Introduction

While the broader crypto market narrative may have shifted its focus, astute traders know that quiet periods are often the best time to identify emerging opportunities. The GameFi sector is a prime example. Although the total GameFi market capitalization currently sits at $12.1 billion—down $4% over the last 24 hours, according to CoinGecko data—a select group of crypto gaming tokens is showing compelling signs of positioning for a potential breakout in August 2025.

By analyzing key on-chain metrics like falling exchange reserves, significant whale accumulation, and strong technical chart patterns, we’ve identified three tokens that stand out from the pack. Let’s dive into the fundamental strengths and technical setups of FLOKI, MAGIC, and RNDR, and also take a look at BEAM as a noteworthy wildcard.

Key Takeaways

- FLOKI: Leading the charge with significant whale accumulation. A $4.52% drop in exchange reserves has seen nearly $96.8 billion tokens moved off exchanges, signaling strong holder conviction.

- MAGIC: Demonstrating powerful bullish momentum with a $57.4% surge over the past 7 days. Declining exchange reserves suggest this rally is spot-driven and has room to continue.

- RNDR: Consolidating within a tight symmetrical wedge pattern as whale holdings increase. The token is approaching key breakout levels that could trigger a significant upward move.

- BEAM: An honorable mention showing steady, long-term accumulation by both whales and smart money, positioning it as a potential sleeper hit if the GameFi sector gains traction.

Floki (FLOKI)

Floki began its journey as a meme-inspired token but has since evolved into a robust ecosystem encompassing DeFi, NFTs, and GameFi. Unlike many of its peers, Floki delivers tangible utility through products like the FlokiFi Locker and its flagship metaverse game, Valhalla.

Despite a recent $12% week-on-week price drop, Floki enters August with arguably the strongest on-chain setup in the crypto gaming space. Data from Nansen reveals that the top 100 wallets have substantially increased their FLOKI holdings over the past 30 days. In parallel, exchange reserves have fallen by $4.52% to $2.14 trillion tokens. This outflow of nearly $96.8 billion FLOKI from exchanges points to a significant reduction in immediate selling pressure and strong accumulation by long-term believers. While smart money allocations have seen a slight dip, this is more than offset by a whale accumulation percentage exceeding $17%, indicating deep conviction from major players.

On the technical front, FLOKI is currently trading at $0.00010399 after finding solid support near $0.00009849. The first critical resistance to watch is the 0.236 Fibonacci level at $0.00011241. A decisive break above this level would open the door to $0.00012799 and a potential retest of the local high at $0.00015749. With sustained bullish momentum, the $0.00019395 level could come into play.

Conversely, a breakdown below the swing low at $0.00009849 would invalidate the bullish thesis in the short term. For now, FLOKI’s combination of whale strength and diminishing sell-side pressure makes it a prime candidate for significant upside in August.

Treasure (MAGIC)

MAGIC is the native token of the Treasure ecosystem, a decentralized gaming hub built on Arbitrum. It functions as the interoperable liquidity layer connecting games, metaverses, and NFT projects, effectively serving as a “decentralized gaming console.”

MAGIC is the only token on this list to post positive gains over the last week, boasting an impressive $57.4% rally. This demonstrates that bulls remain firmly in control. While the initial breakout occurred in July, its positioning for August remains strong. Nansen data confirms a steady decline in exchange reserves, which has directly correlated with the price rally. This reinforces the narrative that the move was driven by spot buyers accumulating the token, not speculative derivatives.

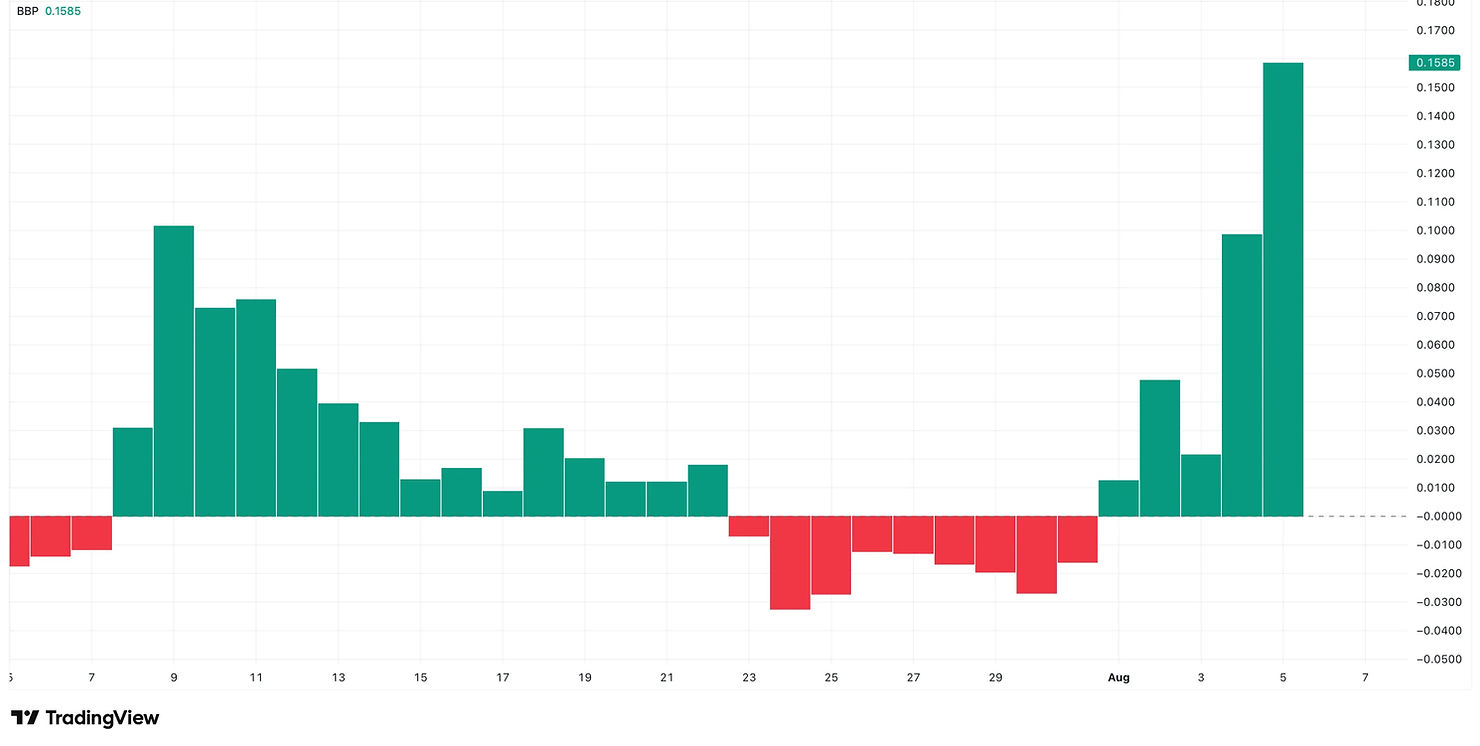

Momentum indicators have also flipped decisively bullish. The Bull-Bear Power (BBP) index has surged to +0.1585 after a prolonged period in negative territory. This indicates that demand is strengthening, even as the price consolidates after its initial surge.

From a technical perspective, MAGIC recently cleared the 1.618 Fibonacci level at $0.27 but met immediate resistance. A clean move above this zone could ignite a run toward $0.36 or higher, according to Fibonacci extension levels. On the downside, the previous swing high at $0.22 now acts as firm support. The bullish market structure remains intact as long as the price holds above $0.17.

Render (RNDR)

The Render Network is a decentralized platform that allows users to contribute their unused GPU power for complex rendering tasks. This makes it a foundational infrastructure layer for the AI, metaverse, and high-fidelity gaming industries. The RNDR token facilitates payments and governance within the network.

Despite an $11.42% decline over the past week to its current price of $3.52, RNDR is exhibiting classic signs of a pre-breakout consolidation.

Whale wallets have been steadily increasing their holdings, and this accumulation isn’t just limited to the top wallets but is seen across a broader cohort. This, combined with declining exchange reserves, suggests that tokens are moving into strong hands, reducing potential sell pressure.

Technically, RNDR is trading within a symmetrical wedge pattern, having recently bounced from support at $3.34.

The next critical resistance is the 0.236 Fibonacci level at $3.83. A breakout above this price point could trigger a surge toward the $4.39 – $4.62 range. A confirmed breakout from the wedge pattern would validate this move and open up higher targets at $4.98, $5.43, and potentially even $6.72. A breakdown below $3.34 would invalidate this bullish setup.

While the Bear-Bull Power (BBP) is still slightly negative at -0.353, it is rapidly improving. If this trend continues, RNDR could quickly become a top performer this month.

Beam (BEAM)

Beam is a modular gaming blockchain within the Merit Circle ecosystem, designed to simplify game development and power robust in-game economies. Over the last three months, whales have increased their BEAM holdings by $2.94%. More impressively, both Smart Money wallets and the top 100 holders have also added to their positions during this period. To top it off, exchange reserves have been depleted by nearly $9%, further strengthening the case for reduced sell pressure.

Currently trading at $0.0067 (down $12% week-on-week), BEAM is holding above its recent low of $0.0063. The token is now attempting to reclaim the 0.236 Fibonacci level at $0.0070. A successful flip of this level could lead to a climb toward $0.0081 and $0.0092, with little technical resistance beyond that. However, a dip below the $0.0063 support would negate the immediate bullish outlook. While its whale inflows aren’t as explosive as FLOKI’s, BEAM’s steady accumulation and chart recovery make it a token to watch closely.

Conclusion

The GameFi sector may be flying under the radar, but on-chain data reveals a brewing storm of accumulation and strategic positioning. FLOKI’s powerful whale activity, MAGIC’s spot-driven momentum, and RNDR’s coiled consolidation pattern all present compelling, data-backed arguments for a bullish August. Meanwhile, BEAM’s consistent, quiet accumulation makes it a strong dark horse.

While these tokens show significant potential, the broader market sentiment, heavily influenced by Bitcoin’s price action, will play a crucial role. Investors should view this analysis as a starting point for their own research and exercise prudent risk management. If the market winds turn favorable, these four tokens are well-positioned to lead the next GameFi rally.

Frequently Asked Questions

What is GameFi?

GameFi, a portmanteau of “Game” and “Finance,” refers to blockchain-based games that incorporate decentralized financial elements. These games often use cryptocurrencies and NFTs to allow players to earn real-world value and own their in-game assets.

Why are on-chain metrics like exchange reserves important?

Exchange reserves track the total amount of a token held in wallets on centralized exchanges. When reserves decrease, it often means investors are moving their tokens to private wallets for long-term holding (HODLing), which reduces the immediately available supply for selling and is considered a bullish signal. Conversely, rising reserves can indicate higher selling pressure.

What factors could prevent these crypto gaming tokens from rallying in August?

Several factors could invalidate this bullish outlook. A significant downturn in the price of Bitcoin or Ethereum could drag the entire altcoin market down. Negative regulatory news, a major security exploit within one of the projects, or a sudden shift in market sentiment away from GameFi could also negatively impact prices.