Key Takeaways

- Power in crypto has shifted from traditional players like exchanges and regulators toward five new forces shaping onchain finance and control.

- These forces are: stablecoins, ETFs, base-layer upgrades, blockspace security, and high-throughput execution.

- The future of crypto now hinges on the leaders directing these levers, not the old exchange-versus-regulator dynamic.

Introduction

The balance of power in crypto has undergone a profound transformation. Once dominated by centralized exchanges and regulatory battles, the sector’s gravity now orbits around five levers: dollar liquidity (stablecoins), capital markets (ETFs and tokenization), base-layer roadmaps, blockspace security markets, and high-throughput execution systems.

Since 2024, this shift has been unmistakable. Exchange-traded funds (ETFs) are drawing unprecedented levels of institutional money into Bitcoin. BlackRock’s IBIT, for instance, has become a juggernaut, with roughly $85 billion in assets under management (AUM), setting the tone for capital flows across the entire industry.

Meanwhile, stablecoins have emerged as the fastest rails for dollar settlement. The passage of the GENIUS Act provided a federal framework in the U.S., accelerating their legitimacy and adoption.

On the technical side, the ecosystem is evolving at record pace: Ethereum’s Pectra upgrade (featuring EIP-7702) is reshaping wallet user experience, Solana’s Firedancer client is nearing rollout with record transaction-per-second tests, and EigenLayer’s restaking model has effectively created a market for Ethereum’s security, complete with live slashing.

The next phase of crypto is being written by the individuals and organizations shaping these five forces. Their decisions will define where liquidity flows, which chains dominate, and how institutions and users engage with blockchain networks.

How We Defined Power in Our Top Five

To identify today’s most powerful players in crypto, we looked at three criteria:

- Direct control over capital flows or block space

- Ability to set and execute roadmaps that others must follow

- Credible and publicly announced next steps expected within the coming quarters

The Most Powerful People in Crypto in 2025

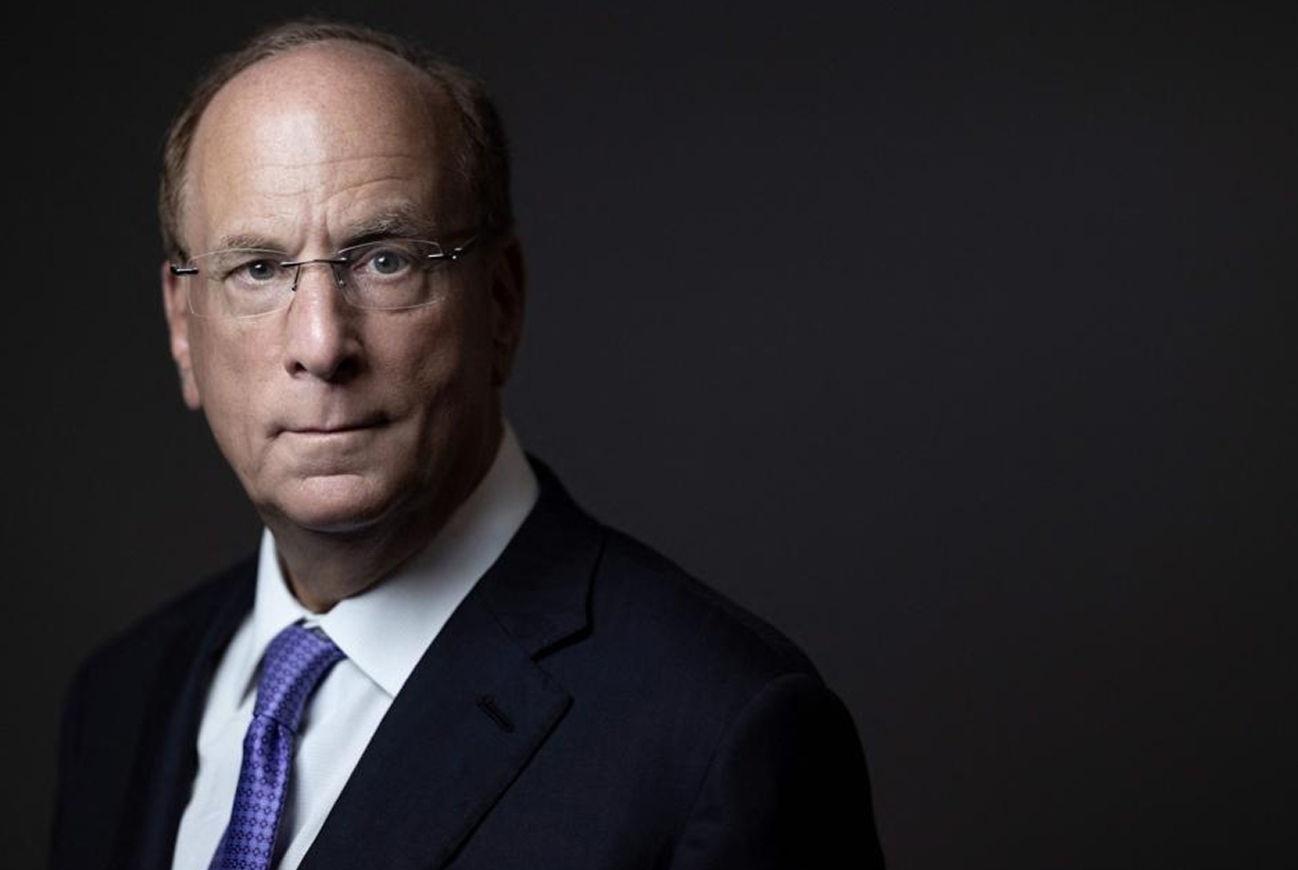

1. Larry Fink (BlackRock)

BlackRock, the world’s largest asset manager, is now at the center of crypto’s capital markets. Its spot Bitcoin ETF (IBIT) and tokenized Treasuries fund (BUIDL) have set benchmarks for institutional participation. IBIT leads the ETF pack by AUM, while BUIDL brought tokenized cash into mainstream finance — and crucially, it’s no longer limited to Ethereum.

Power in Practice

- IBIT: Roughly $85.4 billion in net assets (Aug. 20, 2025), making it the premier TradFi on-ramp for Bitcoin exposure. Its scale influences fees, liquidity, and flows across all crypto ETFs.

- BUIDL: Over $1 billion AUM (March 2025), with share classes now available on Solana ($211.56) and other chains, expanding interoperability and investor access.

What Fink Is Planning Next

- Broader ETF lineup: BlackRock is actively weighing additional crypto ETFs beyond Bitcoin and Ethereum.

- Tokenization integration: BUIDL is expected to be further embedded within BlackRock’s Aladdin system, with multichain distribution expanding wherever counterparties demand it.

Why it matters: With control over ETF inflows and tokenized cash distribution, BlackRock is shaping the liquidity landscape both on- and off-chain.

2. Paolo Ardoino (Tether)

Tether’s USDt is the backbone of dollar liquidity in crypto, powering centralized exchanges, onchain transactions, and global remittances. Its dominance gives Paolo Ardoino unparalleled influence over how dollars move across the digital economy.

Beyond stablecoins, Tether is investing heavily in Bitcoin mining, renewable energy, and privacy-focused AI, embedding itself deeper into the crypto infrastructure stack.

Power in Practice

- USDT market cap: Roughly $167 billion (Aug. 21, 2025), the largest stablecoin by far and a critical benchmark for global onchain liquidity.

- Energy and mining: Ongoing projects include a biogas-powered Bitcoin mining facility in Brazil.

- U.S. expansion: Tether recently hired Bo Hines, a former White House crypto advisor, to shape its U.S. strategy.

What Ardoino Is Planning Next

- Hard-asset footprint: Continued investments in energy, mining, and AI for privacy-preserving computation.

- Payments expansion: Deepening stablecoin adoption in emerging-market USD corridors where demand for fast, cheap remittances is soaring.

Did you know? In 2024, Tether ranked as the seventh-largest net buyer of U.S. Treasuries, surpassing several sovereign nations.

3. Vitalik Buterin (Ethereum)

Ethereum’s co-founder remains one of the most influential thinkers in crypto. The May 2025 Pectra upgrade, highlighted by EIP-7702, allowed externally owned accounts (EOAs) to behave like smart contracts, advancing account abstraction and reshaping wallets, payments, and L2 experiences.

Power in Practice

- EIP-7702 (Pectra): Enables session keys, social recovery, and batched actions for smoother wallet UX while remaining compatible with ERC-4337.

- Staking changes: Validator limits expanded from 32 ETH to 2,048 ETH, consolidating stake and streamlining consensus operations.

What Buterin Is Planning Next

- History expiry (EIP-4444): Already partially live (July 2025), reducing disk needs and paving the way for lightweight nodes.

- Verkle trees and stateless clients: Research continues to enable fully stateless Ethereum nodes.

- Enshrined PBS (proposer-builder separation): Aimed at reinforcing censorship resistance and streamlining MEV.

4. Anatoly Yakovenko (Solana)

Solana has become a hub for consumer-facing applications and high-speed USD settlement, with stablecoin adoption soaring. At the heart of its next phase is Firedancer, an independent validator client designed by Jump to diversify and scale Solana’s execution layer.

Power in Practice

- Firedancer progress: In 2025, hybrid “Frankendancer” tests replayed mainnet blocks and demonstrated seven-figure transactions per second (TPS) in controlled environments.

- Stablecoin activity: By early 2025, Solana had millions of daily active stablecoin addresses, cementing its role as a payments powerhouse.

What Yakovenko Is Planning Next

- Firedancer rollout: Production hardening is expected by late 2025, improving resilience and validator diversity.

- Payments + DePIN: Continued focus on payments UX and decentralized physical infrastructure (e.g., Helium’s onboarding model) to compete directly with Ethereum’s L2s.

5. Sreeram Kannan (EigenLayer)

EigenLayer has pioneered the concept of restaking, turning Ethereum’s stake into a marketplace where new services (AVSs) can “rent” Ethereum’s security rather than building their own validator networks.

With slashing now live and multichain verification enabled, EigenLayer has become the backbone for many projects, reshaping the economics of trust in crypto.

Power in Practice

- Slashing (April 17, 2025): Misbehavior penalties now enforce discipline, with billions in restaked ETH securing dozens of AVSs.

- Multichain verification: Allows AVSs to execute on L2s while anchoring security to Ethereum.

What Kannan Is Planning Next

- Institutional risk frameworks: Development of standardized AVS risk models, insurance, and compliance protocols to enable institutional adoption.

- Expanded footprint: More cross-chain services and developer tools like EigenCloud, enabling “verifiability-as-a-service.”

Why it matters: If EigenLayer becomes the default trust layer for new crypto infrastructure, its rules will determine how risk is priced and how developers choose to deploy.

What to Watch Next

- Tokenization momentum: BUIDL’s $1B+ AUM and Solana integration suggest tokenized cash is rapidly gaining traction.

- Stablecoin regulation: The GENIUS Act and related Treasury rules will reshape issuer risk management and banking access.

- Ethereum’s roadmap: With Pectra live, history expiry and enshrined PBS are the next flashpoints.

- Solana execution: Firedancer’s rollout could redefine performance ceilings for consumer-scale crypto.

- Restaking maturity: Institutional-grade AVS frameworks are the next hurdle for EigenLayer.

Conclusion

Crypto’s new power structure is no longer about who runs the biggest exchange or which regulator makes the boldest enforcement move. The real levers now lie in who directs capital flows, secures block space, and ships the infrastructure others must adopt.

From Larry Fink shaping ETF and tokenization flows, to Paolo Ardoino commanding the dollar layer, to Vitalik Buterin charting Ethereum’s technical future, to Anatoly Yakovenko scaling Solana’s execution, and Sreeram Kannan rewriting the rules of trust with EigenLayer — these five most powerful people in crypto are collectively defining the next decade.

The coming quarters will show whether their bets on ETFs, stablecoins, execution, and restaking translate into a stable and scalable global financial stack — or whether new challengers will emerge to shift power yet again.

Frequently Asked Questions

Why are exchanges and regulators no longer the central power players in crypto?

Because liquidity, security, and innovation have shifted onchain. ETFs, stablecoins, and infrastructure protocols now move more capital and shape more user behavior than centralized exchanges or regulators.

Which force has the most immediate market impact?

Stablecoins, particularly Tether’s USDT, as they dictate dollar liquidity across exchanges, DeFi, and remittance networks in real time.

What’s the significance of the GENIUS Act?

The GENIUS Act provides the first federal regulatory framework for stablecoins in the U.S., granting issuers clearer rules while increasing scrutiny over reserves and risk.

Why is Solana’s Firedancer such a big deal?

It ends Solana’s reliance on a single validator client, increases resilience, and unlocks throughput measured in millions of transactions per second — crucial for scaling payments and consumer apps.

How does EigenLayer change crypto security?

By allowing services to “rent” Ethereum’s security via restaking, it reduces the need for new tokens and validator sets, lowering barriers to entry while creating a marketplace for trust.