Introduction

Imagine a major headline drops: “US House Passes Landmark Crypto Bills.” If you’re a crypto trader, you know the feeling. Your first instinct is to check the price of Bitcoin. Your second is to dive into social media, only to be met by a tidal wave of conflicting information.

For most traders, this moment triggers a familiar cocktail of FOMO (Fear of Missing Out), FUD (Fear, Uncertainty, and Doubt), and one critical question: What now?

For years, the answer was a frantic, manual scramble. Traders would ricochet between X feeds, news aggregators, and private chat groups, desperately trying to piece together a coherent narrative. This gut-driven approach is inefficient and riddled with emotional bias and information overload.

The emergence of sophisticated large language models like Google Gemini offers a powerful new paradigm. This isn’t about finding an AI that will give you a magic “buy” or “sell” signal. It’s about augmenting your own intelligence—transforming you from a passive news consumer into an AI-powered analyst.

So, how do you use a tool like Gemini to systematically turn a complex event, like new US crypto legislation, into a tangible trade signal? Let’s break it down.

Key Takeaways

- Use Gemini to distill complex news, like new legislation, into unbiased summaries from multiple trusted sources.

- Instantly analyze social media reactions on platforms like X to understand whether the market is bullish, bearish, or neutral.

- Pinpoint the specific sectors (e.g., stablecoins, exchanges) and projects poised to benefit or face risks from new developments.

- Leverage AI-generated insights to construct a complete trading plan, including entry points, price targets, stop-losses, and risk analysis.

Step 1: From Noise to Nuance — Aggregate and Summarize

The crypto news cycle is a whirlwind of competing narratives. One outlet screams, “This is bullish for Bitcoin!” while another warns, “This is the end of DeFi.” To make an informed decision, you need a single, balanced source of truth.

You can instruct Google Gemini to cut through the noise by aggregating facts from diverse sources.

Try this prompt:

“Three new crypto bills were passed by the US House on July 17, 2025. Summarize them in 150 words by gathering information from a mainstream financial outlet (like Bloomberg), a crypto-native source (like Cointelegraph), and a tech publication (like Wired).”

Here is Gemini’s response to the prompt above:

Gemini will synthesize information from these varied perspectives, giving you a clear, de-biased overview. It effectively breaks down complex legislation—like the stablecoin rules (GENIUS Act), asset classifications (CLARITY Act), and the ban on a government-issued digital currency (Anti-CBDC Act)—so you can grasp the core facts in minutes, not hours.

Step 2: Read the Room — Analyze Market Sentiment

In crypto, perception is often reality. Market sentiment—the collective feeling of investors—can drive price action more than the fundamental news itself. Gemini can act as your digital sentiment analyst.

Use this prompt to scan the social media landscape:

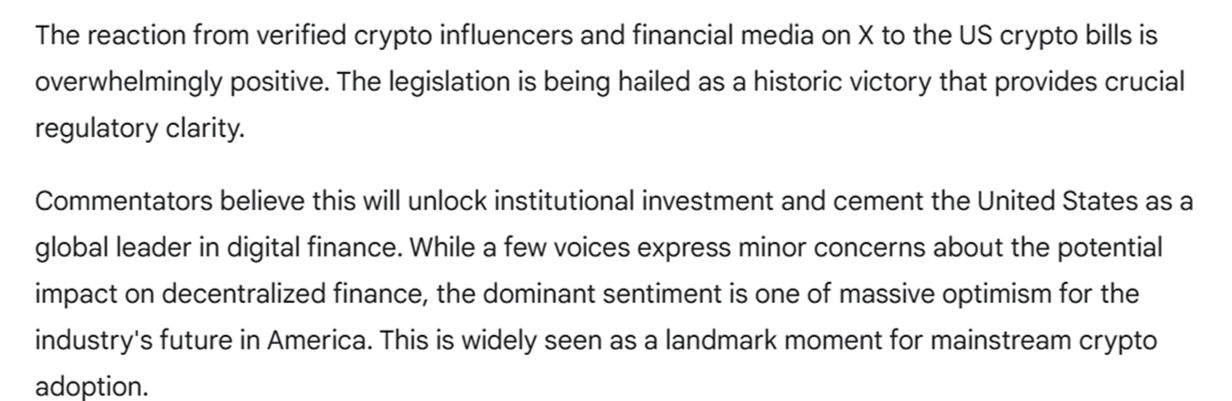

“Analyze the reaction from verified crypto influencers and major financial media on X regarding the three US crypto bills passed on July 17, 2025. Is the overall sentiment positive, negative, or neutral?”

Based on this prompt, Gemini can quickly scan influential voices and determine the dominant mood. For example, it might find that sentiment is overwhelmingly positive, with praise for regulatory clarity, while noting minor concerns about the potential impact on decentralized finance (DeFi). This gives you an immediate read on short-term market momentum.

Step 3: Uncover the Ripple Effect — Identify Second-Order Impacts

Major news doesn’t just affect today’s price; it shapes the future of the industry. Understanding these long-term, or “second-order,” effects is what separates amateur traders from professional ones.

Ask Gemini to connect the dots for you:

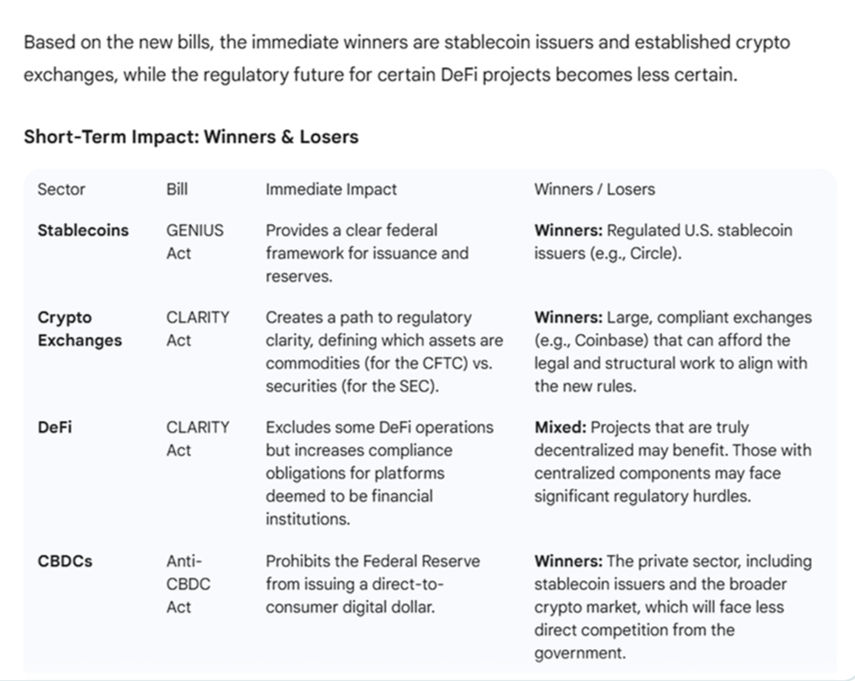

“Based on these new bills, which crypto sectors or companies (e.g., exchanges, stablecoins, DeFi) are positioned to benefit or be harmed in the short term? Then, explain the potential long-term impact on broader trends like institutional Bitcoin adoption.”

In its analysis, Gemini can identify clear winners and losers. For instance, stablecoin issuers like Circle and regulated exchanges like Coinbase stand to benefit from legal clarity. Conversely, DeFi projects with centralized components might face new regulatory hurdles. The ban on a US central bank digital currency (CBDC) could create more room for private sector stablecoins to grow.

Looking at the bigger picture, Gemini can suggest that clearer regulations are likely to boost institutional confidence, solidify Bitcoin’s status as a commodity, and accelerate mainstream adoption by legitimizing the industry’s core infrastructure.

Step 4: From Insight to Action — Construct Your Trading Thesis

This is where all your research converges into an actionable plan. You now have the facts, the market sentiment, and the potential long-term outcomes. It’s time to build your trading thesis.

Use Gemini to help structure your thoughts into a coherent plan.

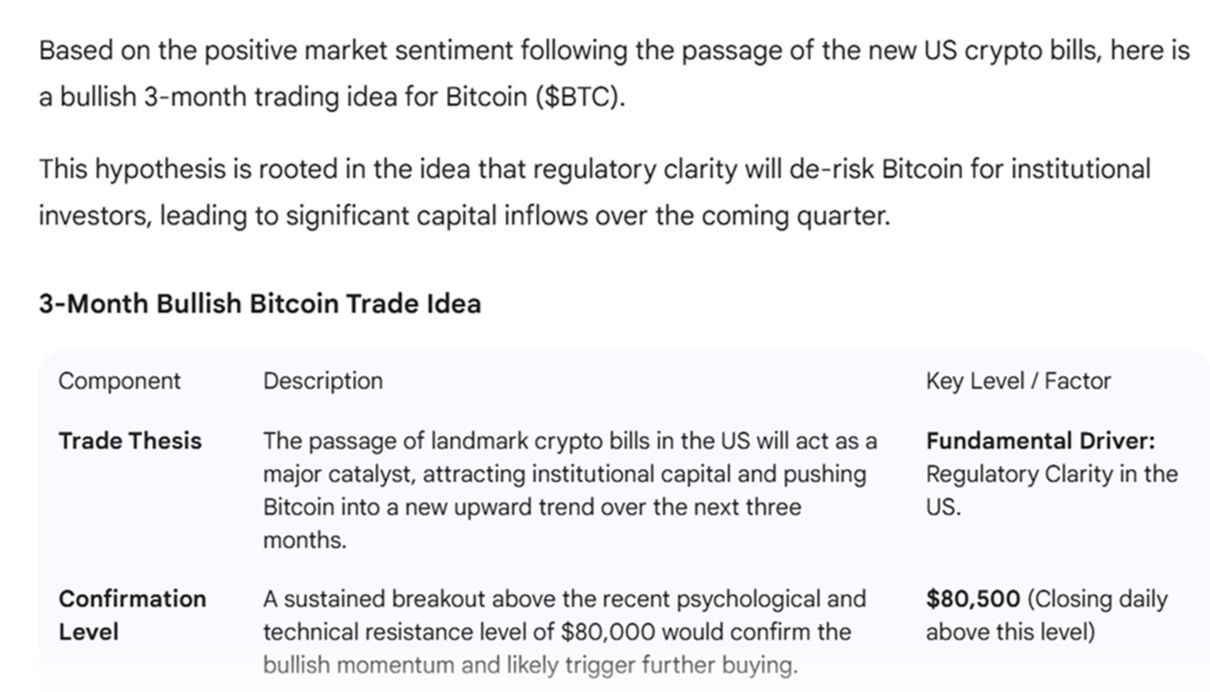

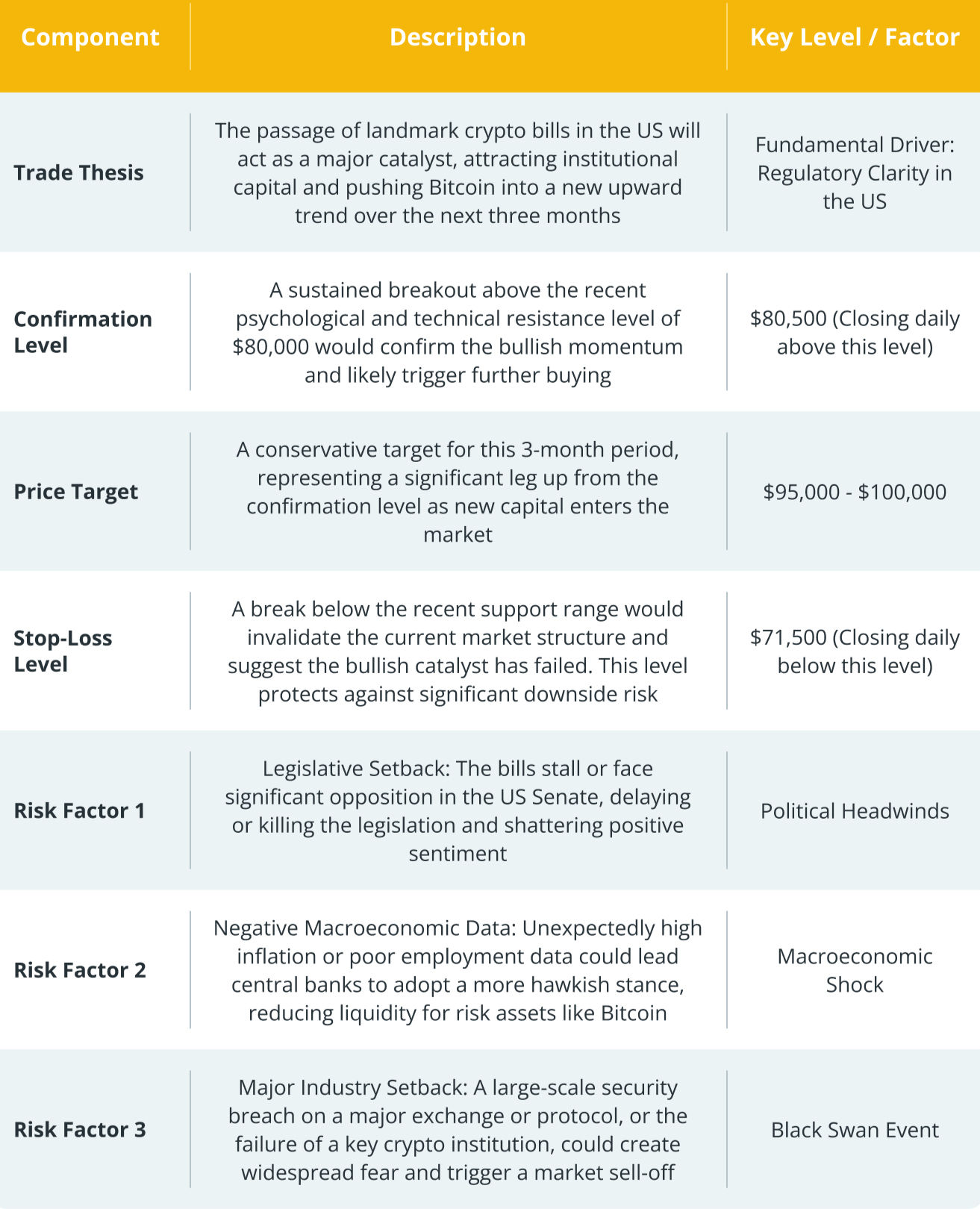

“Using the information on the new US crypto bills and the positive market sentiment, formulate a bullish 3-month trading idea for Bitcoin. Include a confirmation price level for entry, a price target, a suggested stop-loss, and the top 3 risk factors. Present this information in a clear table.”

Gemini can generate a detailed, structured trading thesis based on your inputs. It will outline a clear confirmation level, stop-loss, price target, and key risk factors, all formatted in an easy-to-read table.

This transforms abstract analysis into a concrete plan you can evaluate. See it below.

Conclusion

The rise of AI is not about outsourcing your decision-making; it’s about supercharging it. A tool like Gemini can scan headlines, synthesize sources, measure market sentiment, and model risks—all in the time it takes you to drink your morning coffee.

But let’s be clear: AI doesn’t manage your portfolio—you do. It doesn’t know your financial goals, your risk tolerance, or your emotional state. That remains your domain.

Think of Gemini as your tireless research analyst, not your financial advisor. Its purpose is to bring you clean, unbiased insights to support your thinking, not replace it. In an era of increasing regulatory maturity for crypto, the advantage goes to those who can fuse powerful information with sound judgment.

This is your opportunity to evolve from a passive spectator into an informed participant—to stop chasing FOMO and start making data-driven decisions. Use the tools. Hone your judgment. Stay curious. Because in this new era of AI-augmented investing, the smartest trader in the room is still you. Wanna know more about an AI edge in crypto? Don’t miss our recent article on how to trade smarter with Chat GPT.

Frequently Asked Questions

Is using Gemini for trading signals considered financial advice?

No, absolutely not. The information and trade ideas generated by Google Gemini are for educational and informational purposes only. They are not financial advice. You are solely responsible for your own investment decisions, and you should always conduct your own research and/or consult with a qualified financial professional.

Can Google Gemini accurately predict crypto prices?

No. No AI, model, or person can accurately predict future market prices. Gemini analyzes existing data, news, and sentiment to identify probabilities and formulate potential scenarios. It is a tool for analysis, not a crystal ball.

What if the news sources Gemini uses are biased or contain misinformation?

This is a valid concern. That’s why it’s crucial to prompt Gemini to use multiple, high-quality, and varied sources (e.g., financial, crypto-native, and tech). As the trader, you should still apply critical thinking and, if a piece of information seems questionable, verify it from a primary source.

Do I need a paid subscription to Gemini for this to work?

The techniques described in this article can be performed with the free version of Google Gemini. Paid versions may offer access to more advanced models or features, but the core functionality of summarizing text, analyzing sentiment, and structuring ideas is widely available.

How is this better than just reading X and news sites myself?

The primary advantages are speed and de-biasing. Gemini can process and synthesize information from dozens of sources in seconds, a task that would take a human hours. By aggregating different viewpoints, it helps neutralize the inherent bias of any single source, giving you a more balanced perspective to inform your own judgment.