Key Takeaways

- Keep a close eye on early community activity on X, Reddit, and Discord, and leverage tools like LunarCrush to separate genuine trends from noise.

- Monitor IDOs and decentralized exchanges with DexScreener to spot sudden volume spikes that may indicate upcoming listings.

- Track token holder growth and purchases using block explorers like Etherscan and research platforms such as Arkham for detailed onchain insights.

- Familiarize yourself with Binance’s Innovation Zone, Launchpad, and comparable programs on Coinbase for potential listing signals.

Introduction

The cryptocurrency market is a dynamic arena filled with both opportunities and risks. Every day, new tokens emerge, each competing for attention in a crowded field. For sharp investors and traders, spotting a promising project before its token becomes available on major centralized exchanges such as Binance or Coinbase can create outsized returns.

These large exchanges serve as gateways to mainstream adoption. A listing often attracts fresh liquidity and investor attention, typically resulting in a significant price surge. Learning how to spot coins before listing can give traders a powerful edge in 2025.

Pre-listing Detection as a Strategic Advantage

Finding tokens before they reach Binance or Coinbase is not about luck but a blend of research, diligence and data-driven insights. The work is demanding, but it has become easier with the advent of large language models such as ChatGPT and Gemini.

These AI-driven tools, alongside Perplexity, Claude and other analytics platforms, can help investors filter noise, highlight fundamentals and detect early momentum in ways manual research cannot. They are capable of parsing news, analyzing market sentiment, reviewing onchain metrics and recognizing repeating patterns with far greater efficiency.

Traders who adopt such technologies in their strategies often secure an advantage over those who rely exclusively on manual monitoring. The following steps outline methods to spot tokens before they appear on tier-one exchanges.

Step 1: Monitor the Pulse of the Crypto Community

Online crypto communities are early breeding grounds for signals that eventually develop into market narratives. Platforms such as X, Reddit, Discord and Telegram often capture hype before projects receive exchange attention.

On X, follow respected analysts and investors to sense what major traders are discussing. Using advanced searches can help identify emerging projects. For instance, a query like “(AI OR RWA) token presale min_faves:100” will surface posts about AI or real-world asset tokens with at least 100 likes, filtering for discussions that already have traction. Dedicated tools that scrape and analyze these conversations can help identify rumors before they go mainstream.

On Discord and Telegram, projects host Ask-Me-Anything sessions with founders or well-known crypto figures. Seedify’s weekly spaces often reveal inside scoops on presales. Even Bitcointalk’s altcoin threads remain valuable for spotting overlooked decentralized finance (DeFi) experiments.

On Reddit, subreddits such as r/CryptoMoonShots regularly highlight micro-cap projects. Sorting by new and focusing on threads with 500 or more upvotes provides a way to filter serious due diligence efforts from speculative noise.

An extra step is to run social chatter through LLMs with prompts like: “Analyze sentiment on [Token] and score bullish % while flagging shill activity.” A high positivity score can be promising, but it is critical to cross-check for bot-driven anomalies.

Step 2: Watch Launchpads and Presales

Before tokens hit major exchanges, many projects raise funds through presales, initial DEX offerings (IDOs) or initial exchange offerings (IEOs). Participating in these early rounds can be an effective entry point.

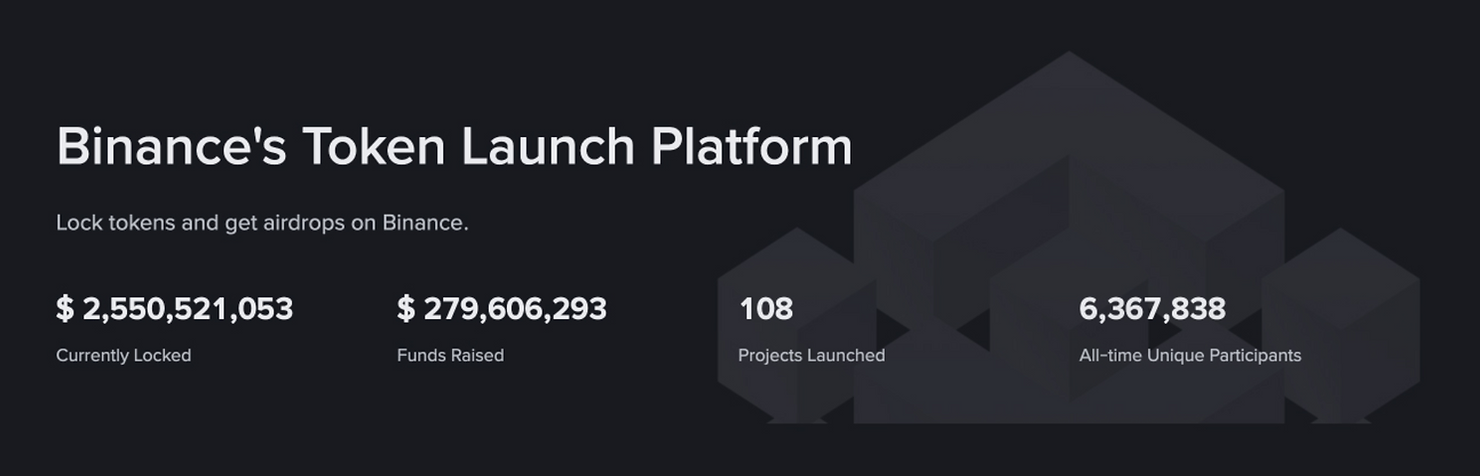

Launchpads like Binance Launchpool allow investors to stake BNB ($1,007.23) in exchange for early access or airdrops. Seedify and DAO Maker remain reliable venues for vetted presales where community governance plays a role. On Solana, Pump.fun has surged in popularity as a hub for memecoin launches, including Bonk (BONK $0.0000193), which started at fractions of a cent and later generated outsized gains.

Keeping track of calendars on platforms like CryptoRank and ICOBench is essential for timing. Set alerts for upcoming sales in trending sectors such as AI and RWAs.

Checking tokenomics is equally critical. Favor launches where more than 50% of supply goes to the community rather than insiders. Mechanisms such as token burns can also help curb inflation and reduce supply overhang.

Step 3: Study Onchain and Market Data

Transparency is one of blockchain’s greatest strengths, and it provides valuable tools for early detection. By analyzing wallet growth, token flows and exchange data, investors can evaluate traction before tokens reach centralized exchanges.

Explorers like Etherscan and Solscan allow monitoring of unique wallet growth. A token gaining more than 5,000 new holders within a month may indicate accelerating adoption.

Platforms such as Nansen and Arkham Intelligence can trace wallet inflows, including purchases made by venture capital firms. This is often a strong validation signal.

Other useful methods include monitoring CoinMarketCap and CoinGecko for low-cap projects (market cap under $10 million) or using DEXTools and DexScreener to catch new decentralized listings on Uniswap or Raydium.

Tokens listed first on mid-tier exchanges such as KuCoin, Gate.io and MEXC often move to larger exchanges later. Similarly, Dune dashboards that track narratives like RWAs can surface projects with market caps under $50 million or TVLs under $10 million, often highlighting early-stage opportunities.

As an extra tip, setting volume alerts on DEXTools (for example, when trading volume rises by more than 200% in an hour) can reveal momentum shifts worth monitoring.

Step 4: Recognize Exchange Patterns and Signals

Centralized exchanges offer indirect hints about future listings through their incubation programs and launch initiatives.

Binance’s Innovation Zone frequently highlights BNB-linked projects and tokens with strong utility, including the wave of AI oracle projects seen in 2025. Coinbase’s Asset Hub, in contrast, places heavier emphasis on compliance, as shown in the listing of Render (RNDR $2.96).

Careful attention to official blogs and X accounts is also valuable. Even subtle reposts or “review in progress” notes have historically preceded listings. Binance often leans into memecoins when hype builds, while Coinbase favors tokens with a clearer path to meeting US regulatory standards.

Step 5: Align With Trends, Fundamentals and Tools

Long-term success in spotting early gems requires aligning with broader market narratives and verifying fundamentals.

Analyzing fundamentals involves reading whitepapers, verifying active developer contributions and checking recent audits from firms such as CertiK or PeckShield. AI tools can summarize whitepapers and filter technical jargon.

Narratives also matter. In 2025, the most closely followed themes include AI, RWAs, decentralized physical infrastructure networks, DeFi and memecoins. Tokens that align with these narratives often reach exchanges faster.

Venture capital participation is another crucial signal. When firms like a16z, Sequoia or Animoca back a project, it frequently accelerates the path to wider exchange adoption.

Risk Management in Pre-listing Hunting

The risks are substantial. Scammers use fake presales and rug pulls to trap unsuspecting investors. Reducing exposure is essential. Conduct contract audits with tools such as RugDoc or Honeypot.is to detect vulnerabilities. Diversify by allocating no more than 1–2% of a portfolio into speculative projects. AI tools can also help flag phishing attempts and analyze contract risks.

Spotting potential Binance or Coinbase listings comes down to three key factors: monitoring community sentiment, evaluating launchpads and presales, and analyzing onchain and exchange data. Combining these with AI-driven foresight strengthens a trader’s ability to recognize opportunities before the mainstream.

Conclusion

In a market as fast-paced as crypto, vigilance pays off. Early detection is not about guessing but about combining social monitoring, launchpad tracking, onchain analytics and exchange pattern recognition. Traders who master these skills will be better positioned to capture gains when tokens move from obscurity to global trading platforms. Large language models such as ChatGPT and Grok can help by turning data into signals, but they are tools, not guarantees. Success still depends on discipline, skepticism and strategic positioning.

Frequently Asked Questions

Why do tokens usually rise in price after a Binance or Coinbase listing?

Listings increase liquidity and visibility, attracting both retail and institutional buyers, which typically drives demand higher.

What are the most reliable signals of an upcoming exchange listing?

Strong community buzz, sudden increases in wallet holders, volume spikes on decentralized exchanges and hints from official exchange accounts are among the most reliable signals.

Are presales safe to invest in?

Not always. Many presales are scams. Only invest small amounts (1–2% of your portfolio) and verify contracts through audit tools.

Which narratives are driving exchange listings in 2025?

AI tokens, real-world assets, decentralized physical infrastructure networks, DeFi and memecoins are leading the trend.

How can AI tools improve my research process?

AI tools like ChatGPT, Perplexity or Arkham can analyze large amounts of data quickly, summarize whitepapers, track sentiment and flag suspicious contract activity, helping traders stay ahead of manual researchers.