Introduction

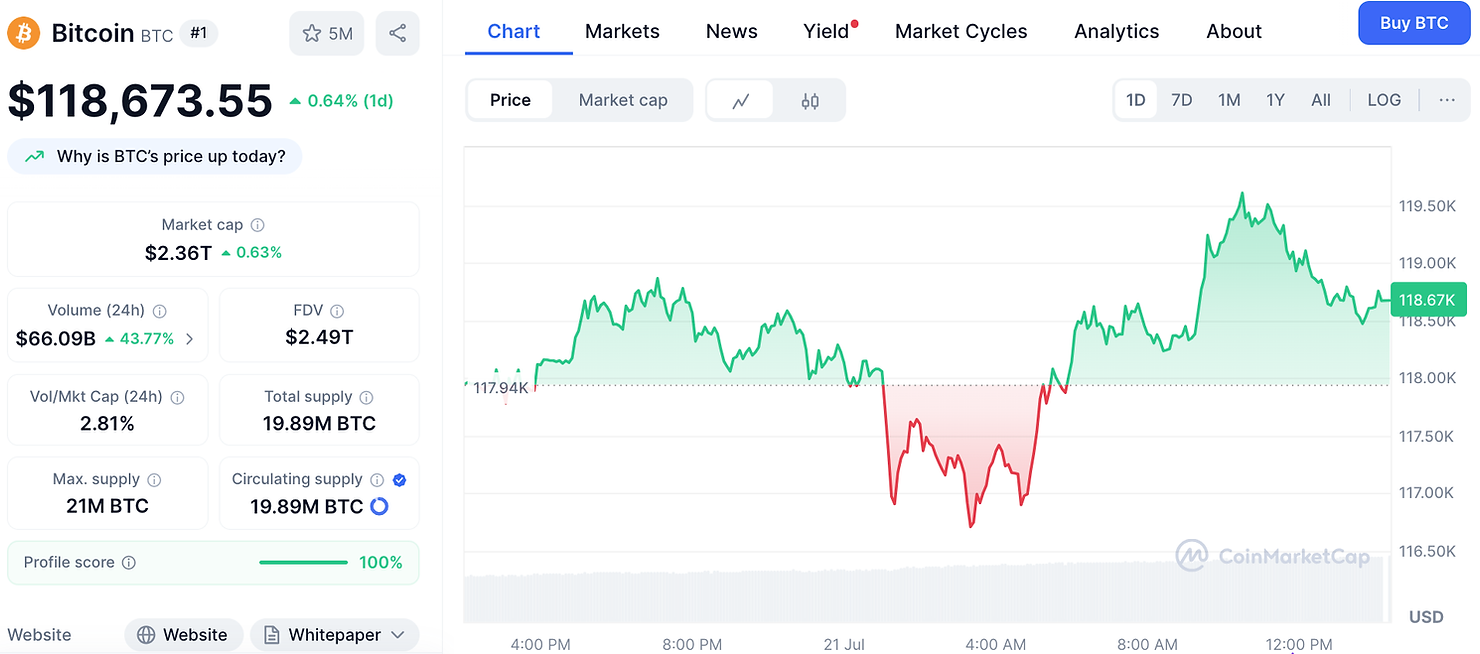

The cryptocurrency market is on high alert as three pivotal US economic reports are scheduled for release this week. The anticipation is palpable, as the influence of traditional macroeconomic indicators on Bitcoin (BTC) and the broader digital asset space has never been more significant. Meanwhile, Bitcoin’s price is showing notable resilience, holding firmly above the $118,000 threshold despite headwinds from falling market dominance and concerns over potential large-scale sell-offs. This week’s data could determine if that strength continues.

Key Takeaways

- Fed Chair Jerome Powell’s speech on Tuesday will be closely scrutinized for hints on future interest rate policy, with intense political pressure from the White House adding a layer of unpredictability.

- Thursday’s Initial Jobless Claims are forecast to rise to 229,000. A higher-than-expected number could signal labor market weakness, potentially strengthening Bitcoin’s appeal as a hedge against economic instability.

- The S&P Flash PMI reports, also on Thursday, will offer a snapshot of the US economy’s health. Weaker data could boost Bitcoin’s price, while strong figures might see capital flow towards traditional markets.

Fed Chair Powell’s Remarks Under the Spotlight

The first major signal to watch this week will be the opening remarks from Federal Reserve Chair Jerome Powell at the Banking Conference on Tuesday. His speech comes just a week after the US Consumer Price Index (CPI) revealed that inflation rose at an annual rate of 2.7% in June, and just over a week before the next Federal Open Market Committee (FOMC) meeting on July 30. Currently, interest rate futures indicate a 95.3% probability that policymakers will hold rates steady.

Traders will be parsing Powell’s every word for clues about the Fed’s future path. However, a significant political wildcard is at play. Powell has faced sustained pressure from the Trump administration to cut interest rates, with the White House arguing that current policy is stifling economic growth. This tension has been exacerbated by official criticism over a $2.5 billion renovation of the Fed’s building, sparking calls for an audit and fueling speculation that it could be used as grounds to terminate him “for cause.”

While Powell has maintained a cautious stance, the possibility of his resignation or ouster before his term ends in May 2026 cannot be dismissed. Such an event would likely be bullish for Bitcoin, as markets would anticipate a new Fed chair more aligned with the administration’s dovish policy, leading to rate cuts. Lower interest rates tend to increase market liquidity, boost risk appetite, and weaken the US dollar, driving demand for assets like Bitcoin as a hedge.

Initial Jobless Claims: A Labor Market Health Check

The second key signal arrives on Thursday with the release of Initial Jobless Claims, which measures the number of people filing for unemployment for the first time. This indicator has become a crucial macro driver for Bitcoin, as the health of the labor market heavily influences Fed policy.

For the week ending July 12, claims stood at 221,000. Economists surveyed by MarketWatch are forecasting an increase to 229,000 for the week ending July 19.

A reading significantly above the forecast could spook markets, signaling a weakening job sector. For Bitcoin, this “bad news is good news” scenario would reinforce calls for the Fed to cut interest rates to support the economy, providing a potential tailwind for BTC.

Conversely, if claims remain low, it would point to a robust labor market, diminishing hopes for rate cuts and creating a potentially bearish outlook for Bitcoin in the short term.

S&P Flash PMI: Gauging Economic Strength

Also on Thursday, the market will receive the S&P Flash Services and Manufacturing PMI reports. The Purchasing Managers’ Index (PMI) is a key indicator of economic health. A reading above 50 signals expansion, while a reading below 50 indicates contraction.

In June, the Services PMI (which reflects the dominant US sector) was 52.9, while the Manufacturing PMI rose to a three-year high of 52.9. For July, forecasts suggest a slight increase in the Services PMI to 53.2 but a softening in the Manufacturing PMI to 52.4.

Historically, strong PMI readings boost investor confidence in the traditional economy and equities, which can divert capital away from assets like Bitcoin. On the other hand, weaker-than-expected readings can fuel recession fears and increase expectations for rate cuts, enhancing Bitcoin’s appeal as a non-sovereign safe-haven asset.

Other Factors Adding to Volatility

While macroeconomic data will be the main event, several market-specific factors could exacerbate volatility this week. Bitcoin’s market dominance has been falling, a trend that often precedes an “altcoin season” where capital rotates out of BTC.

Furthermore, there are reports of Bitcoin miners and large holders (“whales”) increasing their selling pressure. This, combined with the ongoing potential for a large Bitcoin sale by the UK government, creates a complex and potentially turbulent trading environment.

Conclusion

This week serves as a critical test for Bitcoin, highlighting its evolving role at the intersection of technology and traditional finance. No longer operating in a silo, its price is now deeply intertwined with the macroeconomic landscape. The combination of Jerome Powell’s politically charged speech, the vital health check from jobless claims, and the economic snapshot from PMI data will create a crucible for market sentiment.

The outcome of these events will pull Bitcoin in two directions, testing its dual narrative as both a risk-on technology asset and a risk-off safe-haven hedge. A strong economy may weigh on its price, while signs of weakness could send it higher. For investors, this week is a stark reminder that understanding monetary policy and economic indicators is now just as important as analyzing the blockchain.

Frequently Asked Questions

Why does a weak US economy often lead to a stronger Bitcoin price?

When economic data (like high jobless claims or low PMI) signals weakness, it increases the probability that the Federal Reserve will cut interest rates or introduce other stimulus measures. These actions devalue fiat currency (like the US dollar) and increase liquidity in the market, making scarce assets like Bitcoin more attractive as a hedge against inflation and currency debasement.

What is the FOMC, and why is it important?

The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy. Its meetings, held approximately every six weeks, are where decisions on the federal funds rate are made. These decisions influence borrowing costs across the entire economy and have a major impact on all financial markets, including crypto.

Is Fed Chair Jerome Powell likely to be fired or resign?

While there is significant political pressure and public criticism directed at Chair Powell, predicting his departure is purely speculative. A forced termination of a Fed Chair is historically unprecedented and could cause massive market instability. Most analysts believe he will serve out his term, but the political tension remains a significant “wildcard” for the markets.

What is Bitcoin dominance, and why does a drop matter?

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies. A drop in dominance means that altcoins (alternative cryptocurrencies) are gaining value at a faster rate than Bitcoin. This often signals a shift in investor risk appetite towards smaller, more volatile assets and can mark the beginning of an “altcoin season.”