Introduction

For years, the Web3 ecosystem has been compared to the Wild West, a frontier rife with opportunity but also plagued by bad actors. Coordinated pump-and-dump schemes are one of the most persistent threats in this landscape, preying on the allure of quick profits. These scams leverage sophisticated disinformation campaigns, and increasingly, AI-generated fake news and deepfakes, to manipulate markets at the expense of unsuspecting investors.

While the decentralized design of the crypto world has historically allowed these schemes to operate below the radar, regulators are intensifying their efforts. For instance, the landmark ‘Operation Token Mirrors’ in October 2024 led to the seizure of $25 million and charges against 18 individuals, signaling that the era of impunity is ending. This article will dissect the anatomy of modern pump-and-dump schemes, explain how they operate, and provide clear strategies to help you identify and avoid these deceptive tactics.

Key Takeaways

- Web3 pump-and-dump schemes are a form of fraud where manipulators artificially inflate a cryptocurrency’s price using coordinated buying and misleading information, only to sell off their holdings en masse, causing the token’s value to collapse.

- The inherent anonymity and the unregulated, 24/7 nature of decentralized markets make the cryptocurrency industry particularly susceptible to these manipulative schemes.

- These schemes typically unfold in four distinct stages: a pre-launch phase to build a community, a promotional launch to generate hype, a coordinated “pump” to drive up the price, and a final “dump” where orchestrators cash out, leaving other investors with worthless assets.

- Protecting yourself involves critical thinking: avoid unsolicited investment advice, scrutinize social media promotions—especially those using celebrity likenesses—and be deeply skeptical of any scheme promising guaranteed or unrealistic returns.

What Are Pump-and-Dump Schemes in Web3?

A pump-and-dump scheme is a form of market manipulation where the price of a cryptocurrency or blockchain asset is artificially inflated. This is achieved through a combination of coordinated buying by a group of insiders and a deluge of false or misleading information designed to create hype and attract outside investors.

Once the token’s price reaches a predetermined target, the scheme’s orchestrators execute a swift, massive sell-off, or “dump,” to realize their profits. This flood of sell orders overwhelms demand, causing the price to plummet dramatically. The result is catastrophic for everyone else, who are left holding severely devalued or completely worthless tokens. Because these assets typically lack any real utility or value, the price never recovers.

Why These Schemes Thrive in the Web3 Era

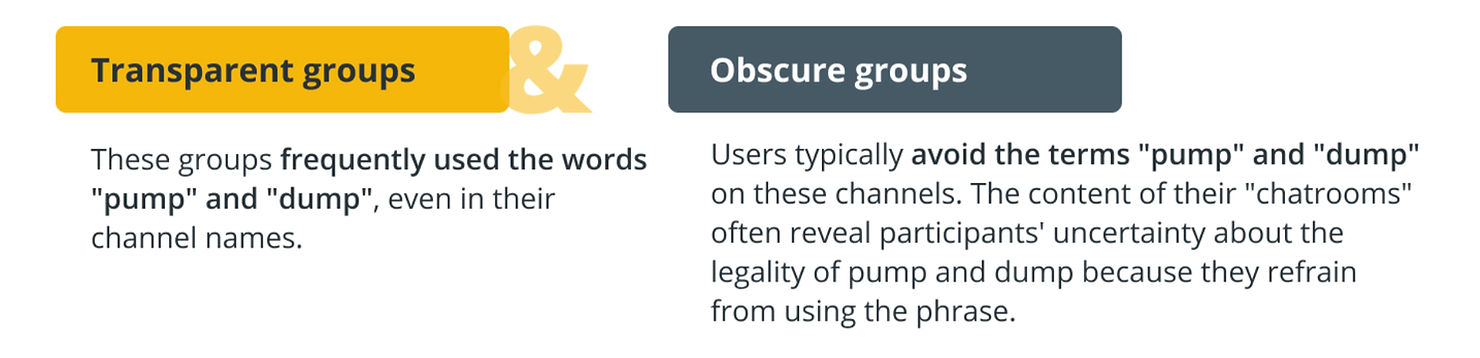

The peer-to-peer, decentralized architecture of Web3 creates fertile ground for this type of fraud. Schemers often conceal their identities, operating anonymously and communicating through encrypted, privacy-focused channels like Telegram and Discord. This makes it incredibly difficult for investors and law enforcement to hold them accountable.

Furthermore, the 24/7 nature of crypto markets, combined with a lack of universal regulatory oversight and safeguards like circuit breakers, means there are no brakes on the manipulation. The ease with which new tokens can be created on platforms like Pump.fun—which saw over one million tokens launched in 2024 alone—exacerbates the problem, allowing scammers to churn out new fraudulent assets at an alarming rate.

The Anatomy of a Pump-and-Dump

Web3 pump-and-dump schemes meticulously follow four stages:

- Pre-Launch: The orchestrators begin by building a community around a new or obscure token. They sow the seeds of hype through private groups, airdrops, and pre-sales on platforms like X (formerly Twitter), Discord, and Telegram, creating an initial base of interested individuals.

- Launch: At launch, the promotional efforts are ramped up significantly. Promoters, including sometimes unwitting influencers, are used to broadcast the project’s alleged potential to a wider audience, creating a sense of urgency and excitement.

- Pump: This is the critical phase where disinformation is deployed. The community is flooded with fake news about impending major exchange listings, non-existent corporate partnerships, or fabricated technological breakthroughs. Increasingly, scammers use AI-generated deepfake videos of industry leaders or celebrities to create false endorsements. This calculated deception triggers a buying frenzy (FOMO – Fear of Missing Out), skyrocketing the token’s price as demand surges.

- Dump: Once the price manipulation reaches a profitable peak, the orchestrators cash out. They dump all of their holdings simultaneously, causing the token’s supply to massively exceed demand. This triggers a catastrophic price collapse, often within minutes, leaving late investors with nothing.

How to Protect Yourself: Spotting the Red Flags

Distinguishing a legitimate, high-potential investment from a fraudulent pump-and-dump can be challenging, as scammers are masters of mimicking genuine enthusiasm. Here’s how to spot the warning signs and protect your capital.

- Be Skeptical of Unsolicited Advice: If a stranger contacts you on a social media or messaging app with a “guaranteed” investment tip, be extremely wary. Legitimate opportunities do not begin with unsolicited DMs. It is best to ignore and block these contacts.

- Scrutinize Social Media Hype and Ads: Social media is plagued by ads promising impossibly high returns. These often use AI-generated deepfake videos of well-known figures like Elon Musk or other business moguls to appear legitimate. Always question endorsements, especially from celebrities, as they may be fake or undisclosed paid promotions.

- DYOR (Do Your Own Research): Resist the pressure of “now or never” investment opportunities. Take your time. A legitimate project will have a detailed whitepaper, a transparent and verifiable team of founders, a clear use case, and a long-term roadmap. If you cannot easily find this information, consider it a major red flag.

- Beware of Unrealistic Guarantees: The single biggest red flag is the promise of high returns with little to no risk in a short timeframe. No legitimate investment can guarantee profits. To mitigate risk, never invest more than you can afford to lose and diversify your portfolio rather than committing all your funds to a single, high-risk asset.

Conclusion

The evolution of pump-and-dump schemes represents a dangerous fusion of old-school financial fraud with cutting-edge technology. By leveraging fake news, AI-driven disinformation, and deepfakes, scammers have found potent new ways to exploit the excitement and complexity of the Web3 space. The very decentralization that gives crypto its power also creates vulnerabilities that these manipulators are eager to exploit.

However, as the tactics of scammers evolve, so too does the awareness of investors and the reach of regulators. The most powerful defense remains a well-informed and skeptical mindset. By understanding the anatomy of these schemes and learning to recognize their red flags, you can navigate the crypto market more safely and protect yourself from those who seek to profit from deception.

Frequently Asked Questions

What is the main difference between a legitimate project gaining hype and a pump-and-dump?

The key differences are transparency, utility, and long-term vision. A legitimate project typically has a public and verifiable team, a detailed whitepaper explaining its purpose and technology, and a goal of creating long-term value. A pump-and-dump focuses exclusively on short-term price action, driven by vague promises and intense, coordinated hype with no underlying substance.

How are deepfakes specifically used in these crypto scams?

Scammers use deepfake technology to create highly realistic but entirely fake videos of trusted public figures, such as tech CEOs, renowned investors, or celebrities. In these videos, the deepfaked person might appear to endorse a new token or announce a fake partnership, lending a powerful but false layer of legitimacy to the scam and tricking investors into buying.

Are all new, low-priced cryptocurrencies pump-and-dump schemes?

No, not at all. Many legitimate and innovative projects start as low-priced tokens (often called “altcoins” or “micro-caps”). However, these assets inherently carry higher risk due to their volatility and unproven track record. It is crucial to perform thorough due diligence on any new project before investing.

What should I do if I think I’ve been a victim of a pump-and-dump?

If you believe you’ve been scammed, you should report the incident immediately. You can report it to the cryptocurrency exchange where you traded the token, as well as to national law enforcement and financial regulators. In the UK, this would be Action Fraud; in the US, it would be the FBI’s Internet Crime Complaint Center (IC3) and the Securities and Exchange Commission (SEC). While recovering funds can be extremely difficult, reporting helps authorities track and prosecute these criminal networks.

Are pump-and-dump schemes illegal?

Yes. Pump-and-dump schemes are a form of securities fraud and market manipulation. They are illegal under financial regulations in most countries and are actively prosecuted by agencies like the SEC in the United States and the Financial Conduct Authority (FCA) in the United Kingdom.