Introduction

Pendle Finance is changing the DeFi staking game by introducing yield tokenization—a system that lets users trade future earnings and lock in fixed returns. Designed for both risk-takers and conservative investors, Pendle bridges traditional finance tools with DeFi innovation. Whether you’re looking to stabilize your crypto yields or dive into variable returns, Pendle has strategies tailored to your appetite.

Key Takeaways

- Pendle Finance allows users to tokenize and trade future yields for flexible income strategies.

- Investors can choose between fixed and variable yield options based on their risk tolerance.

- Pendle improves liquidity by converting staked assets into tradable tokens.

- Tools like Principal Tokens (PT) and Yield Tokens (YT) offer granular control over yield management.

- Staking on Pendle can be optimized with $PENDLE and $vePENDLE for governance and boosted returns.

Exploring Pendle

Understanding Pendle’s Value Proposition

Pendle Finance shakes things up in the DeFi scene by tackling the tough stuff: dealing with shaky yields and tricky liquidity. They know that DeFi returns can be all over the place, so Pendle steps in to bring some calm and order. How do they do it? By letting folks stabilize and take control of their returns right on their platform.

What Pendle offers is a game-changer: the ability to turn future yields into tradable assets. This means you can manage the rollercoaster of risks better, hedge your bets on those uncertain yields, or even fix your returns to a specific rate. By splitting the return from the initial investment, Pendle gives you tools that feel just like those Wall Street pros use, like zero-coupon bonds and interest rate swaps, adding a touch of classic finance know-how to the DeFi world.

Features

- Fixed Yields: Say goodbye to those wild, unpredictable returns of other DeFi platforms. Pendle lets you lock in a stable return without the chains of a lock-up period. This predictability offers a comforting buffer in the normally wild ride that is DeFi.

- Tokenization of Future Yields: Future returns are given a whole new life by being turned into their own tokens. This means they can be traded separately from the initial investment, offering a way to juggle rate changes like in the traditional finance world.

- Yield Control Options: Users have the flexibility to strategize like seasoned traders by taking positions either in favor of or against yield movements. These options add layers of complexity and control, which come in handy when facing different levels of risk tolerance.

- Unlocking Liquidity: Transform those locked-up assets into spendable cash. By trading your tokenized future returns, you get to turn rigid assets into something you can move and reinvest, offering financial nimbleness and fresh investment horizons.

| Feature | Description |

|---|---|

| Fixed Yields | Secure stable returns without needing to tie up your money |

| Tokenization of Future Yields | Trade future returns separately from initial investments |

| Yield Control Options | Opt for long positions or guard against falling yields |

| Unlocking Liquidity | Make locked assets flexible and ready for new investments |

Pendle is making waves in the DeFi staking game with these neat offerings. Crypto buffs and DeFi players can use their suite of tools to fine-tune their returns, mitigate risks, and amp up how their assets perform. For more insights into where Pendle fits in the DeFi staking territory, check our guide on the best DeFi staking platforms in 2025 to see its head-to-head with big names.

Yield Tokenization with Pendle

Pendle Finance is flipping the script by letting folks put a price tag on their future earnings—a move that’s putting more control and flair into the hands of investors. Below, we’ll break down the whole fixed versus variable yield thing and explain how Pendle’s doing the whole tokenizing future yields combo.

Fixed Yields vs. Variable Yields

Pendle makes it smooth sailing for investors diving into the risky waters of DeFi staking by offering two picks: fixed and variable yields.

Fixed Yields

- When markets get shaky, fixed yields are like a warm security blanket. You can grab a fixed yield contract with Pendle and snag yourself a solid return without locking things down tight.

- Perfect for anyone tired of the rollercoaster of returns and just wanting to know what’s coming their way.

Variable Yields

- Variable yields ride the ups and downs of the market rollercoaster. Risky business, but with the potential for some juicy returns.

- On Pendle, you can go the risky route (long yield) or play it cool and hedge your bets, letting you personally tweak your investment plan.

Tokenizing Future Yields

Pendle’s bringing an epic twist to the DeFi saga by turning yield-producing assets into stuff you trade, similar to staples like zero-coupon bonds. It’s like taking a financial stroll down Wall Street but DeFi-style.

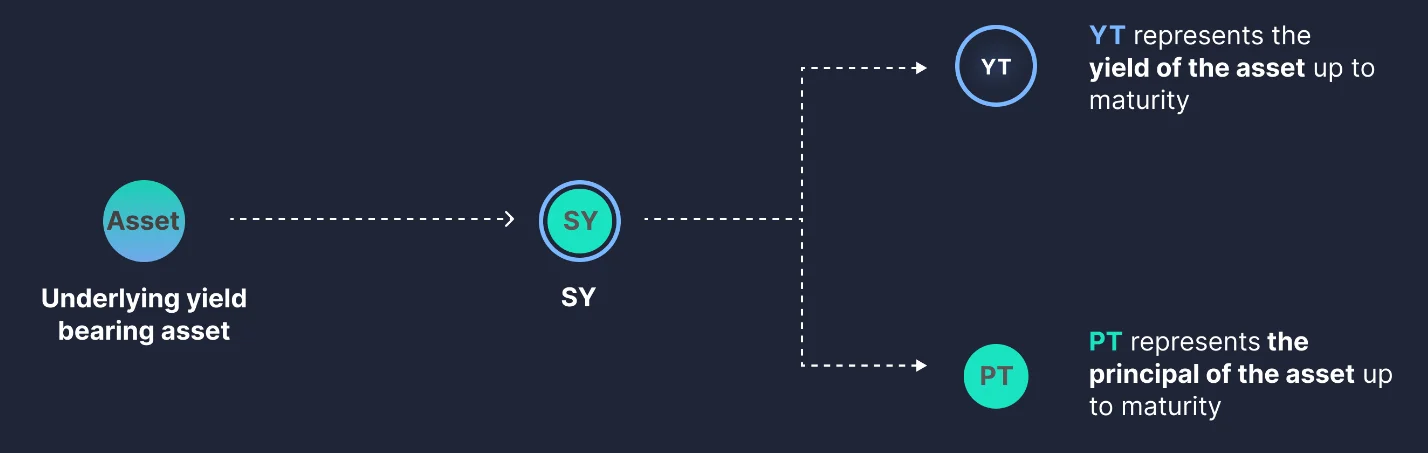

Concept and Mechanics

- Pendle slices your yield-toting DeFi assets into two pieces—principal and the golden yield.

- You can then take the yield part and mint it into a whole new asset, making it easier to juggle and strategize your funds (Pendle Finance).

Practical Application

- Asset Tokenization: Stake your assets, and Pendle gives you two tickets: one for the main act (principal) and one for the encore (yield).

- Tradability: Trade these puppies on Pendle’s exchange, opening up routes for liquidity and yield strategy galore.

| Token Type | Description | Use Case |

|---|---|---|

| Principal Token (PT) | Holds onto the original chunk of asset value | Swap back to claim what you originally staked |

| Yield Token (YT) | Your ticket to potential future gains | Swap to lock in fixed returns or keep things liquid |

With Pendle’s distinctive system, investors can get crafty in piecing together their plan based on how much risk they fancy and where they think the market’s heading. By serving up a tradeable platform for future yields, Pendle is opening doors and giving decentralized finance players new tools to expand their playbook.

Unlocking Liquidity with Pendle

Liquidity Provision Opportunities

Pendle is shaking up the crypto scene with its way of squeezing liquidity from yield-earning assets. They do this magic by turning those assets into tokens, which can be traded like Pokémon cards on secondary markets. It’s like giving a kick to the regular DeFi staking methods that often have people stuck with underutilized capital.

Pouring some liquidity into Pendle’s Automated Market Makers (AMMs) isn’t just another fish in the sea; it’s potentially a goldmine. When you’re in, you could earn extra cash from those Principal Tokens (PT) and Yield Tokens (YT). It’s like getting bonus points when you shop – trading fees, and Pendle’s own rewards, all add up to a tidy little extra income.

| Token Type | Income Source | Extra Benefits |

|---|---|---|

| Principal Tokens (PT) | Trading fees, stake rewards | Consistent income, possible token rise |

| Yield Tokens (YT) | Trading fees, stake rewards | Bet on future profits |

Trading Tokenized Future Yields

With Pendle, you’re not only trading in the now – you’re jumping in a time machine and dealing with the future. Trading tokenized future yields lets you beat the system a bit by mixing the best of old-school finance and new-school DeFi. Going big on smart yield strategies can let you lock in returns or ride those market waves to potential gains.

Stacking up $PENDLE for $vePENDLE is not just about beefing up those yields; it’s about getting a seat at the big table. You gain more muscle in the decision-making parade of the Pendle universe.

The playground that is Pendle lets you try fancy tricks with yield strategies, using PT and YT tokens to either gamble on what could be, lock in the return rate, or dance around various market shifts.

| Strategy | Description | Benefits |

|---|---|---|

| Locking $PENDLE | Get $vePENDLE in return | Supercharged yield, decision-making power |

| Yield Token Trading | Play the YT game | Big win potential, market bets |

| Principal Token Holding | Keep that PT steady | Safe returns, less risk |

Pendle’s plan to crack open liquidity and trade future yields is a breath of fresh air for those deep in the crypto waters.

Utilizing Pendle for Yield Strategies

Pendle Finance is shaking things up for crypto investors looking to squeeze the most out of their yield with strategies that cater to the cautious and the bold. Whether you’re all about those steady gains or itching for a bit of a gamble on the ups and downs, here’s the lowdown on how you can use Pendle to your advantage.

Fixed Yield Strategies

So, you want a bit of predictability in this wild crypto game? Pendle lets you snag a fixed yield by splitting off the interest from the main investment chunk. Great way to dodge the unpredictable rollercoaster ride of interest rates in DeFi.

To get the ball rolling with a fixed yield on Pendle, you buy what’s called Principal Tokens (PT). Holding onto PT means you’ve got a ticket to secure that sweet fixed yield, as it locks in your ability to cash out the main asset later on. Perfect for folks who like the idea of knowing what they’re getting and not stressing over potential yield dips.

Speculating on Variable Yields

If you’re one to throw caution to the wind in hopes of bigger gains, Pendle’s got you there too. By snapping up Yield Tokens (YT), you’re buying the right to the interest being earned by whatever’s underlying. It’s a bit like betting on the spinning wheel with your fingers crossed for growth.

Unlike PT, Yield Tokens are a wild card. They let you rake in more if the yield heads north but brace yourself—they also mean you’re riding the waves of market changes. This path suits adrenaline-seeking investors looking to cash in on the potential surge in yield.

Pendle Finance gives investors a nifty way to sync up their yield goals with how much risk they can stomach. Whether you’re all about the calm seas of fixed yields or more inclined to chase the high tide of variable yields, Pendle’s got the tools to help you maximize your returns.

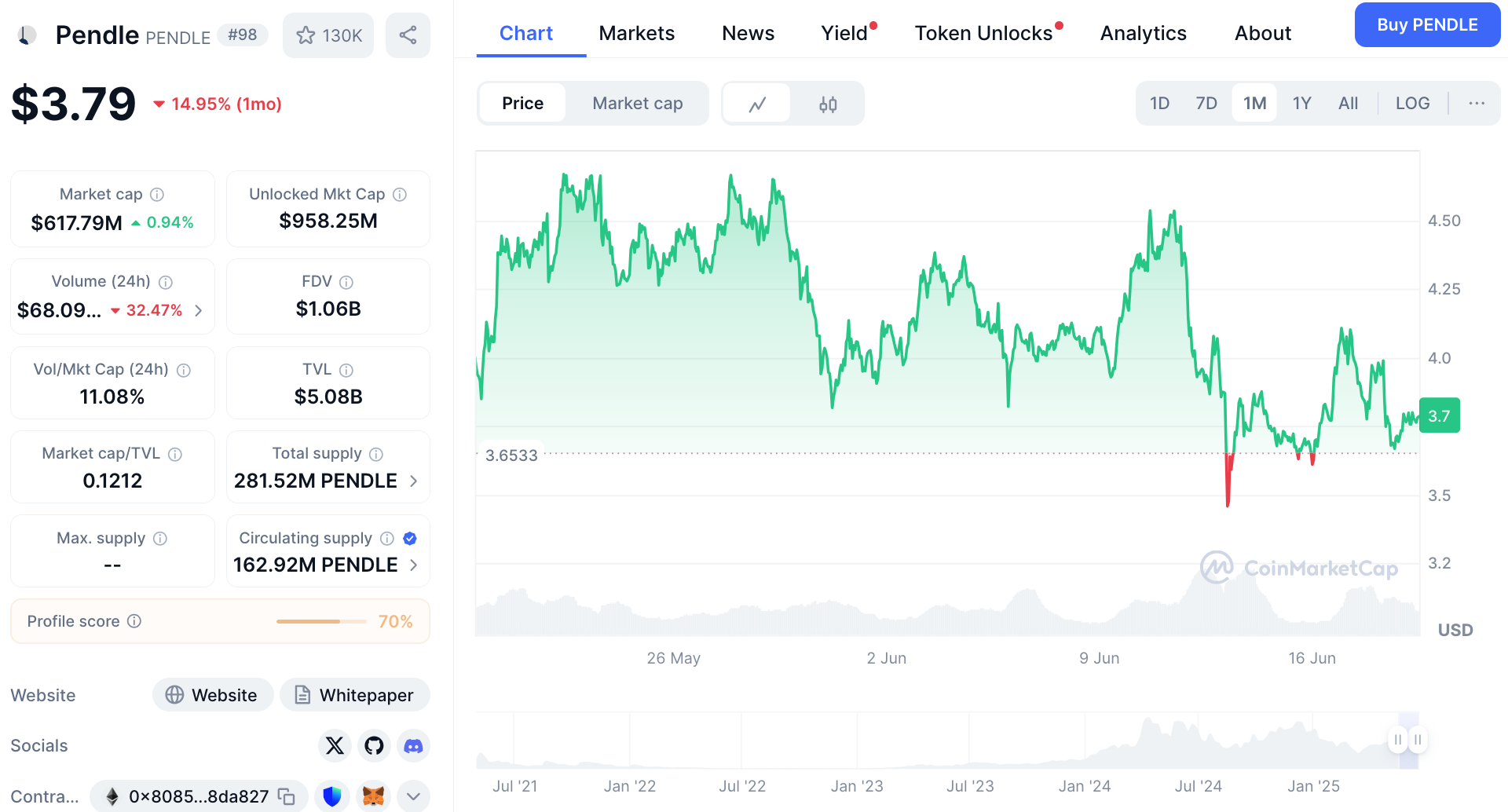

Future of DeFi Staking Ecosystem

Diving into the future, DeFi staking platforms like Pendle are reshaping how folks invest and earn. By 2025, we’re looking at some compelling trends and strategies that might up your game and help you rake in more with Pendle Finance.

What’s Likely in 2025 for DeFi Staking

Expectations for DeFi staking by 2025 are sky-high, with tech breakthroughs and more folks warming up to crypto. Here’s what might be around the corner:

- Stablecoins Shooting Up: The buzz around stablecoins is likely to grow loud, with market caps shooting past $500 billion. This shift means folks are banking on stablecoins to keep DeFi smooth and steady.

- Liquid Staking Trends: Since Ethereum made a big splash with its Merge, platforms like Lido Staking and Rocket Pool are all the rage. Pendle is in the game too, pulling in users chasing combo deals of steadiness and strong returns.

- Mixing TradFi with DeFi: Pendle’s got this cool thing where it tokenizes and trades future gains, drawing more big players keen on blending old-school finance with the new school of decentralized finance.

How to Milk the Most with Pendle

Pendle Finance throws out some neat ways to stretch your earnings with its spin on future yield tokenizing. Check out these:

| Strategy | What’s in it for You |

|---|---|

| Fixed Yield | Stable returns, no lock-up hassle |

| Variable Yield Speculation | Higher returns if market nods your way |

| Liquidity Provision | Earn extra from fees, plus more goodies |

| Risk Management | Flexibility to move with market swings |

| Multi-Platform Staking | Chops risk down, might boost returns across the board |

With these ideas, Pendle Finance doesn’t just help you fatten your wallets with its crafty yield tokenizing, it’s also nudging us toward a smarter, sleeker DeFi staking chapter by 2025.

Fast Facts

- Platform: Pendle Finance

- Core Feature: Yield tokenization

- Token Types: Principal Tokens (PT), Yield Tokens (YT)

- Main Use Case: Turn future yields into tradable assets

- Staking Rewards: Earned via AMM pools, $PENDLE incentives

- Risk Strategies: Fixed (low risk), Variable (high risk)

- Extra Utility: $vePENDLE for governance and higher yield

- Part of: Best DeFi staking platforms in 2025

- Target Audience: Yield-maximizing DeFi users, risk managers, and liquidity providers

Conclusion

Pendle Finance brings a smart and innovative approach to the DeFi staking space by merging the predictability of traditional finance with the flexibility of decentralized tools. Whether you’re seeking stable returns or high-risk, high-reward yield plays, Pendle gives you the levers to control your strategy. With growing integration in the DeFi landscape, Pendle is poised to be a key player among the best DeFi staking platforms in 2025.

FAQ

What is Pendle Finance?

Pendle is a DeFi platform that allows users to tokenize and trade future yield streams using smart contracts.

What are Principal Tokens and Yield Tokens?

Principal Tokens (PT) represent your original investment, while Yield Tokens (YT) represent the future interest, both tradable separately.

Can I earn fixed returns on Pendle?

Yes, by holding PTs, you can secure stable, fixed yields without long lock-up periods.

How does Pendle boost liquidity?

Pendle’s tokenization model allows users to trade locked yields, unlocking capital and adding flexibility.

What’s $vePENDLE used for?

Holding $vePENDLE gives you governance power and increased yield rewards on the platform.