Understanding Cryptocurrency Whale Activity and Its Market Impact

What exactly is a crypto whale? A whale represents a wallet or entity that controls significant amounts of coins or tokens. These wallets possess the power to move thousands of Bitcoin in a single transaction or shift tens of thousands of Ether between exchanges and self-custody addresses. The key distinction lies in recognizing that massive transfers do not automatically predict price movements. However, these flows absolutely influence liquidity, sentiment, and volatility levels, particularly when many traders are away celebrating and bid-ask spreads have widened considerably.

Market analysts studying both traditional finance and cryptocurrency have consistently documented that holiday periods introduce specific conditions into financial markets. Lower liquidity, wider spreads, and reduced market maker participation characterize these stretches. During the late December and early January holiday breaks, trading volumes drop substantially. While cryptocurrency operates continuously, the human participation that fuels price discovery becomes sparser. This environment makes whale tracking especially valuable because outsized price swings become more likely when large orders hit thinly-populated order books. This guide covers how to track crypto whale movements during holiday markets.

Key Takeaways

Large cryptocurrency movements during holidays can move markets more dramatically than they would during regular trading weeks. This occurs because thin liquidity conditions mean fewer orders can absorb substantial transactions. Understanding the context behind each whale movement is far more important than reacting to isolated alerts. Effective whale watching relies on confirmed destination data, pattern analysis, and respect for thin-market dynamics. Preparation and systematic monitoring give you a calm, objective perspective when holiday markets become unpredictable.

Why Holiday Periods Create Special Opportunities for Whale Tracking

Holiday trading introduces a level of unpredictability that differs sharply from regular market conditions. With lighter volumes and shifting sentiment, even a single large crypto transaction can send ripples through prices. This is exactly why monitoring whale activity becomes especially important when markets quiet down.

Thinner Liquidity Dynamics

When fewer active market makers are present, large orders create more noticeable impacts on prices. Research examining traditional finance patterns and trading guides confirms that lower volumes and wider spreads consistently appear around late-December and early-January breaks. This pattern extends into cryptocurrency markets as well. A single whale transfer to an exchange during regular weekday conditions might barely register. That same transfer during a holiday lull can create measurable price movement simply because fewer orders exist on the order book to absorb the incoming liquidity.

Sentiment Shifts and Portfolio Adjustments

Festive optimism mixed with year-end portfolio adjustments influences market direction during holidays. Some industry experts describe this as a “holiday effect,” though researchers emphasize this pattern is not guaranteed and should never be treated as a reliable trading rule. The net result is that a single whale transfer to an exchange, or a cluster of new wallets quietly accumulating coins, can have far greater impact than identical activity would have during a typical Tuesday in June.

Building Your Essential Whale Tracking Toolkit

You do not require a full-time career as an on-chain analyst to spot the major moves that matter. Starting with these widely-used tools and information sources puts you ahead of most casual observers. Each tool serves a specific purpose in your monitoring routine.

Whale Alert represents a long-running service that flags large on-chain transactions across many blockchain networks. The platform provides both a live transaction feed and the ability to set custom alerts based on size thresholds or specific assets you care about. This tool excels at providing broad coverage across multiple networks and tokens. You can watch the live feed passively or set specific alerts that notify you only when transactions meet your size requirements.

Arkham Intelligence goes beyond simple transaction tracking by labeling major entities such as exchanges, cryptocurrency funds, and notable wallets. Beyond labeling, this platform provides research and sends alerts about significant flows, including exchange inflows and outflows. Many professional traders rely on Arkham specifically to quickly determine whether a transfer originated from a trading venue, a fund, or an unlabeled wallet cluster. This distinction matters tremendously when analyzing what a movement might signal.

Lookonchain operates as a popular on-chain watcher that highlights notable whale moves and compiles detailed wallet histories. This service often links activity across exchanges and decentralized finance protocols. Its strength lies in providing timely analysis threads that add crucial context to raw transactions. Instead of seeing just numbers moving between addresses, you see what those movements mean in the broader context of a wallet’s history and market conditions.

Block explorers such as Etherscan provide the ground truth for all on-chain activity. After seeing an alert from any other source, block explorers allow you to drill into the specific transaction hash, examine the complete wallet history, and trace related addresses. Explorers confirm whether a transfer reached an exchange deposit address or simply moved between self-custody wallets. Without this verification step, you risk acting on misinterpreted information.

A practical tip for holiday season monitoring involves setting low-noise alerts from the start. Choose wide-size filters rather than ultra-sensitive thresholds. The goal is to avoid having your phone buzz continuously while you spend time with family. Configure alerts to notify you only about transfers large enough to matter given current market conditions.

Preparing Your Holiday Whale Monitoring Routine

Holiday stretches blur normal trading patterns in ways that require specific preparation. With fewer participants and thinner order books, large wallet moves stand out more clearly. This clarity makes it an ideal time to establish systematic whale tracking.

Building Your Asset Watchlist

Before a holiday stretch begins, select five to ten assets you actively follow. These should be tokens or coins that represent meaningful holdings in your portfolio or align with your research interests. Once you have selected your core watchlist, establish alert rules for large transfers affecting those assets. Additionally, set up alerts specifically for exchange inflows. Create simple feeds using RSS syndication or social media alerts for Whale Alert, Arkham posts, and Lookonchain output. This approach eliminates the need to stare constantly at charts while still keeping you informed of significant developments.

Verifying Exchange Relationships

When an alert indicates “X BTC moved,” your next step requires clicking through and checking whether that destination belongs to an exchange or a new self-custody address. This single verification step changes the entire interpretation. Exchange deposits suggest potential sell pressure or at least readiness to trade. Withdrawals from exchanges often indicate accumulation behavior or moves to long-term cold storage. Arkham and Whale Alert label many major exchange addresses, which makes this verification step much faster than it would be otherwise.

Understanding Historical Context

Examine whether the wallet in question has a pattern of depositing to exchanges before price drops or withdrawing during market rallies. Lookonchain threads frequently compile this history for major entities, linking you to prior activity. A wallet that repeatedly sent coins to exchanges before downturns signals different information than a wallet that has never touched an exchange before. Understanding these patterns transforms isolated events into meaningful signals.

Adjusting for Holiday Market Conditions

Thin markets behave differently than deep markets in ways that matter for execution. Even neutral transfers can trigger outsized reactions when order books are depleted. If you decide to trade during a holiday lull, keep this dynamic firmly in mind. Order execution behaves unpredictably in thin markets. Slippage increases, and small positions can create larger price movements than normal. Consider either adjusting your position sizes downward, widening your stop-loss levels, or sitting out entirely if the market looks particularly erratic.

Real Examples of Whale Movement Patterns During Holiday Periods

Whale moves demonstrate how on-chain behavior provides hints about shifting market sentiment. This becomes especially valuable when liquidity thins out. From dormant Bitcoin giants becoming active to long-term Ethereum holders reorganizing their holdings, these signals offer useful context. It is important to recognize that individual examples do not guarantee specific price outcomes. The genuine value lies in understanding the context around each movement and asking the right questions about what might happen next.

During mid-October 2025, Arkham data revealed that a long-inactive Bitcoin whale distributed approximately 2,000 BTC valued at roughly 222 million dollars at the time across numerous new addresses. This type of distribution often precedes more complex movements and typically draws substantial attention precisely because it breaks a long dormancy pattern. When major holders reorganize their coins, market participants pay close attention.

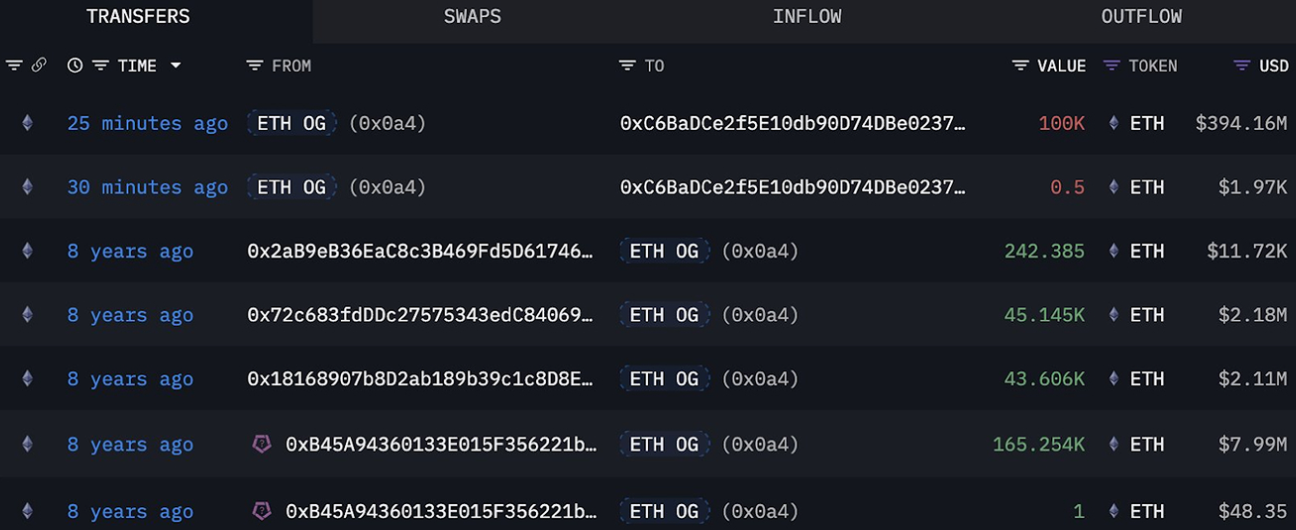

In late September 2025, on-chain trackers identified two Ethereum wallets that had remained dormant for more than eight years suddenly moving about 200,000 ETH valued at approximately 785 million dollars at the time. These coins transferred to two newly created addresses. Analysts determined that the same Ethereum original holder had sourced most of this ETH from the Bitfinex exchange during Ethereum’s early days. Despite this massive movement, the entity retained about 736,316 ETH worth roughly 2.89 billion dollars across eight different wallets. These awakenings often raise fundamental questions about whether the owner is reorganizing funds, improving security measures, or taking profits. The point is that during low-liquidity periods such as holidays, such movements absolutely warrant monitoring.

None of these examples proves a specific price outcome in isolation. The authentic value comes from understanding the context. Who moved the funds? Where exactly did they go? Did this activity occur during lower-liquidity periods when fewer orders could absorb the transaction? These contextual details transform whale watching from fortune telling into analytical observation.

Decoding the Cryptocurrency Whale Trading Patterns That Matter Most During Holidays

Different types of whale movements signal different things. Some point toward potential selling pressure, others suggest quiet accumulation or routine wallet management. During holiday lulls, these signals become even more pronounced. Understanding what kind of flow you are observing before reacting is critical.

Exchange inflows represent situations where multiple whale-sized deposits arrive at major exchanges within a short timeframe. This pattern suggests potential sell pressure or at minimum a readiness to trade. The presence of these deposits does not guarantee immediate selling, but it signals that these large holders have positioned themselves to trade if they choose. Arkham’s entity labels and exchange-specific dashboards make it significantly easier to see clusters of inflows grouped by exchange.

Fresh wallets accumulating coins present an entirely different signal. When new addresses receive large amounts of cryptocurrency, this pattern often suggests quiet accumulation by holders who value privacy or are building positions gradually. Industry media occasionally highlights weeks when new whales add hundreds of thousands of ETH or significant Bitcoin quantities. This information becomes particularly informative during holiday periods when liquidity is thinner and more concentrated among fewer hands.

Dormant addresses waking up after extended inactivity consistently draw substantial market attention. Old coins moving after months or years of inactivity frequently become breaking news. When this happens during a holiday when order books are not as deep, the market impact can be larger than it would be during regular conditions. The sheer surprise of seeing ancient coins move often drives sentiment shifts.

Entity-specific flows matter enormously. It is not just abstract whales doing generic things. Labeled entities include cryptocurrency exchanges, major funds, corporations, and even government-linked wallets connected to asset seizures. When these identified players shift holdings, they often dominate news cycles. Arkham’s extensive research has profiled major entities and their flow patterns. This work helps you distinguish routine exchange activity from movements that genuinely signal something important about market direction.

Maintaining Perspective When Major Whale Alerts Emerge

Seeing a giant transaction alert can trigger fear of missing out or outright panic. These emotional responses are exactly what can hurt results during thin markets. A more measured approach serves you better.

Confirming Destination and Intent

An exchange deposit versus a cold-storage shuffle imply completely different things. Using the explorer link every single time you see an alert prevents you from acting on misinterpreted information. This single verification step is not optional. It is the difference between informed decision-making and reactive trading based on incomplete information.

Looking for Signal Clusters Rather Than Single Events

A single large move can absolutely be noise. Whales transfer coins for operational reasons unrelated to market direction. However, several large inflows to exchanges across a single day provide stronger signals. Look for patterns. Look for clusters of related activity. Single outliers deserve skepticism.

Checking Derivatives Metrics Alongside Whale Data

If funding rates or open interest spike on the same day a whale moves funds, the overall setup may be more fragile than it appears on the surface. Holiday conditions can make liquidation cascades more severe than they would be otherwise. Understanding leverage levels in the market context helps you assess how significant a particular whale movement might be.

Right-Sizing Your Risk for Thin Market Conditions

Thin books increase the possibility of slippage. This is not theoretical. This is practical. Adjust position sizes and stops accordingly. If the market looks particularly erratic or if you feel uncertain about conditions, sitting out entirely represents a valid choice. No single whale movement is important enough to justify trading in conditions you cannot understand.

Avoiding Common Pitfalls in Holiday Whale Analysis

Holiday whale alerts often mislead people into overreacting. Labels get misread. Rumors spread quickly. Some transfers are simply custody shuffles or collateral moves unrelated to market direction. The calendar matters. Holiday slowdowns thin liquidity and create environments where a single misinterpreted alert can snowball into outsized moves that nobody intended.

The most common mistake involves treating every alert as inherently directional. Whales rebalance. Whales move collateral. Whales reshuffle custody for operational reasons. An alert is a starting point for analysis, never a trade signal in itself. Just because money moved does not mean the market will move in any particular direction.

False signals and rumors travel quickly through social channels. Wallet labels get misinterpreted. Connections get fabricated. There have been documented instances where spurious alerts or misread labels spooked traders into panicked selling that pushed prices temporarily lower. This is why cross-checking information before acting remains so important.

The calendar cannot be ignored. Holiday closures in traditional markets directly spill into cryptocurrency liquidity conditions. Although cryptocurrency trades every minute of every day, many participants step back during festive periods. Plan for this. Expect it. Build it into your risk management approach.

Your Pre-Holiday Whale Tracking Setup Checklist

Preparation beats reaction when managing whale tracking. Setting appropriate alerts, following reliable on-chain sources, and knowing how to verify and respond to major wallet moves transforms chaotic holiday markets into something manageable. Instead of reacting under pressure, you can maintain a calm, systematic approach.

Create push alerts on Whale Alert configured for your top assets and set at transfer thresholds high enough to filter noise. Follow Arkham and Lookonchain feeds to receive labeled-entity context and curated analysis threads rather than isolated transaction data. Bookmark your preferred blockchain explorers for quick reference so you can verify exchange tags and transaction details rapidly without searching. Think ahead about how you might interpret common scenarios such as a large exchange inflow, a dormant whale becoming active, or a cluster of fresh wallets accumulating coins. This mental preparation prevents impulsive reactions when alerts arrive in real-time.

Remember that holiday markets introduce unpredictability into normal patterns. Preparation helps you stay grounded when conditions shift. Crypto whales do not move funds to entertain observers. Those flows serve specific purposes. By setting smart alerts, verifying destinations consistently, watching for clusters of related activity, and respecting thin-liquidity dynamics, you develop a calmer and more objective view of what major wallets are doing. You stay informed without becoming obsessed. You understand context without creating false narratives. This balanced approach keeps you ahead when the rest of the market is checking out.

Fast Facts

- In approximately 80 percent of years, cryptocurrency volatility increases noticeably during holiday periods, although sustained price gains remain far less consistent than volatility increases. The so-called Santa Claus rally appears in many years with wide variation in both magnitude and duration.

- Large whale transfers during low-liquidity periods have historically created price movements 3 to 5 times larger than identical transfers during normal trading weeks due to reduced market maker participation and thinner order books.

- Exchange-level whale monitoring tools process millions of transactions daily, with major exchanges typically consolidating thousands of on-chain addresses into single labeled accounts for tracking purposes.

- Dormant Bitcoin addresses containing coins inactive for more than two years represent approximately 35 percent of all Bitcoin currently in existence. When these addresses activate, they consistently generate significant market attention and analysis.

- Holiday trading slowdowns thin cryptocurrency order books by 40 to 60 percent on average, creating conditions where single whale transfers can move prices substantially more than they would during peak trading periods.

Conclusion

Holiday markets in cryptocurrency operate under fundamentally different conditions than regular trading weeks. Fewer participants, wider spreads, and thinner order books create an environment where established whale tracking becomes more valuable than ever. The tools and techniques discussed throughout this guide serve professional traders and curious beginners alike. Setting up your monitoring routine before the holidays begin eliminates reactive stress when alerts arrive during your celebration time.

The core principle is straightforward: understand context rather than chase alerts. Verify whether funds are going to exchanges or self-custody. Look for clusters of related activity rather than isolated transactions. Respect the calendar and thin-market dynamics. By building a systematic approach now, you position yourself to observe and understand whale behavior calmly throughout the holiday season and beyond.

Frequently Asked Questions

What exactly defines a cryptocurrency whale and how much does one need to hold?

A whale is typically any wallet or entity controlling sufficient coins to move prices materially through a single transaction. While no official threshold exists, whales usually hold enough Bitcoin to move markets or enough Ethereum to create noticeable liquidity impacts. The definition is somewhat subjective and depends on the specific asset and market conditions.

Why should I care about whale movements during holidays specifically?

Holiday periods feature significantly fewer active traders and wider bid-ask spreads. These conditions mean whale movements have outsized impacts compared to regular trading weeks. The thinner liquidity creates an environment where whale activity deserves special attention because price swings can be much larger than normal.

How can I verify whether a whale’s transfer to an exchange signal selling pressure or something else?

Block explorers allow you to examine the transaction destination and the historical patterns of that specific wallet. Check whether the wallet has deposited to exchanges before price declines previously or whether this represents a first-time interaction with exchanges. Context matters more than the single transaction.

What is the best tool for beginners starting to track whale movements?

Whale Alert provides the most straightforward entry point for beginners. The service clearly labels major transactions, lets you set custom alerts, and explains where coins moved. Once comfortable with basics, add Arkham Intelligence for entity labeling and context, plus Lookonchain for analysis threads that explain what movements mean.

Should I use whale tracking data to make specific trading decisions during holidays?

Whale movement data should inform your understanding of market sentiment and holder behavior. However, single whale alerts should never become trading signals in themselves. Always verify destination, check for related activity clusters, and assess broader market conditions before making decisions. Treat whale tracking as one input among many, not as a standalone trading system.