Introduction

2025 marked a definitive turning point for the cryptocurrency sector. The industry moved decisively away from speculative mania and toward a model prioritizing tangible utility and deep institutional integration. Investors increasingly favored projects offering real economic value and onchain utility over those driven solely by social media hype. This shift was underscored by the performance of market leaders and the resurgence of privacy-focused assets, cementing the role of digital assets in global finance.

This article provides a detailed analysis of the crypto coins that shaped the market landscape in 2025, highlighting the specific price movements and fundamental developments that defined their success.

Key Takeaways

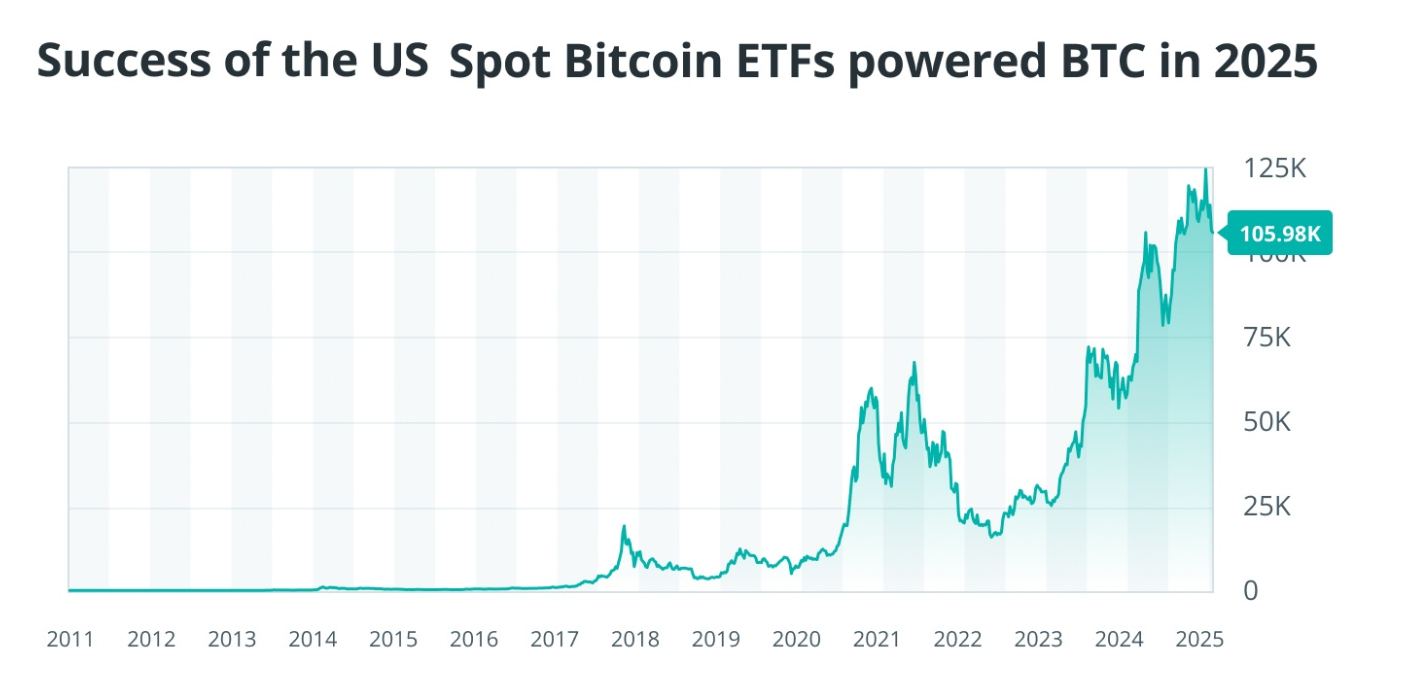

- The market pivoted from speculation to utility, with US spot ETFs anchoring Bitcoin near or above the $100,000 threshold for the majority of the year despite periodic pullbacks.

- After a significant early-year decline, Ether staged a robust recovery fueled by institutional capital and renewed market confidence following the approval of spot Ether ETFs.

- Privacy-centric assets like Zcash and Monero experienced a surge in demand driven by tightening supply mechanics and a growing global interest in financial anonymity.

- New entrants like Hyperliquid demonstrated that fundamentals matter, with strong fee generation and deflationary mechanics driving substantial value accrual.

1. Bitcoin (BTC)

Bitcoin consolidated its position as the premier digital asset in 2025, buoyed by the sustained success of US spot Bitcoin exchange-traded funds (ETFs). These financial products, which commenced trading in early 2024, provided a steady conduit for institutional capital throughout 2025, stabilizing the asset’s price action even during broader market corrections.

Price Performance and Market Dynamics

Bitcoin opened the year at $93,425 on January 1, 2025. It demonstrated significant strength early in the first quarter, crossing the psychological $100,000 barrier multiple times in January and February. Although it briefly dipped below this level on February 5, the asset rebounded decisively by May 9, maintaining a valuation above $100,000 through early November.

The year’s peak occurred on October 7, when Bitcoin climbed to $124,752. However, market volatility saw the price correct to $101,298 by November 7. Entering November, the price softened further to hover around $100,000 amidst broader bearish sentiment. Despite this late-year consolidation, Bitcoin’s historical resilience suggests a strong potential for recovery following such downturns.

2. Ether (ETH)

The narrative for Ether in 2025 was defined by institutional adoption following the pivotal approval of spot Ether ETFs in the United States on July 23, 2024. This regulatory milestone fundamentally altered how large investment funds perceived the asset, leading to increased monitoring and capital allocation.

Volatility and Recovery

Despite the institutional tailwinds, Ether faced a turbulent path. A price slump that began in mid-December 2024 extended through the holiday season and into the first quarter of 2025. From a price of approximately $3,880 on December 13, 2024, Ether retraced significantly to reach a low of about $1,500 by mid-April 2025.

This decline was exacerbated by macroeconomic factors, including concerns over US Federal Reserve rate policy, high-profile hacks in the decentralized finance (DeFi) sector, and over $1 billion in liquidations that shook trader confidence. However, just as retail sentiment hit a nadir, Ether initiated a powerful reversal. Aside from a brief consolidation in June, the asset rallied to reach approximately $4,500 by August 15, 2025, before experiencing a subsequent correction.

3. XRP (XRP)

XRP experienced a dynamic year in 2025, characterized by significant volatility and the resolution of long-standing legal challenges. The asset began the year trading near $2 and quickly gathered momentum to climb above $3 in January.

Legal Clarity and Price Action

The major catalyst for XRP in 2025 was the conclusion of its litigation with the US Securities and Exchange Commission. The case settled in August with a $125 million fine and an injunction against institutional sales. Following this settlement, XRP stabilized around the $3 mark for several weeks, buoyed by the regulatory clarity.

However, market forces eventually weighed on the price. After reaching a yearly low of around $1.70 in April, XRP recovered to trade near $2.20 by November. In early October, the asset slipped below the $3 threshold and remained under that level through the first half of November 2025.

4. BNB (BNB)

BNB displayed a pattern of consolidation followed by explosive growth in 2025. The asset started the year near $700, holding that level through January before dipping below $600 in early February. It remained range-bound until late June, when renewed ecosystem activity sparked a rally.

Ecosystem Expansion

Momentum accelerated in the second half of the year, with BNB reaching a yearly high of approximately $1,310 on October 8 before cooling to around $990 in November. Key developments bolstered the network’s credibility, including a partnership between BNB Chain and blockchain investigator ZachXBT in November to audit ecosystem projects. Additionally, Coinbase signaled growing support for the ecosystem by adding the BNB Chain-based token ASTER to its listing roadmap.

5. Solana (SOL)

Solana navigated a challenging start to 2025, slipping below the $200 level in early February and remaining suppressed for several months. However, the network’s fundamental strengths drove a midyear resurgence.

Technical Upgrades and Corporate Adoption

SOL regained the $200 mark briefly in July and again in late August. By mid-October, the asset rallied to its annual peak of around $247. This growth was supported by significant technical and commercial milestones. In September, Forward Industries adopted a Solana-based treasury model, reflecting corporate confidence in the blockchain. On October 31, 2025, the network successfully deployed its v2.0 upgrade, which introduced parallel transaction processing and native Ethereum Virtual Machine (EVM) compatibility, significantly enhancing its interoperability and throughput.

6. Hyperliquid (HYPE)

Hyperliquid (HYPE) emerged as a standout performer in 2025, building on its launch in late 2024. The token began the year around $23 and, after dropping to a low of $10.21 in April, surged to an all-time high of $58 on September 19.

Fundamentals Driving Growth

The rapid appreciation of HYPE was driven by robust onchain metrics rather than speculation. The platform cemented its dominance in decentralized perpetual trading, generating significant revenue. In August alone, the platform accrued $106 million in fees from nearly $400 billion in perpetual contract volume, a 23% increase from the previous month. Deflationary token burns further enhanced the asset’s value proposition, attracting investors focused on sustainable protocol revenue.

7. Zcash (ZEC)

Zcash experienced a dramatic resurgence in late 2025, reclaiming its status as a top-20 cryptocurrency by market capitalization. The asset rallied from a modest $48 in early September to soar past $600 within a single month, driven by a renewed market appetite for privacy.

Supply Shocks and Upgrades

A key driver of this price action was the mid-November halving event, which reduced block rewards and tightened the new supply of ZEC. Additionally, the network’s technical foundation was strengthened with the activation of the NU6.1 testnet upgrade in August 2025, which introduced critical bug fixes and improvements to shielded transactions.

8. Monero (XMR)

Monero continued to lead the privacy sector in 2025. The asset began the year near $190 and maintained a steady upward trajectory through the first half of the year, reaching approximately $410 by late May. After a mid-year dip to around $235, XMR regained momentum to trade near $440 by November.

Privacy Protocol Enhancements

Capital rotation into privacy coins in 2025 significantly benefited Monero. The network continued to evolve, implementing the Fluorine Fermi upgrade on October 10 to strengthen protections against spy nodes. With its robust suite of privacy technologies, including stealth addresses, ring signatures, and RingCT, Monero remained the gold standard for users seeking financial anonymity.

Conclusion

2025 proved that the long-term viability of cryptocurrency depends on real-world utility, transparency, and institutional confidence. The year’s top performers were those that offered tangible solutions, from Bitcoin’s ETF-driven stability to the technical innovations of platforms like Solana and Hyperliquid. The market’s maturity was further evidenced by the renewed interest in privacy assets like Zcash and Monero. These developments suggest that innovation and utility have replaced hype as the primary drivers of value in the digital finance ecosystem.

Fast Facts

- Bitcoin reached a yearly peak of $124,752 on October 7, 2025.

- Ether swung from a low of $1,500 in April to a high of $4,500 in August.

- The v2.0 upgrade on October 31, 2025, added native EVM compatibility to Solana.

- The platform generated $106 million in fees in August 2025 alone.

- ZEC rallied from $48 to over $600 in one month during late 2025.

Frequently Asked Questions

What caused the crypto market to shift in 2025?

The market shift in 2025 was primarily driven by the maturation of institutional investment products, such as US spot ETFs for Bitcoin and Ether, and a decline in retail speculation. Investors began prioritizing assets with proven utility, revenue generation, and onchain activity over hype-driven meme coins.

Why did privacy coins like Zcash and Monero rally in 2025?

Privacy coins saw renewed interest due to a combination of technical upgrades and market dynamics. Zcash benefited from a supply-tightening halving event and network improvements, while Monero attracted capital as investors sought stronger financial anonymity and protection against surveillance.

How did the Bitcoin ETF impact price performance?

The US spot Bitcoin ETFs provided a consistent source of institutional demand, which helped cushion Bitcoin’s price during market downturns. This structural support allowed Bitcoin to maintain a price above $100,000 for a significant portion of the year, despite broader bearish trends in the fourth quarter.

What is the significance of Solana’s v2.0 upgrade?

Solana’s v2.0 upgrade, rolled out on October 31, 2025, was a critical milestone that introduced parallel transaction processing and native EVM compatibility. This allowed Solana to support Ethereum-based applications more seamlessly, increasing its utility and attractiveness to developers.

Is Hyperliquid (HYPE) a good investment based on 2025 performance?

Hyperliquid demonstrated strong fundamentals in 2025, driven by high trading volumes and significant fee revenue that supported token burns. Its rise from $10 to a peak of $58 suggests that the market values its decentralized perpetual trading model, though all crypto investments carry inherent risks.