Introduction

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is currently experiencing a profound shift in its supply dynamics. Despite recent price consolidation within a multi-month range, on-chain data reveals that large addresses, commonly known as “whales,” have been accumulating ETH at an unprecedented pace. This surge in accumulation mirrors patterns observed in 2017, a period that preceded a monumental 1,000% rally for Ethereum. The renewed conviction among these significant holders, coupled with growing institutional interest, suggests that ETH may be coiling for its next major price breakout.

Key Takeaways

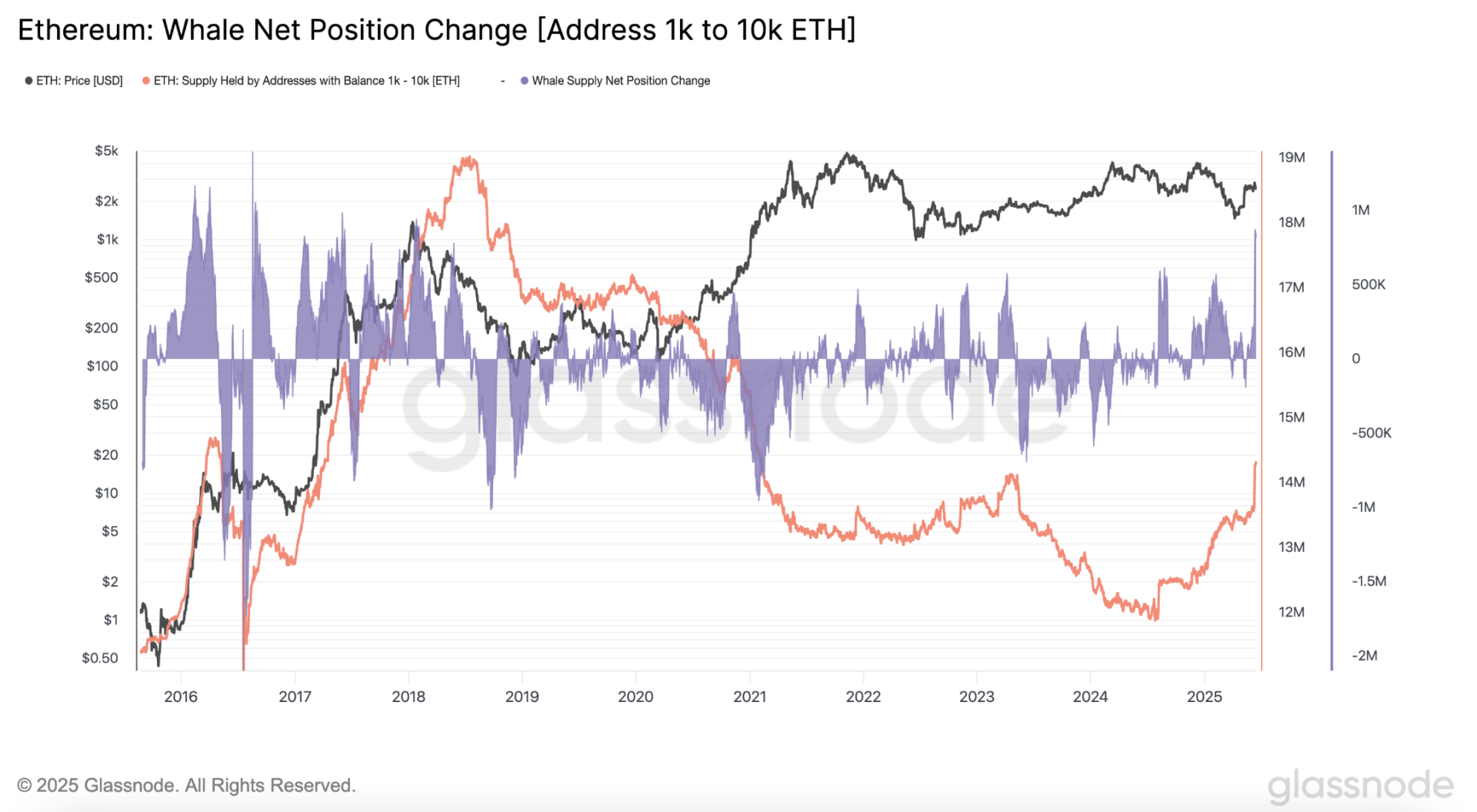

- Ethereum whales (wallets holding 1K-10K ETH) have significantly increased their holdings, accumulating over 800,000 ETH daily for nearly a week. This surge included a record single-day inflow of 871,000 ETH on June 12th, and over 818,000 ETH (worth approximately $2.5 billion) on Sunday, marking their largest daily inflow since 2018.

- Despite recent price fluctuations (with ETH dropping 3.7% in the past 24 hours before stabilizing around $2,555), ETH’s price is consolidating within a multi-month range, mirroring its 2017 chart pattern that preceded a 1,000% rally.

- Analysts are maintaining optimistic price targets for ETH, foreseeing a short-term goal of $4,000 and the potential for a rally to $10,000.

Ethereum Whales Fuel Accumulation Spree

One of Ethereum’s wealthiest investor cohorts has been actively increasing their Ether holdings at a rate not seen in years. Data from Glassnode indicates that wallets holding between 1,000 and 10,000 ETH have consistently accumulated over 800,000 ETH daily for nearly a week. This aggressive buying pushed their total holdings to over 14.3 million ETH, and notably, on June 12, 2025, a staggering 871,000 ETH was added in a single day – marking the highest daily net inflow for this group so far this year, and the largest since 2017.

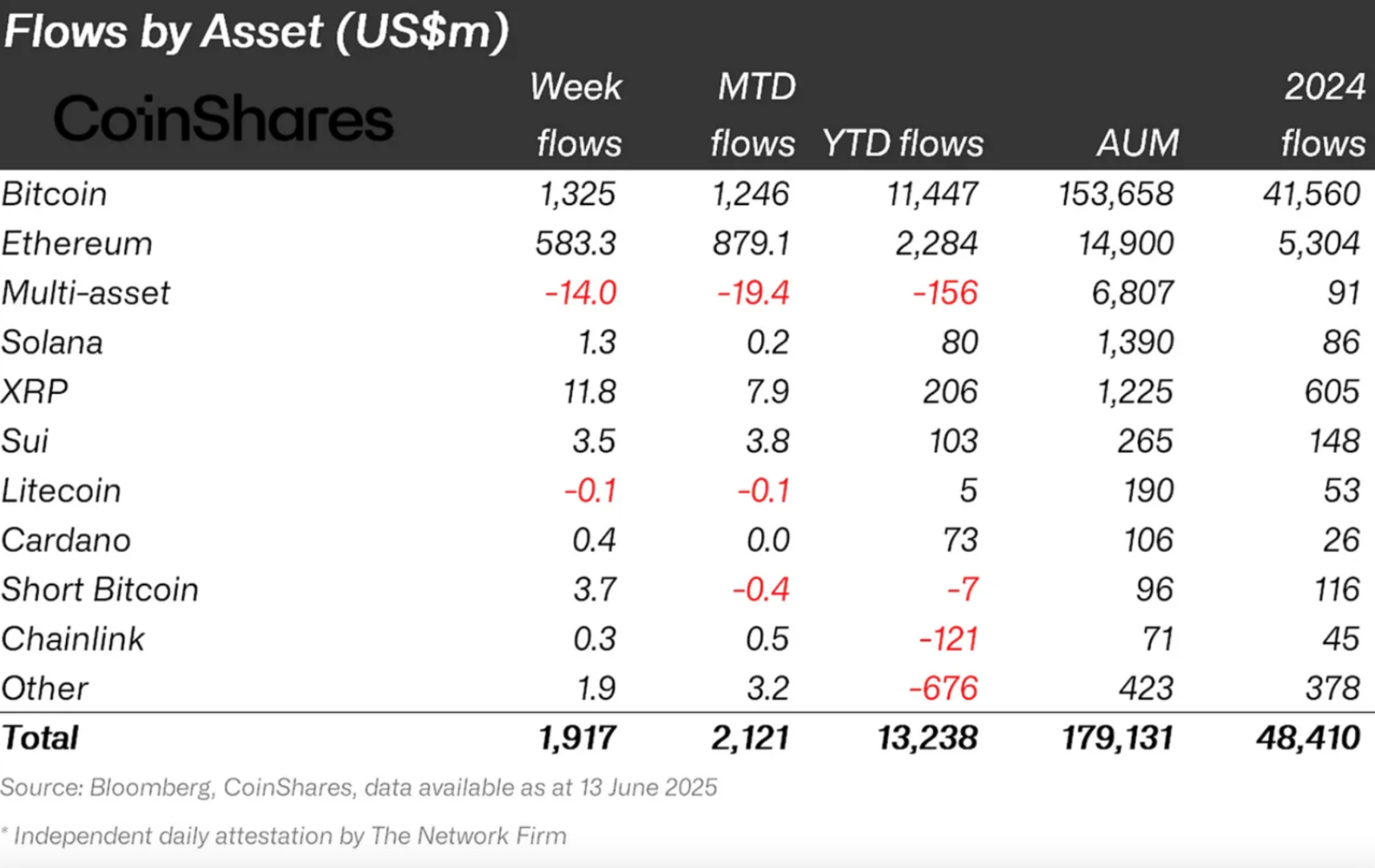

This significant accumulation spike aligns with a notable surge in institutional demand for Ethereum. Ether investment funds have recently attracted substantial inflows, with one week alone seeing $583 million flow into ETH-focused products, contributing to year-to-date net inflows exceeding $2.28 billion. This growing institutional appetite, alongside strategic positioning by whales, underscores a growing conviction in Ethereum’s future.

Echoes of 2017: A Familiar Chart Pattern

Despite a recent 90% price increase over the past two months, fueled by optimism surrounding Ethereum’s Pectra upgrade and the restructuring of its foundation’s core team, ETH’s price remains confined within a multi-month consolidation channel.

However, analysts like Milkybull Crypto highlight a striking resemblance between current price action and the period leading up to Ethereum’s explosive 1,000% rally in 2017. In 2016-2017, ETH consolidated within a $10-$20 range after the DAO hack and Ethereum Classic split. A lack of market conviction gave way to a surge past $1,500 within a year, largely driven by the ICO boom.

Similarly, in 2024-2025, ETH is consolidating again, this time between $2,150 and $3,600, while maintaining support above its 50-week and 200-week exponential moving averages (EMAs). While the current drivers differ—including the emergence of spot ETH ETFs, widespread staking adoption, and the rise of tokenization—the underlying technical setup is remarkably similar: ETH is coiling below resistance, much like it did before its last major breakout.

This technical alignment leads some analysts to project a short-term ETH price target of around $4,000, consistent with the channel’s upper trendline. Furthermore, long-term projections, as noted by Milkybull Crypto in May, suggest that a $10,000 ETH price target “cannot be ruled out.”

Technical Insights and Market Sentiment

While Ethereum’s price saw a 3.7% dip on Tuesday to $2,555, it has largely held key support levels. The downturn followed a sharp rejection near the $2,673 level, which triggered some selling pressure. However, on-chain data strongly suggests that larger market participants are viewing these price pullbacks as strategic accumulation opportunities. The magnitude of this buying activity signals growing conviction among large entities, contrasting with some retail profit-taking.

Detailed technical analysis reveals that ETH fell 5.7% from $2,679.99 to $2,527.37 during a recent trading session, with volume exceeding 560,000 ETH. A sharp drop confirmed resistance at $2,650, accelerating downside momentum. Despite this, the subsequent recovery stalled near $2,540, forming a narrow consolidation pattern with reduced volatility. The $2,553-$2,555 zone has emerged as a key intra-period consolidation level during the recovery phase, with buyers stepping in to form an ascending channel.

This persistent whale accumulation, coupled with the ongoing technical consolidation and surging institutional interest, paints a compelling picture for Ethereum’s future trajectory.

Fast Facts

- Ethereum whale wallets (holding 1,000 to 10,000 ETH) accumulated over 818,000 ETH (approximately $2.5 billion) on a single day, marking their largest daily inflow since 2018.

- On June 12, 2025, whale wallets added over 871,000 ETH in a single day, the highest daily net inflow recorded so far this year.

- These whale addresses now control more than 16 million ETH, representing approximately 27% of Ethereum’s total supply, a concentration level historically preceding significant price movements.

- ETH-focused investment funds attracted $583 million in a recent week, pushing year-to-date net inflows to $2.28 billion.

- The current price consolidation and whale accumulation behavior are drawing striking similarities to Ethereum’s chart pattern in 2017, which ultimately led to a parabolic price surge.

- Analysts are eyeing a short-term ETH target of $4,000, with some forecasting a potential rally to $10,000.

- Over 35 million ETH are now staked, indicating strong long-term commitment from holders and a reduction in circulating supply.

Conclusion

The current landscape of Ethereum is characterized by a significant influx of capital from large-scale investors and institutions, reminiscent of the pre-bull run dynamics of 2017. While the immediate price action may appear to be in a consolidation phase, the underlying accumulation trend by Ethereum whales is a powerful signal of strong long-term conviction. As new drivers like ETFs, enhanced staking, and widespread tokenization continue to mature, Ethereum appears well-positioned for a potential breakout. The market is keenly watching whether this robust whale-driven accumulation translates into a sustained upward movement, potentially setting the stage for a new all-time high. Read more on ETH price here.

FAQ

What is an “Ethereum whale”?

An Ethereum whale refers to an individual or entity holding a very large amount of ETH, typically between 1,000 and 10,000 ETH, or even more. Their large holdings mean their buy and sell orders can significantly impact the market.

Why is whale accumulation significant for ETH’s price?

Whale accumulation often indicates strong confidence in the asset’s future price performance. When large, savvy investors are buying in bulk, it suggests they anticipate future growth, potentially leading to increased demand and upward price pressure. Historically, such accumulation has preceded major price rallies.

How is the current ETH market similar to 2017?

The similarity lies in the multi-month price consolidation pattern and the aggressive accumulation by large holders. In 2017, ETH consolidated before a massive rally driven by the ICO boom. While the specific catalysts are different now (ETFs, staking, tokenization), the technical setup and whale behavior suggest a similar potential for a significant upward move.

What are the main drivers for Ethereum’s potential growth in 2025?

Key drivers include the ongoing excitement around spot Ethereum ETFs, the increasing adoption and rewards from ETH staking, and the growing trend of asset tokenization on the Ethereum blockchain. Network upgrades like Pectra also contribute to overall optimism and utility.

What are the price targets for ETH according to analysts?

Short-term price targets often hover around $4,000, aligning with the upper trendline of its current consolidation channel. Some analysts maintain more ambitious long-term targets, with figures like $10,000 not being ruled out, especially if the 2017 pattern truly repeats.