curve cryptography expose it to emerging threats like quantum computing, which could undermine its security.

- If Bitcoin reaches $1 million, early investors stand to gain massively, while late entrants risk financial losses, highlighting inequalities and speculative dynamics.

Key Drivers Behind Bitcoin’s Valuation in 2025

Bitcoin has reached unprecedented milestones that once seemed unimaginable. The narrative behind its latest all-time high is still unfolding.

One of the most significant catalysts was the launch of spot Bitcoin exchange-traded funds (ETFs) in early 2024, including BlackRock’s iShares Bitcoin Trust. By mid-2025, U.S.-based Bitcoin ETFs had attracted $14.8 billion in net inflows, with BlackRock’s product alone pulling in over $1.3 billion within just two days.

Adding further momentum, President Donald Trump issued an executive order in March 2025 to create a Strategic Bitcoin Reserve, allocating approximately 200,000 BTC. This move signaled strong federal endorsement and cemented Bitcoin’s position as a mainstream financial asset, bolstering investor confidence.

Market enthusiasm peaked during “Crypto Week” in Washington, D.C., in July 2025, when Bitcoin soared to a record-breaking price of $123,166.

Is a $1 Million Bitcoin Within Reach?

So, could Bitcoin realistically hit the $1 million mark? Several crucial factors indicate that this milestone is achievable, although it will demand significant developments.

Limited Supply: One of Bitcoin’s most compelling attributes is its scarcity. With a fixed maximum supply of 21 million coins, Bitcoin’s value tends to appreciate as demand grows. Unlike fiat currencies, Bitcoin cannot be arbitrarily inflated, positioning it as a potential store of value akin to gold.

Institutional Investment: The surge of institutional capital is reshaping Bitcoin’s market landscape. The entry of major financial players lends credibility to Bitcoin, fueling increased demand and driving prices upward.

Crypto Adoption Growth: Currently, around 6.8% of the global population—more than 560 million people—own cryptocurrency, with the sector expanding at a compound annual growth rate of roughly 34%. This leaves ample room for continued adoption and market expansion.

Fear of Missing Out (FOMO): According to a 2025 survey by Security.org, 67% of existing cryptocurrency holders primarily invest in assets like Bitcoin with profit expectations. As Bitcoin’s price escalates, the fear of missing out intensifies, attracting even more investors.

Who Thinks Bitcoin Could Reach $1 Million?

Several influential voices in finance and crypto have confidently predicted that Bitcoin could soar to $1 million per coin, underscoring the growing belief in its immense potential.

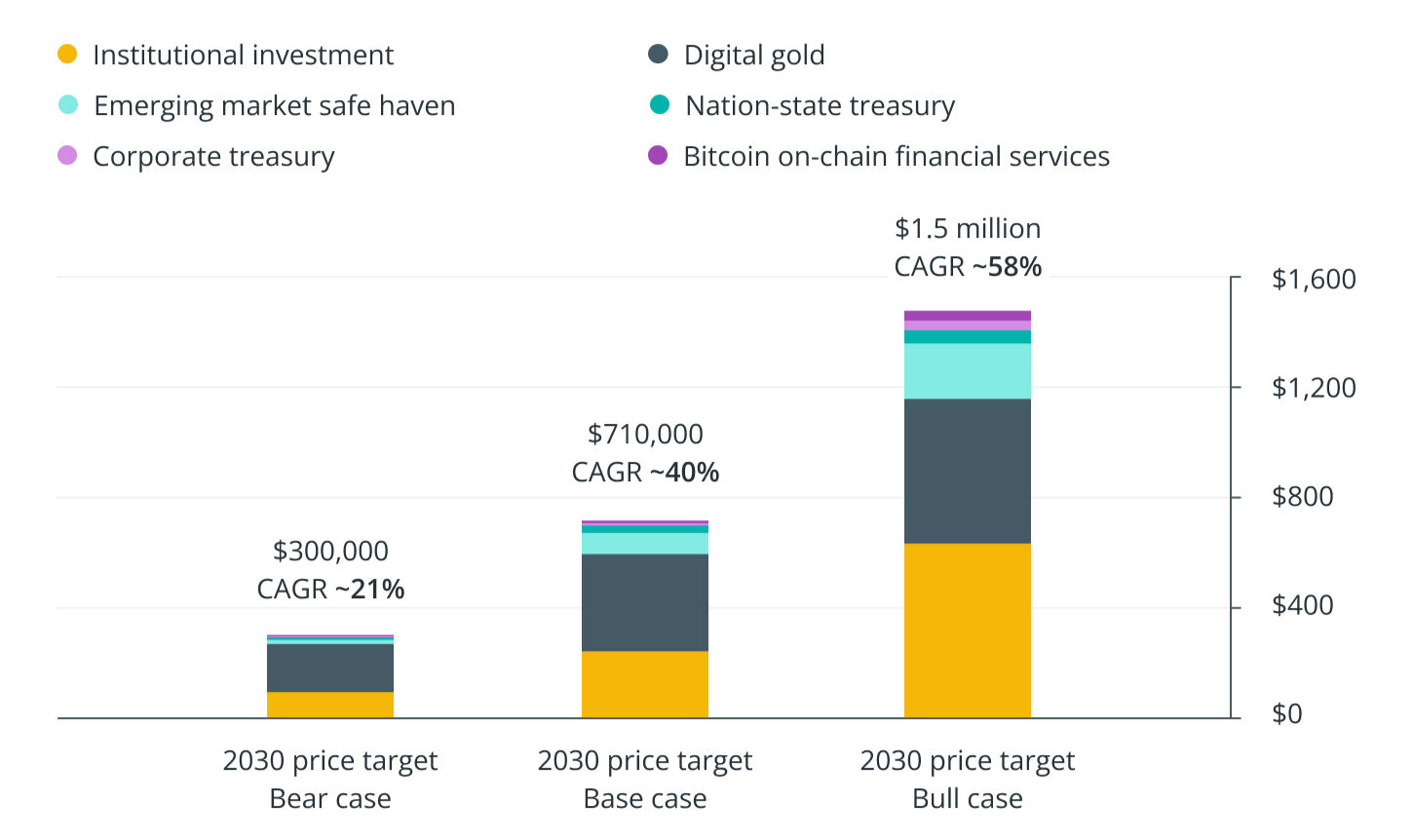

Cathie Wood, CEO of ARK Invest, has been a prominent advocate for Bitcoin, projecting that it could climb as high as $1.5 million by 2030 under the firm’s “Bull Case” scenario.

Michael Saylor, founder of MicroStrategy, has consistently maintained that Bitcoin will reach the $1 million mark once Wall Street allocates 10% of its reserves to the cryptocurrency.

Similarly, Robert Kiyosaki, author of Rich Dad Poor Dad, shares this bullish outlook, forecasting Bitcoin could hit $1 million by 2030. He considers Bitcoin a powerful hedge against inflation, comparable to traditional safe-haven assets like precious metals.

What Will It Take for Bitcoin to Reach $1 Million?

For Bitcoin to hit the $1 million mark, several key market dynamics must align. Here’s a closer look at the main factors involved:

- Significant Increase in Institutional Investment. To achieve a price of $1 million per Bitcoin, its market capitalization would need to surpass $21 trillion—exceeding the current value of gold. Michael Saylor has suggested that if Wall Street allocated just 10% of its reserves to Bitcoin, the market cap could approach $20 trillion, driving the price close to $1 million. However, institutional participation remains relatively modest, with long-term institutional investors holding less than 5% of Bitcoin ETF assets. Currently, retail investors dominate the ETF landscape.

- Widespread Global Adoption. Achieving a $1 million Bitcoin also requires mass adoption worldwide. Experts estimate that between 20% and 40% of the global population—roughly 1.6 to 3.2 billion people—would need to embrace Bitcoin. This level of adoption hinges on improvements in infrastructure, broader educational efforts, and supportive regulatory frameworks.

- Sustained Regulatory Clarity and Support. Clear, consistent, and supportive regulations are vital to Bitcoin’s sustained growth. A unified regulatory approach would reduce market uncertainty and encourage more investment. Legislative initiatives such as the GENIUS Act and the Clarity Act, both enacted in 2025, have established clearer guidelines for digital assets, enhancing institutional confidence and paving the way for wider acceptance.

- Ongoing Technological Advancements. Continuous innovation is essential for Bitcoin’s scalability and usability. Developments like the Lightning Network, which boosts transaction speed and lowers costs, play a critical role in enabling Bitcoin to function not only as a store of value but also as a practical means of payment.

What Would Happen If Bitcoin Hits $1 Million?

If Bitcoin truly reaches $1 million, who stands to gain—and who might lose? Spoiler alert: it resembles the dynamics of a pyramid scheme.

Winners: The Early Adopters

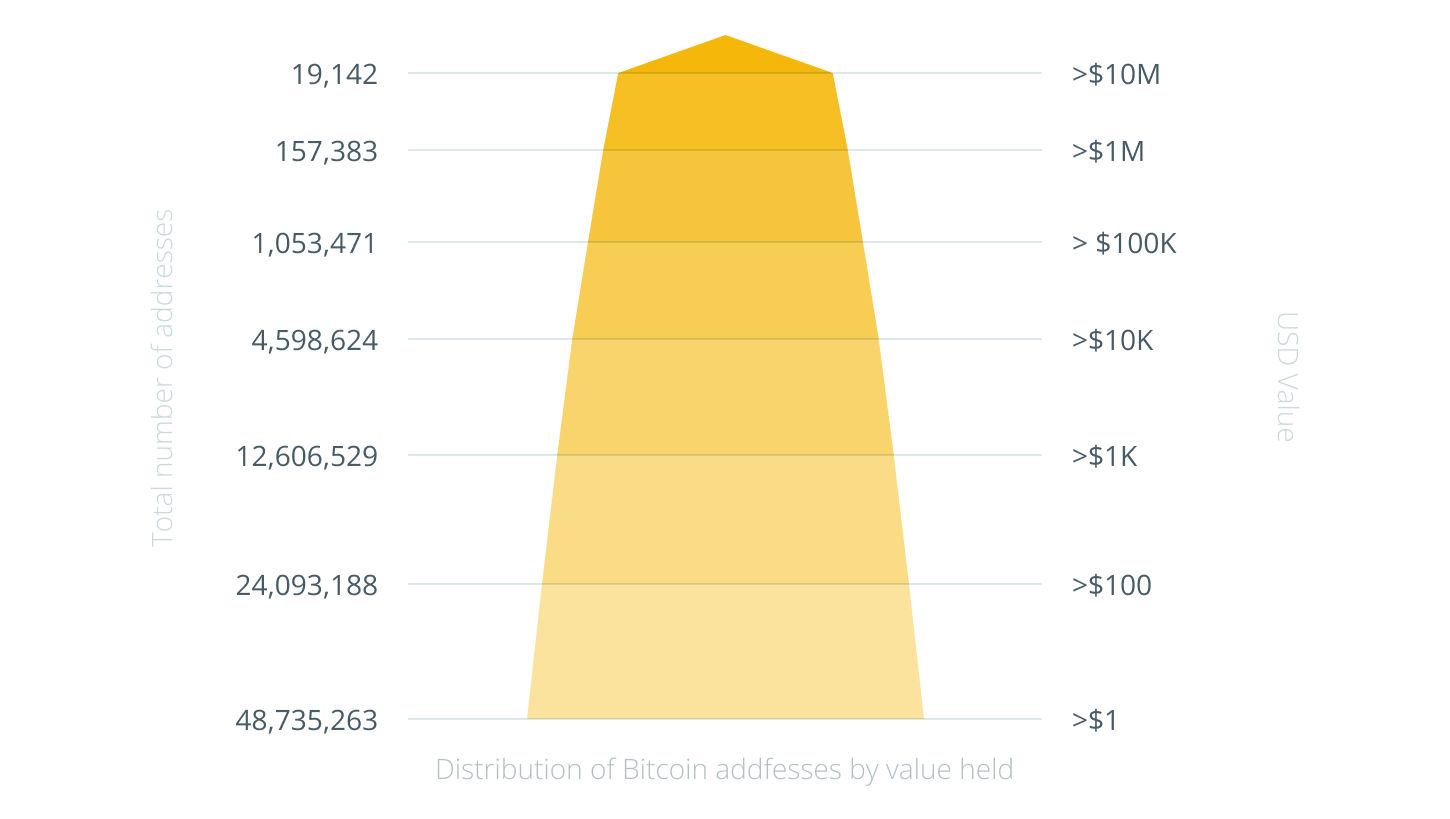

A $1 million Bitcoin would catapult the value of holdings across the network to astronomical levels. As of 2025, roughly 900,000 addresses hold at least one full BTC, while about 4% of the global population owns some amount of Bitcoin. However, the lion’s share of Bitcoin is concentrated in the hands of a small elite—wealthy individuals and institutions.

MicroStrategy, for instance, would emerge as a colossal winner. With its current Bitcoin stash, a $1 million price would translate into assets valued at over $600 billion.

Early retail investors who acquired Bitcoin at fractions of a cent to just a few dollars would see their investments multiply exponentially. Someone who bought Bitcoin for mere cents could now be sitting on a multimillion-dollar fortune.

Satoshi Nakamoto, Bitcoin’s enigmatic creator, is believed to hold approximately 1.1 million BTC, about 5.2% of the total supply. At $1 million per Bitcoin, Satoshi’s holdings would be worth an estimated $1.1 trillion.

Losers: The Latecomers

As Bitcoin climbs toward $1 million, the divide between early adopters and late entrants could widen dramatically, worsening financial inequality worldwide.

Those who entered the market early stand to reap massive rewards, while latecomers—especially retail investors—face steep entry costs and diminished upside potential. Furthermore, newcomers risk severe losses if Bitcoin’s price experiences a sharp correction or crash after peaking.

Bitcoin’s growth pattern often resembles a pyramid structure: early participants profit as fresh capital flows in from new buyers paying increasingly higher prices. Yet this model’s dependence on continual influx of new investors creates systemic vulnerabilities.

Unlike traditional assets such as stocks or real estate, Bitcoin’s value is largely speculative and driven by supply-and-demand dynamics, without intrinsic utility. As prices surge, late investors are essentially fueling the gains of earlier holders. If the price plateaus or declines, those who bought at peak levels could face devastating losses.

Is Bitcoin’s $1 Million Potential Just a House of Cards?

While Bitcoin’s future looks promising, it faces significant existential threats—most notably from emerging technologies like quantum computing.

Quantum computers have the capability to compromise Bitcoin’s cryptographic security, primarily through Shor’s algorithm. This breakthrough allows quantum machines to efficiently factor large integers and solve discrete logarithms—tasks currently beyond the reach of classical computers—posing a direct risk to Bitcoin’s encryption protocols.

Because Bitcoin relies on elliptic curve cryptography, it is especially vulnerable to such quantum attacks. Alarmingly, around 4 million BTC (approximately 25% of the actively used supply) are held in addresses with exposed public keys, leaving them susceptible to potential quantum breaches.

The economic fallout from a successful quantum attack on Bitcoin could be devastating. Given Bitcoin’s market capitalization of about $1 trillion as of July 21, 2025, a large-scale hack could ignite a global financial crisis.

Bitcoin’s decentralized architecture means there is no central authority to swiftly deploy patches or countermeasures, heightening the risk of systemic instability in the face of a quantum threat.

Fortunately, efforts are underway to shield Bitcoin from these vulnerabilities. Post-quantum cryptographic algorithms are in development, with the National Institute of Standards and Technology (NIST) leading the charge to standardize these quantum-resistant protocols for digital assets.

However, rolling out these new algorithms would require an enormous, coordinated upgrade across the entire Bitcoin network. Experts estimate that transitioning to quantum-secure cryptography could necessitate up to 76 days of network downtime.

While this is just one of many challenges Bitcoin faces, the looming quantum threat serves as a sobering reminder: even if Bitcoin hits $1 million, can it truly be considered a guaranteed success?

Frequently Asked Questions

Is it realistically possible for Bitcoin to reach $1 million?

Yes. Experts point to factors such as limited supply, increasing institutional investment, expanding global adoption, and market psychology (FOMO) as reasons why Bitcoin could hit $1 million. However, reaching this target will require significant growth in demand and supportive infrastructure.

Who are the main proponents predicting Bitcoin will hit $1 million?

Prominent figures like Cathie Wood, Michael Saylor, and Robert Kiyosaki have publicly forecasted Bitcoin reaching or surpassing $1 million, citing factors such as institutional adoption and Bitcoin’s role as a hedge against inflation.

What major hurdles could prevent Bitcoin from reaching $1 million?

Key challenges include limited institutional involvement to date, the need for broader global adoption, regulatory uncertainty, and emerging technological risks—especially the threat posed by quantum computing to Bitcoin’s cryptographic security.

What would be the economic impact if Bitcoin price reached $1 million?

Early investors would see massive gains, while late entrants risk losses due to higher entry prices. Bitcoin’s growth pattern resembles a pyramid scheme where early adopters benefit most. Governments could also face challenges due to reduced control over fiat currencies and monetary policy.

How serious is the quantum computing threat to Bitcoin?

Quantum computing poses a significant risk by potentially breaking Bitcoin’s encryption. Although solutions like post-quantum cryptography are in development, implementing these defenses across the decentralized Bitcoin network will be complex and time-consuming, posing a risk to Bitcoin’s security in the near future.