Introduction

Anyone managing an online store or handling cross-border transactions has likely encountered payment friction points that disrupt operations. Bank transfers frequently stall for multiple days, card processing fees gradually erode profit margins on every invoice, and support teams spend countless hours resolving disputes that drain both time and resources. These operational bottlenecks create tangible costs that compound across thousands of transactions.

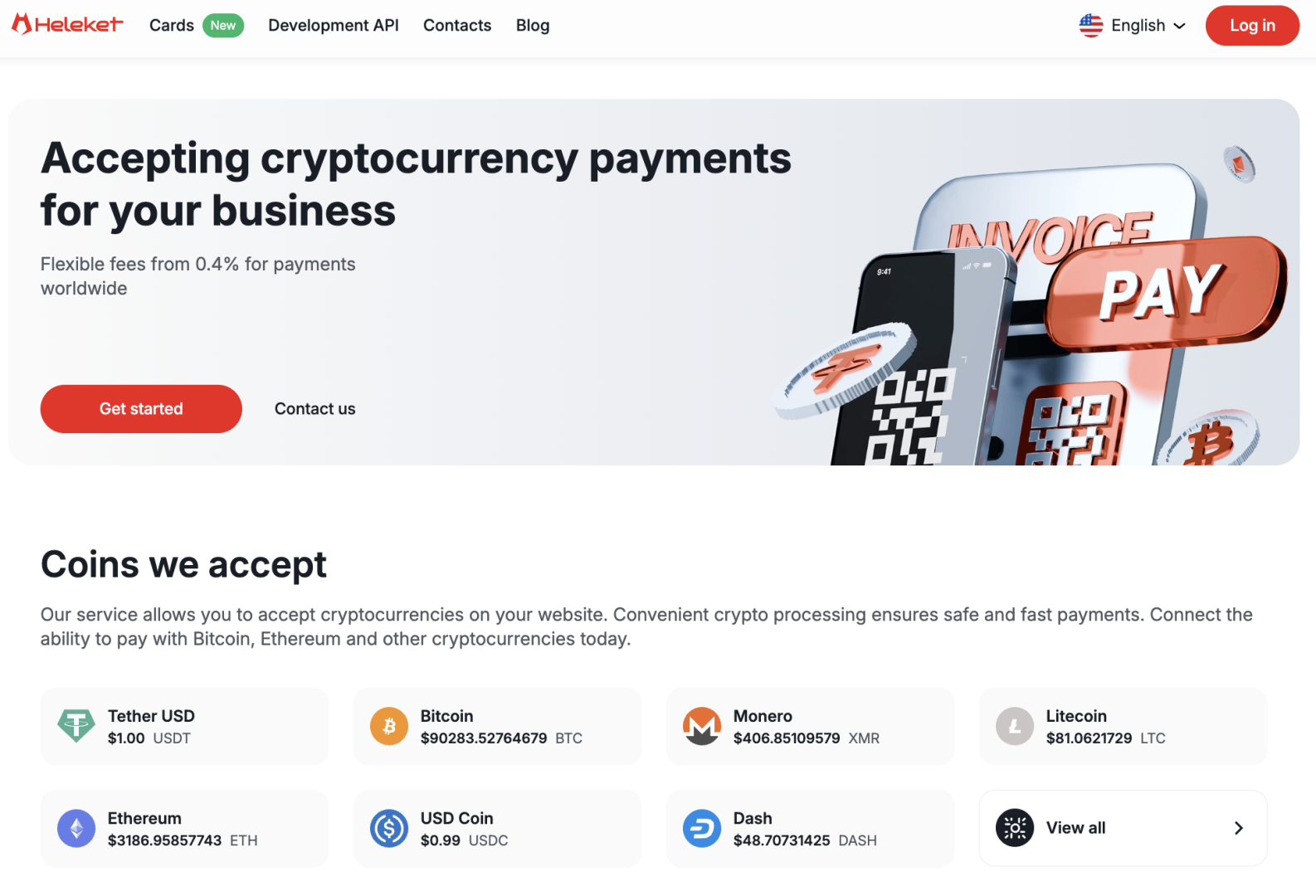

While cryptocurrency promises accelerated value transfer across borders, most existing solutions function as disconnected components attached to unstable infrastructure. Heleket takes a different approach by constructing a comprehensive system designed specifically for business operations. The platform delivers a unified environment for payment acceptance, currency conversion, automated payouts, and operational spending through virtual cards that businesses can fund directly from revenue.

This comprehensive review examines Heleket from multiple perspectives, covering its technical architecture, operational capabilities, integration options, and practical utility for businesses requiring reliable cross-border payment infrastructure. The analysis begins with foundational concepts and progresses through advanced features that distinguish this platform from conventional payment processors.

Key Takeaways

- Heleket constructs a structured crypto payment infrastructure that replaces fragmented and unreliable wallet configurations typically used by businesses attempting to accept digital currency. The platform establishes predictable settlement processes through transparent invoice logic, flexible asset conversion capabilities, and clearly defined processing status flows that eliminate ambiguity.

- The system provides merchants with automation tools including scheduled withdrawals, batch payout capabilities, and virtual payment cards that convert incoming revenue directly into operational expenses without intermediate transfer steps. This integration reduces the operational complexity that typically accompanies crypto payment acceptance.

- Heleket supports flexible implementation through developer-focused APIs, ready-made plugins for popular platforms, and dedicated account management that guides businesses through integration processes. This combination addresses the needs of cross-border companies requiring dependable payment flows without extensive technical overhead.

Why Cross-Border Businesses Examine Crypto Payment Options

Traditional payment infrastructure reveals its limitations most clearly at international borders. Once merchants recognize the delays, geographical restrictions, and unpredictable settlement windows inherent in conventional banking rails, they naturally search for alternatives offering superior speed, global reach, and reliable settlement timing without those operational constraints.

Cryptocurrency emerges as a practical solution because it transfers value across networks and national boundaries without depending on traditional banking infrastructure or intermediary institutions. This architectural difference means crypto payments avoid the multi-day clearing periods and cascading fees that result when transactions pass through multiple financial institutions before reaching final settlement.

Stablecoins add another strategic advantage to this equation. These digital assets maintain consistent price references tied to traditional currencies while still settling globally within minutes rather than days. This combination of price stability and rapid settlement creates practical utility that volatile cryptocurrencies alone cannot provide.

Businesses serving international customer bases notice these operational differences immediately. A stalled card payout or rejected wire transfer can simultaneously disrupt sales pipelines, overwhelm support queues, and freeze cash flow in a single event. Stablecoin transfers typically bypass these failure points entirely, which explains why e-commerce platforms, software-as-a-service providers, and subscription-based services increasingly evaluate crypto as a parallel payment rail rather than treating it as experimental technology.

This market shift toward alternative payment infrastructure creates demand for enterprise-grade systems rather than improvised wallet solutions patched together from consumer-focused tools. Businesses require the same operational stability they expect from traditional payment processors, but with the geographical flexibility and settlement speed that blockchain networks can provide.

Heleket’s Core Processing Infrastructure for Merchants

The increasing need for robust payment infrastructure among businesses highlights the significance of Heleket’s fundamental product offering. The processing system establishes a controlled pathway from the initial moment when customers select cryptocurrency as their payment method through to the point where merchants receive confirmed funds in their accounts.

The service generates invoices automatically, monitors blockchain confirmations in real time, and updates payment status with clear signals that correspond to actual on-chain events. This structured approach removes the guesswork and manual tracking typically required when managing scattered wallet addresses across multiple cryptocurrencies.

Heleket maintains support for several major cryptocurrencies including Bitcoin, Ethereum, and widely adopted stablecoins such as USDT and USDC. This multi-currency support enables merchants to avoid maintaining separate addresses or isolated processing flows for each digital asset.

The company implements standardized procedures where each payment follows a defined sequence with fixed invoice states, expiration rules, and callback behavior that integrates with existing business systems. This level of operational clarity provides substantial value for online stores, software platforms, and digital exchanges that require predictable order logic without constant manual verification.

Heleket delivers business stability by consolidating this entire flow within a single integrated system. This approach replaces fragmented wallet management with a cohesive process that functions like a proper payment stack rather than a collection of disconnected tools requiring constant supervision.

API-First Architecture and Developer Integration

Once payment flow operates on a stable foundation, the next consideration concerns operational control and system integration. Development teams require infrastructure that integrates into existing backend systems without requiring extensive rewrites or architectural changes. Heleket addresses this requirement through an API that handles invoice creation, status verification, conversion triggers, and payout coordination through structured requests with predictable responses.

Each endpoint follows consistent rules that help developers avoid the unexpected behavior that frequently emerges when integrations depend on improvised wallet logic or inconsistent third-party services. The standardization reduces debugging time and accelerates deployment cycles.

The integration process maintains straightforward steps where teams establish merchant profiles, obtain authentication keys, and define payment flows within their existing systems. Webhook notifications report each status change automatically, allowing products to update order records and release services at the appropriate time without polling APIs for status updates.

Sandbox testing environments help teams validate edge cases before deployment reaches production customers. This testing capability reduces the risk of payment processing errors affecting actual transactions and customer experiences.

This technical structure fits naturally into architectures for platforms that prioritize rapid development cycles. Heleket can integrate into existing systems without forcing complete redesigns while still delivering the operational control that enterprise-grade payment logic requires.

Ready-Made Plugins and Platform Compatibility

Not every business entering the crypto payment space possesses the resources or inclination to build custom integrations from scratch. Some organizations prefer faster implementation paths that add cryptocurrency payment capabilities without touching core backend infrastructure. Heleket addresses this market segment through ready-made plugins designed for widely adopted commerce and billing platforms.

These integration modules carry the same processing engine found in API implementations but package it within familiar administrative interfaces. This approach helps teams test crypto payment demand without committing to full development cycles or allocating significant engineering resources.

Standard content management systems can typically enable Heleket functionality after plugin installation and brief configuration procedures. Similarly, software-as-a-service products already using subscription billing platforms can incorporate Heleket’s invoice flow through its dedicated module rather than building fresh integrations from foundational code.

These options lower adoption barriers for companies prioritizing capability deployment over extensive customization. Businesses can begin accepting crypto payments quickly while still drawing from the same stable infrastructure that supports fully customized API-driven implementations.

Business Tools for Automated Withdrawal and Mass Payouts

Heleket extends its infrastructure capabilities beyond basic payment acceptance by providing businesses with enhanced control over fund movement and distribution. Auto-withdrawal functionality allows merchants to establish rules that transfer balances to their designated wallets according to schedules or when specific thresholds are met. This automation keeps treasury movements predictable and reduces manual intervention requirements.

Mass payout capabilities address the opposite operational direction by handling outbound payments efficiently. Companies paying affiliates, independent contractors, or business partners can distribute funds across numerous addresses through a single consolidated request rather than processing individual transfers manually. This batch processing structure significantly reduces administrative workload, minimizes human error probability, and brings systematic organization to crypto operations that typically feel fragmented and difficult to manage.

The mass payout system supports payment to hundreds or thousands of recipients simultaneously, which proves particularly valuable for affiliate networks, gaming platforms, and businesses maintaining large contractor pools across multiple countries. Recipients receive funds in minutes regardless of geographic location or time zone, eliminating the delays associated with traditional wire transfers.

Converter Systems and Fee Structure

Once businesses gain operational control over payment distribution, attention typically shifts to value preservation and cost management. Incoming payments may arrive in volatile cryptocurrencies while companies require stable balances for accurate accounting and budget planning. Heleket addresses this operational concern through converter and auto-converter systems that transform incoming funds into preferred assets immediately when payments clear.

Merchants can accept payments in Bitcoin or Ethereum while settling automatically into stablecoins without delay or additional manual processing steps. This automated conversion protects businesses from price volatility exposure while maintaining the settlement speed advantages that blockchain payments provide.

The fee structure integrates directly with this conversion logic. Heleket establishes processing rates starting at 0.4% and calculates each commission with precise figures rather than rounded amounts. This precision prevents the small incremental losses that accumulate at significant scale across thousands of transactions.

This exact calculation approach provides finance teams with clearer visibility into cost per transaction, which helps maintain predictable profit margins across diverse markets and payment volumes. The transparency eliminates surprises in financial reporting and supports more accurate forecasting.

Trust Infrastructure, Security Protocols, and Operational Support

After establishing value control mechanisms, attention naturally turns to system reliability and operational consistency. Payment infrastructure holds genuine business value only when its behavior remains consistent under varying load conditions and edge cases. Heleket structures its processing flow with explicit status codes, standardized error responses, and strict invoice rules that help businesses avoid the uncertainty that appears when payments depend on improvised configurations.

This technical clarity accelerates issue resolution for support teams because each outcome follows documented patterns rather than requiring investigative troubleshooting. The systematic approach reduces mean time to resolution and minimizes customer friction during payment processing.

Operational support reinforces this technical stability through dedicated account management. Heleket assigns personal managers to each business project to eliminate much of the trial-and-error experimentation that typically slows initial onboarding and integration processes. These managers guide configuration decisions, validate edge case handling, and align the payment system with each business’s internal operational processes.

For companies depending on steady and predictable payment flows, this combination of structured technical architecture and responsive human support becomes equally important as the payment processing capabilities themselves. The support model reduces implementation risk and accelerates time to operational status.

Virtual Cards That Transform Revenue Into Real-World Expenses

Once payments enter the system and settle into stable balances, businesses still confront a practical challenge regarding how to utilize that revenue without additional transfers or delays. Heleket resolves this operational gap through virtual payment cards that businesses can fund directly from revenue arriving through the platform.

Companies can accept cryptocurrency payments on their websites and subsequently use those same funds to pay for advertising campaigns, software subscriptions, hosting services, and other online operational expenses. The virtual cards function within existing payment networks, making them compatible with the vast majority of online merchants.

This integrated approach removes the conventional detour through cryptocurrency exchanges or traditional banking intermediaries. Funds move from customer payments directly to operational spending within a single environment, which shortens the path between revenue recognition and practical utilization. For teams depending on recurring digital tools and services, this approach converts crypto income into immediately deployable working capital rather than creating balances that await multiple conversion steps before becoming usable.

The virtual card system supports the subscription economy model that dominates modern business operations. Companies can maintain recurring payments for essential services without manually converting crypto balances to fiat currency through exchanges, then transferring to bank accounts, and finally funding traditional payment methods.

Heleket Within a Broader Financial Infrastructure Stack

The complete system architecture becomes clearer when examining how individual components interconnect. Heleket does not function as a narrow checkout feature sitting in isolation. Rather, it constructs a comprehensive layer that connects payment acceptance, settlement rules, automated payouts, and operational spending into unified infrastructure.

This integrated reach matters because businesses across numerous markets increasingly view crypto payments as operational tools rather than optional experiments. They expect the same reliability standards they receive from conventional payment rails while avoiding the delays and regional restrictions that frequently disrupt cross-border commerce.

This comprehensive perspective reveals Heleket’s market position. The platform supplies foundational infrastructure that allows online stores, software products, and digital platforms to treat crypto payment flows as routine business operations rather than experimental initiatives requiring constant attention. Once the structural pieces align including processing, conversion, treasury automation, and spending capabilities, the payment rail becomes robust enough to support genuine business growth instead of isolated proof-of-concept tests.

The platform addresses the reality that modern businesses operate across borders by default. Companies serving international markets require payment infrastructure that matches their operational scope without introducing new friction points or geographical limitations. Heleket constructs this infrastructure by combining blockchain settlement speed with business-grade operational tools.

Fast Facts

Transaction settlement through stablecoins typically completes within minutes compared to the two to five day windows required for traditional international wire transfers. The virtual card market is projected to grow from $5.2 trillion in 2025 to approximately $17.4 trillion by 2029, representing 235% expansion as businesses seek flexible payment solutions. Stablecoin transaction volumes reached $27.6 trillion in 2024, surpassing the combined volumes of Visa and Mastercard, while 90% of financial institutions now actively integrate stablecoins into their operations. Heleket’s processing fees start at 0.4% with exact calculation methods that avoid rounding losses, providing cost predictability across high transaction volumes.

Conclusion

Examining all operational aspects, Heleket’s infrastructure demonstrates how crypto payment stacks can evolve when they move beyond basic checkout functionality. The framework successfully connects payment acceptance, currency conversion, automated payouts, and direct operational spending in ways that reduce friction typically surrounding cross-border business operations.

The platform takes a practical rather than speculative approach, with individual components fitting together through clear operational logic. Whether this architectural direction scales smoothly across additional markets will depend on continued execution quality and market adoption patterns. However, based on its current feature set as of late 2025, Heleket represents a mature option within its market segment for businesses requiring comprehensive crypto payment infrastructure.

Frequently Asked Questions

What operational problem does Heleket address for businesses?

Traditional cross-border payment systems slow business operations through processing delays, incremental fee deductions, and unpredictable settlement timing. Cryptocurrency removes portions of that friction, but most available tools remain fragmented and operationally unstable. Heleket replaces that patchwork infrastructure with structured flows from initial acceptance through final settlement and operational spending. The platform does not attempt to reinvent payment processing fundamentally but rather provides businesses with cleaner, more reliable systems for managing digital currency transactions.

How does Heleket manage payment volatility for merchants?

Payments frequently arrive in volatile cryptocurrencies, creating complications for accounting procedures and budget planning. Heleket enables merchants to settle in preferred currencies through its converter and auto-converter systems. This automated approach reduces requirements for manual processing steps and limits exposure to sudden price movements. The conversion capability also provides finance teams with more predictable figures for financial reporting and analysis.

Where do virtual cards fit within Heleket’s operational system?

Virtual cards occupy the final stage of the payment flow architecture. They enable businesses to utilize crypto-derived revenue for operational costs without requiring external transfers or traditional banking delays. This creates direct linkage between incoming revenue and outgoing expenses within a single integrated environment. The approach simplifies internal processes because funds remain within the same system from initial customer payment through final operational expenditure.

How does Heleket support companies during system integration?

Personal account managers assist each business project with system configuration, edge case testing, and alignment of payment flows with internal operational processes. This dedicated support removes substantial portions of the trial-and-error phase that frequently slows technology adoption. Developers work with clearly documented API rules and predictable response patterns, which maintains integration stability throughout implementation. The combined technical and human support structure reduces operational risk during rollout phases.